Common Stock: Camil Alimentos (CAML3)

Current Market Price: R$ 13.07

Market Capitalization: R$ 4.8 billion

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Camil Alimentos Stock – Summary of the Company

Camil Alimentos is a Brazilian food company focused on the production and sale of a wide range of food products. Their main products include rice, beans, sugar, and canned fish (mainly sardines and tuna). They sell their products under several brands, some of which have significant recognition. The company’s brands include Camil, Namorado, União, Da Barra, and Coqueiro. Camil sells its products throughout Brazil and exports to Uruguay, Chile, and Peru. The company was founded in 1963 and is headquartered in Sao Paulo, Brazil.

Revenue and Cost Analysis

Camil had total revenue of R$ 5.4 billion in 2019, a significant increase from R$ 4.7 billion in 2018. The company’s COGS were R$ 4.1 billion in 2019, representing a gross margin of 23%. The company was profitable in each of the past 2 years, with net income of R$ 239.6 million in 2019 and R$ 362.4 million in 2018, representing profit margins of 4.4% and 7.6% in 2019 and 2018 respectively.

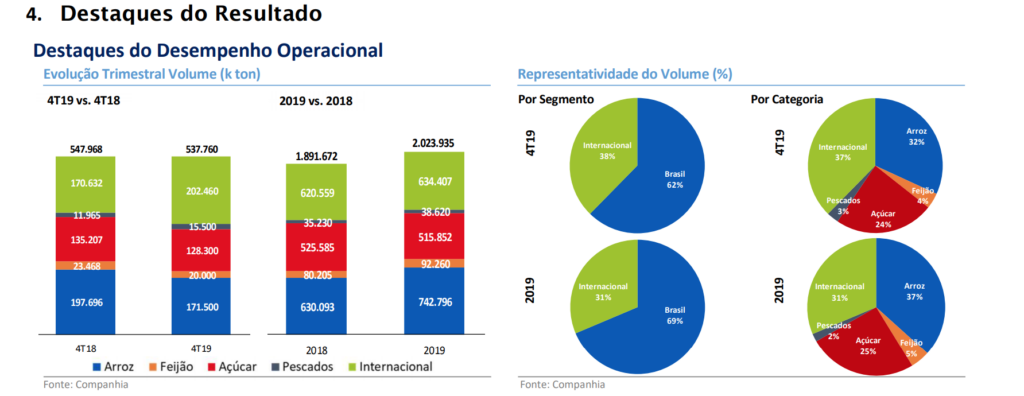

In 2019, 69% of the company’s revenue came from Brazil, the remainder coming from international markets. Within Brazil, rice and sugar accounted for the majority of the company’s revenue, with 37% and 25% of total revenue coming from the domestic sale of rice and sugar respectively.

Acquisitions

In 2019 Camil acquired the pet food division of Iansa S.A., a company based in Chile. The transaction value was roughly R$ 200 million.

Balance Sheet Analysis

Camil has a decent balance sheet. They have a solid liquidity position; however, they are leveraged, with a significant amount of debt outstanding.

Camil Alimentos – Debt Analysis

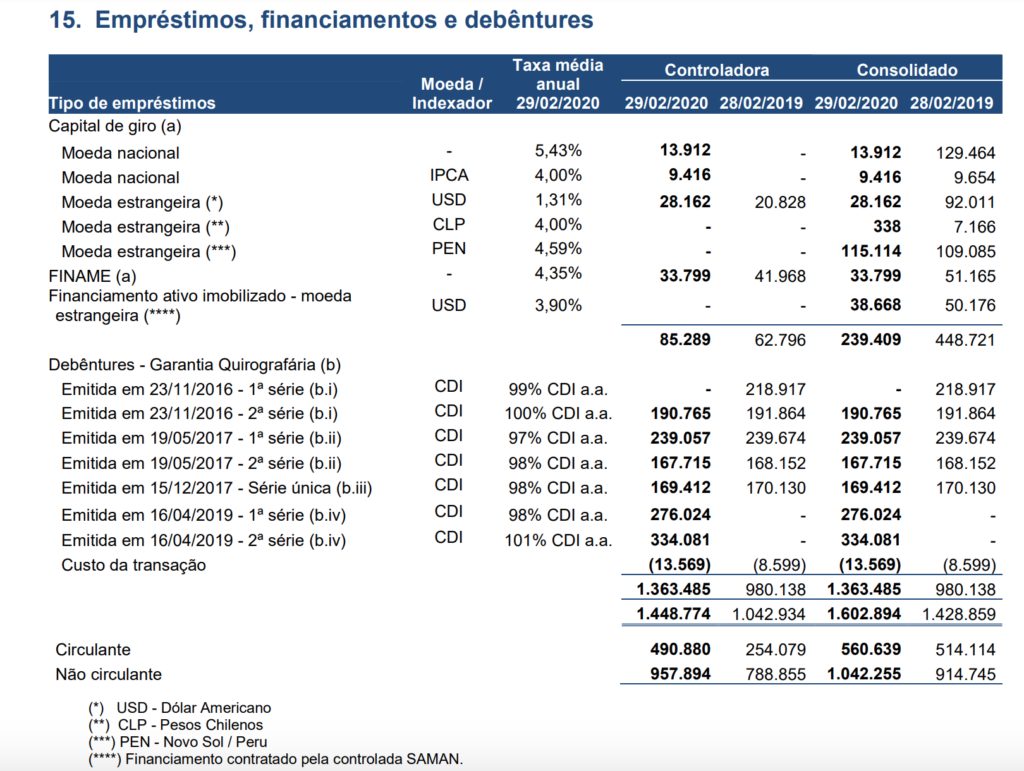

Camil has a significant amount of debt outstanding. As of year-end 2019 the company has R$1.6 billion in total debt outstanding, R$ 560.6 million of which is classified as current. Furthermore, a portion of the company’s debts are denominated in foreign currency, including the US Dollar, meaning a depreciating Brazilian Real is likely to have a negative impact of the company’s financial performance.

Camil Alimentos Stock – Share Dynamics and Capital Structure

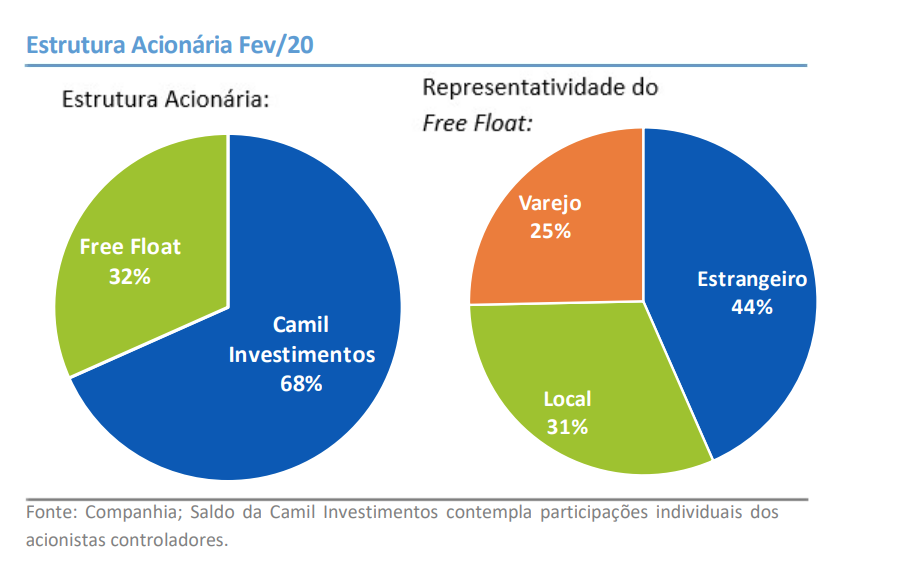

As of February 2020, Camil had 370 million shares outstanding. Around 32% of the company’s shares float in the market. 44% of the company’s shares are owned by foreigners and 25% are owned by Brazilian retail investors.

Camil repurchased 30.6 million shares in 2019 at an average price of R$ 6.25 per share.

Camil Alimentos Stock – Dividends

Camil made five dividend payments based on the results for the 2019 fiscal year, totaling R$ .20 per share. At the current market price this implies a dividend yield of 1.5%.

Camil Alimentos Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 2.6 billion / R$ 2.3 billion = 1.1

A debt to equity ratio of 1.1 indicates that Camil uses a mix of debt and equity in its capital structure and is not overly reliant on either, but does rely slightly more on debt financing to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 2.7 billion/ R$ 1.2 billion = 2.2

A working capital ratio of 2.2 indicates a sufficient liquidity position. Camil should not have problems meeting its near-term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

R$ 13.07 / R$ 6.08 = 2.1

Based on total shares outstanding Camil has a book value per share of R$ 6.08. At the current market price this implies a price to book ratio of 2.1, meaning Camil Alimentos stock currently trades at a premium to the book value of the company.

Camil Alimentos Stock – Summary and Conclusions

Camil Alimentos is a solid company that appears to be well managed and focused on growth in Brazil and throughout Latin America. They have a fairly diverse product line, some with significant brand recognition, including some Brazilian dietary staples. The company has significant leverage, but is in good financial health. Management has returned capital to shareholders via dividends and buybacks.

Camil stock is investable long term. Given their leverage and growth focus, they are a higher risk, higher potential return play when compared to other Brazilian food companies, such as Excelsior Alimentos.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.

One Comment

Comments are closed.