Common Stock: BR Properties (BRPR3)

Current Market Price: R$ 9.60

Market Capitalization: R$ 4.7 billion

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

BR Properties Stock – Summary of the Company

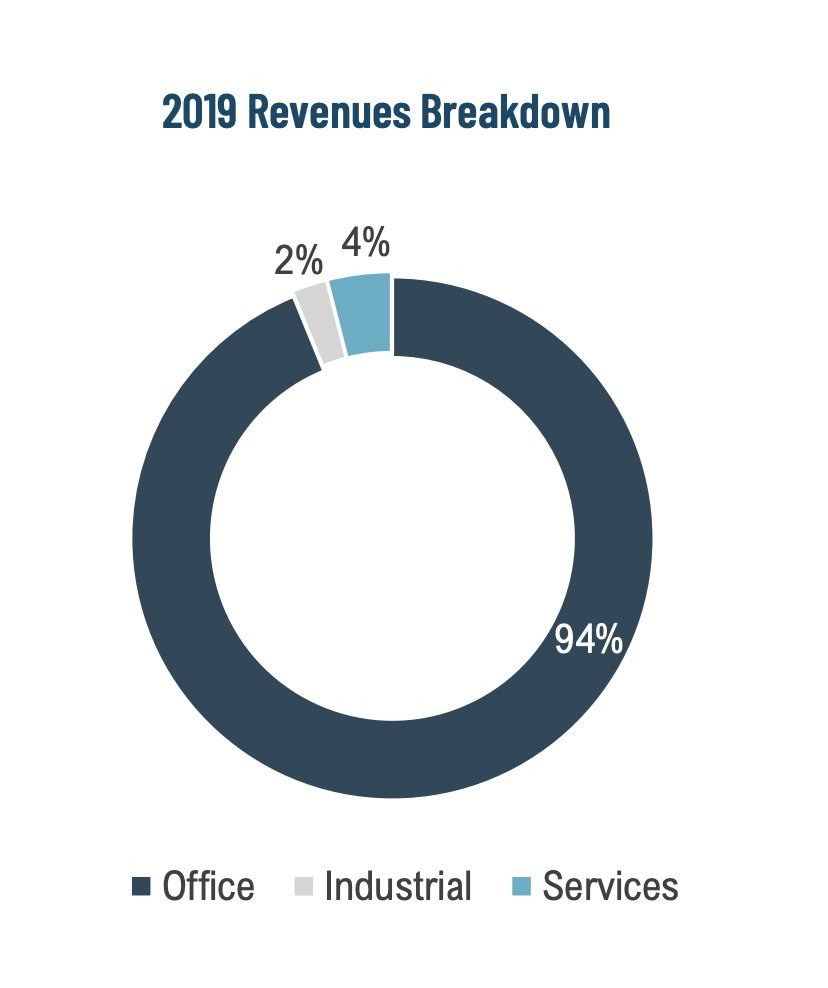

BR Properties is a Brazilian commercial real estate company focused on the acquisition, leasing, management, development, and sale of commercial real estate properties in Brazil’s major metropolitan areas. The company works with office buildings as well as industrial and logistics warehouses. As of year-end 2019 they own 31 properties totaling 682,000 square meters of space. BR Properties was founded in 2004 and is headquartered in Sao Paulo Brazil. They have 86 employees.

Revenue and Cost Analysis

BR Properties had total revenue of R$ 474.7 million in 2019, a decrease from R$ 506.6 million in 2018. Net revenue was R$ 379.2 million in 2019, representing a gross margin of 80%. The company was profitable in each of the last two years. Net income in 2019 was R$311.3 million, a significant increase from R$ 13.7 million in 2018. This increase is due to decreasing financing expense and a significant write up of the value of their investment properties.

The company reduced its client concentration significantly in 2019. Their top 10 lessees accounted for 56% of revenue in 2019 compared to 63% in 2018.

Balance Sheet Analysis

BR Properties has a solid balance sheet. Their liquidity position is strong and they have reasonable liability levels. It is worth noting that the company’s financial position has likely deteriorated due to the coronavirus crisis.

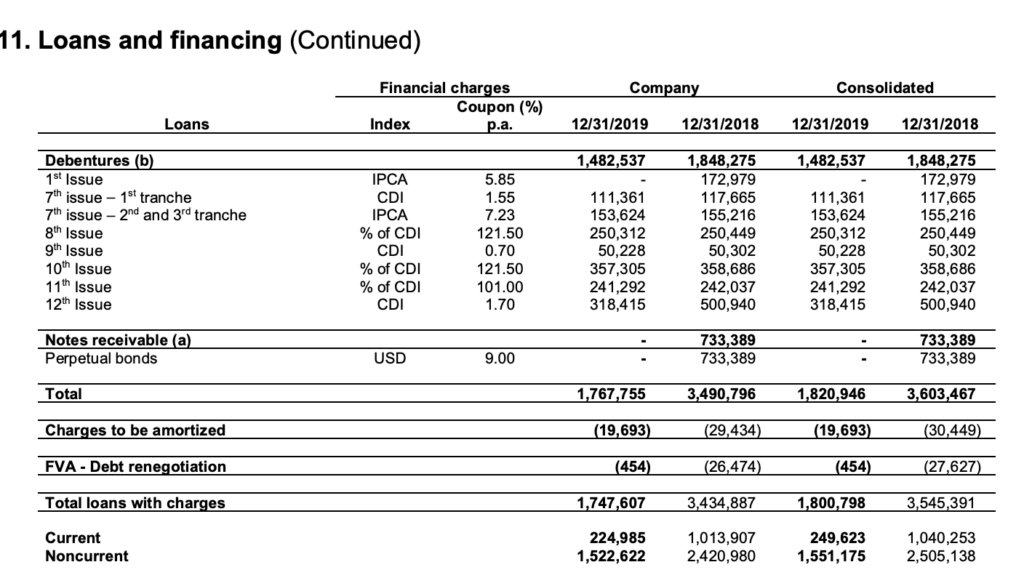

BR Properties – Debt Analysis

As of year-end 2019 the company has R$ 1.8 billion in total debt outstanding, R$ 249.6 million of which is classified as current.

BR Properties Stock – Share Dynamics and Capital Structure

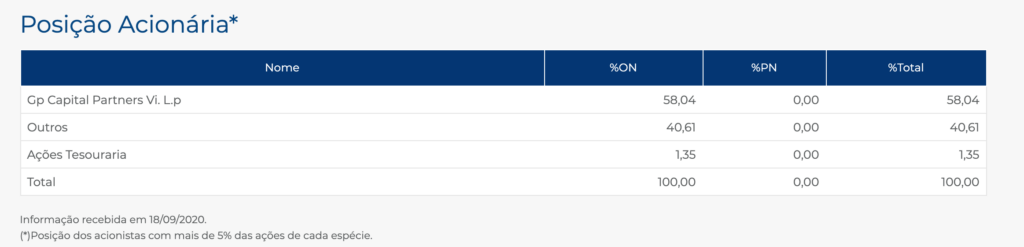

As of September 2020 the company has 491.5 million common shares outstanding. One institutional investor, GP Capital partners, owns 58% of the outstanding shares and the company holds 1.3% of the shares in its treasury. The remaining 40% float in the market.

BR Properties Stock – Dividends

Based on 2019’s results, the company paid a dividend of R$0.086 cents per share in May of 2020. At the current market price this represents a dividend yield of 0.9%.

BR Properties Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 2.7 billion / R$ 7.2 billion = .38

A debt to equity ratio of .38 indicates that BR Properties uses a relevant amount of debt in its capital structure, but relies more heavily on equity financing.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 1.5 billion / R$ 309 million = 4.9

A working capital ratio of 4.9 indicates a sound liquidity position under normal conditions. However these numbers are pre coronavirus, so the company’s liquidity position has likely deteriorated.

Price to Book Ratio

Current Share Price/Book Value per Share.

R$ 9.60 / R$ 14.66 = .65

BR Properties has a book value per share of R$ 14.66. At the current market price this implies a price to book ratio of .65, meaning the company’s stock currently trades at a significant discount to the book value of the company.

Brazilian Commercial Real Estate Market- Economic Factors and Competitive Landscape

The Brazilian commercial real estate market, like most commercial real estate markets globally, has been profoundly affected by the corona virus crisis. The industry is undergoing fundamental changes due to the global economic crisis and a cultural shift towards remote work and away for traditional office work. Investors in commercial real estate should be extra cautious, increasing their due diligence and demanding a higher margin of safety.

BR Properties Stock – Summary and Conclusions

BR Properties appears to be a decent commercial real estate company that performed well under normal conditions. However commercial real estate is not currently operating under normal conditions. There are simply too many unknowns for me to invest in any commercial real estate play at this time. I will need to see 2020’s results before I can even begin to understand the impact of the coronavirus crisis on companies like BR Properties. This analysis will serve as a point of comparison when I analyze the company’s 2020 financials. For now, if I had to allocate to Brazilian equity, I would prefer to allocate to a more stable business less effected by the economic crisis, for example Grupo Dimed.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.