Common Stock: Capstone Mining (OTC: CSFFF)

Current Market Price: $.53

Market Capitalization: $214.4 million

Capstone Mining Stock – Summary of the Company

Capstone Mining is a base metals exploration and development company with properties throughout the Americas. Their primary focus is copper. They have two operating mines, one in Arizona and one in Mexico. They also have a portfolio of exploration stage projects. Capstone was founded in 1987 and is headquartered in Vancouver, Canada.

Revenue and Cost Analysis

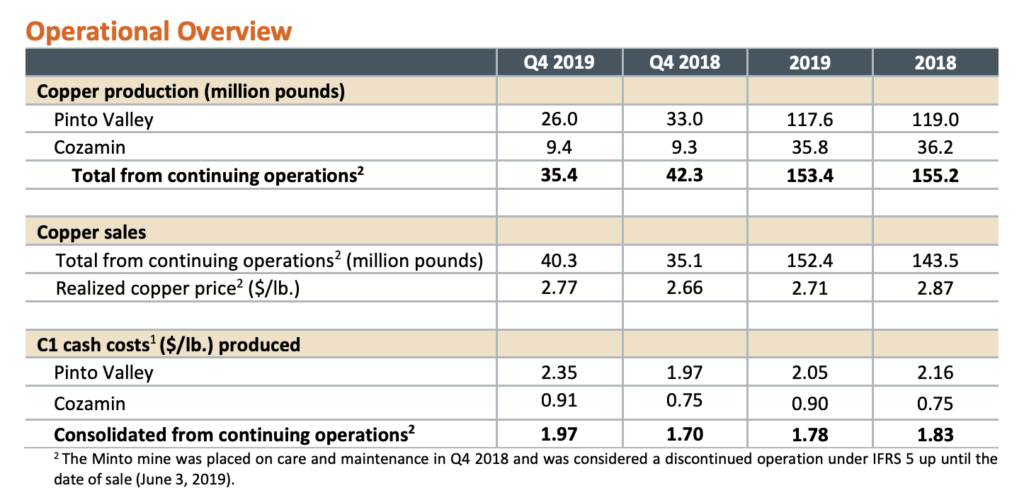

In 2019, the company produced 153.4 million pounds of copper and had cash costs of $1.78 per pound. Total revenue was $418.6 million and earnings from mining operations were $42.4 million.

Capstone had a net loss of $16.2 million in 2019, a slight improvement from a net loss of $23.5 million in 2018. This improvement is due to the divesture of a property.

Capstone Mining – Royalty and Streaming Agreements

The Cozamin Mine has a 3% net smelter royalty.

Balance Sheet Analysis

Capstone has a solid balance sheet with sufficient short term liquidity and what appears to be manageable liability levels. However, the debt levels discussed below are concerning.

Capstone Mining – Debt Analysis

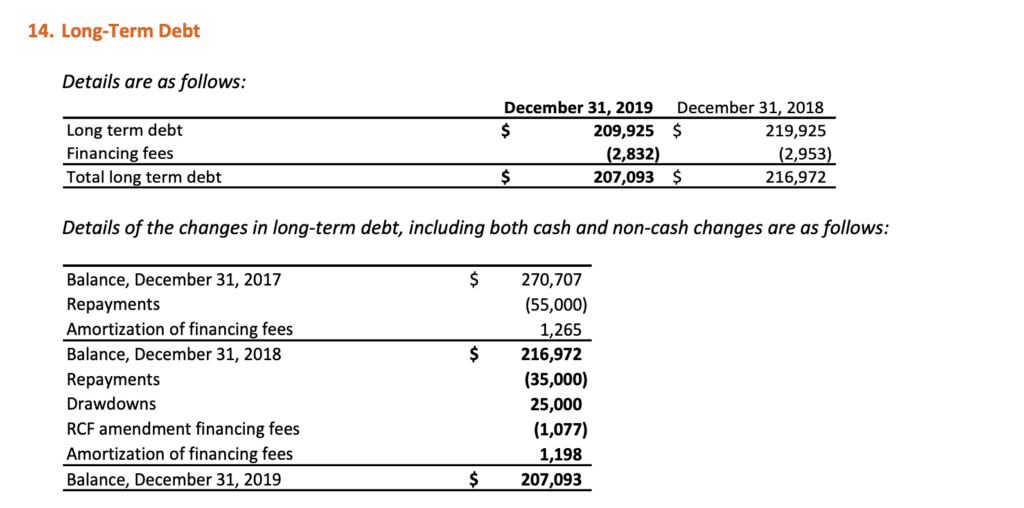

As of year-end 2019, Capstone had long term debt outstanding totaling $207 million. The debt carries and interest rate of Libor plus 2.5% to 3.5%, depending on debt levels. The debt matures in July of 2022.

Capstone Mining Stock – Share Dynamics and Capital Structure

As of February 2020, Capstone had 400 million common shares outstanding and 23.3 million options outstanding. Fully diluted shares outstanding is 423.3 million.

Capstone has significant dilutive instruments outstanding in addition to senior debt. Investors should carefully consider their place in the capital structure before investing.

Capstone Mining Stock – Dividends

The company does not currently pay a dividend.

Management – Skin in the game

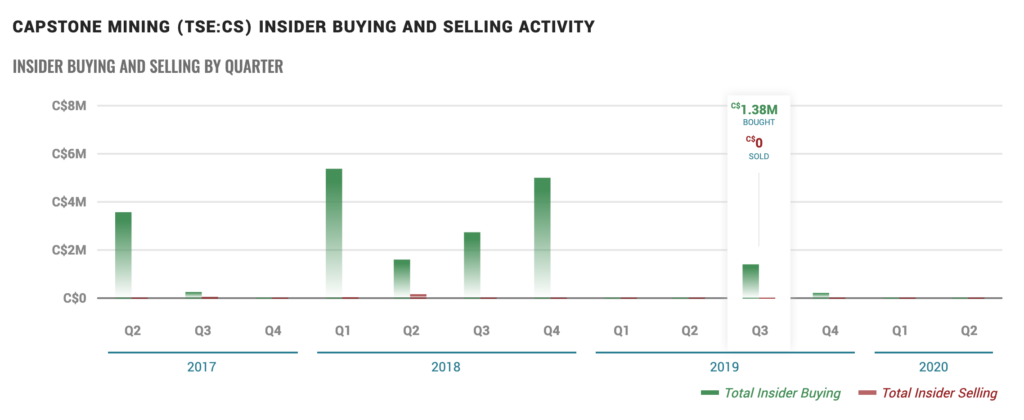

Insiders at Capstone Mining have been net buyers of the common stock in the recent past. This is generally viewed as a bullish signal for the stock.

Capstone Mining Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$460 million/ $871.3 million =.52

A debt to equity ratio of .52 indicates that Capstone has relevant amounts of debt in its capital structure, but uses more equity financing then debt financing. They should not be overly reliant on any one form of financing in the future.

Price to Book Ratio

Current Share Price/Book Value per Share.

$.53/$2.06 = .26

Based in fully diluted shares outstanding, Capstone has a book value per share of $2.06. At the current market price this implies a price to book ratio of .26, meaning the company’s stock currently trades at a significant discount to the book value of the company.

Working Capital Ratio

Current Assets/Current Liabilities

$123.4 million/ $55.4 million = 2.2

A working capital ratio of 2.2 indicates adequate short term liquidity. Capstone should not have a problem meeting its short-term obligations.

Capstone Mining Stock – Summary and Conclusions

Capstone has two solid producing properties as well as an intriguing exploration portfolio. The company is operating at a net loss and debt levels are concerning. Dilution is also a concern.

I am not currently investing in Copper stocks, so I will not be investing in Capstone, however due to the company’s undervaluation based on book value, I will continue to monitor the stock.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.