Common Stock: BK Brasil (BKBR3)

Current Market Price: R$ 10.70

Market Capitalization: R$ 3 billion

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

BK Brasil Stock – Summary of the Company

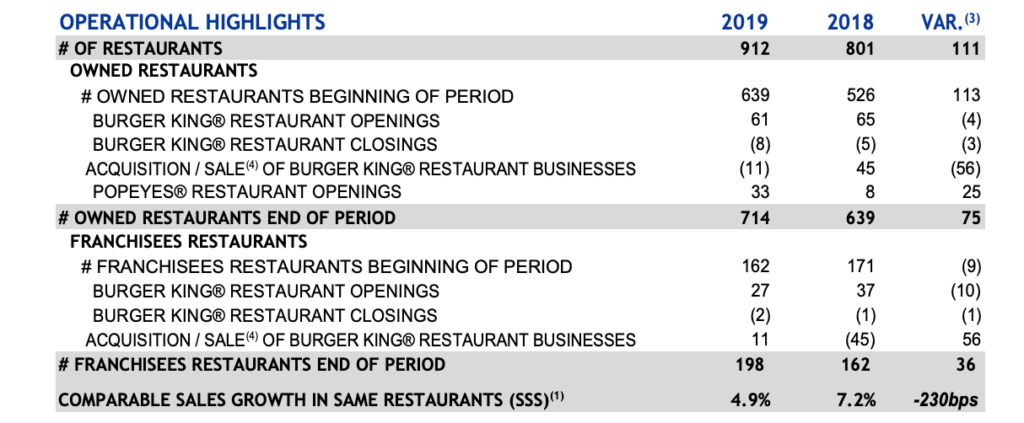

BK Brasil is a restaurant management company focused on the development and operation of Burger King and Popeyes restaurants in Brazil. They have master franchise agreements with both Burger King and Popeyes to operate in Brazil. As of year-end 2019 the companyoperates a total of 912 restaurants, 871 Burger King’s and 41 Popeyes. The company opened 121 new restaurants in 2019, 88 of which were Burger King’s and 33 were Popeyes. They also opened 98 new “desert centers”, bringing total desert centers to 454. The company has a significant digital presence, their app has 19 million downloads and 3.6 million active users. BK Brasil was founded in 2011 and is headquartered in the state of Sao Paulo, Brazil.

Revenue and Cost Analysis

BK Brasil had net revenue of R$ 2.9 billion in 2019, an increase from R$ 2.3 billion in 2018. Their COGS in 2019 was R$ 1 billion, representing a gross margin of 62%, equal to their gross margin in 2018.

The company was profitable in each of the last two years. In 2019 BK Brasil had net income of R$ 48.5 million, representing a profit margin of 1.6%, a significant decrease from 5.4% in 2018.

Balance Sheet Analysis

BK Brasil has a sound balance sheet. They have sufficient liquidity in the near term, a solid base of long term assets, and reasonable liability levels.

BK Brasil – Debt Analysis

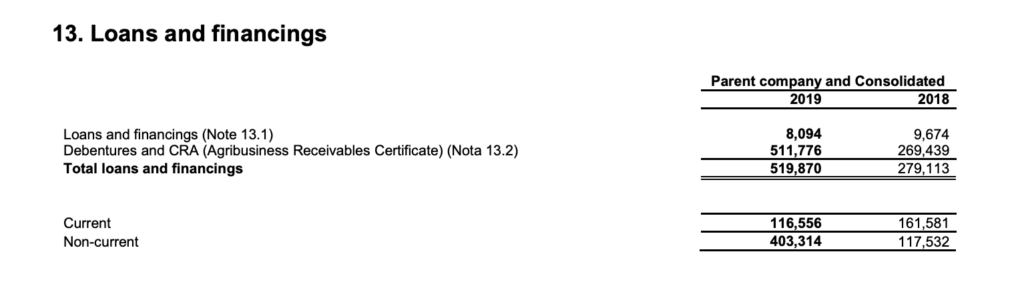

As of year-end 2019 BK Brasil has R$ 519.8 million in total debt outstanding, R$ 116.5 million of which is classified as current.

BK Brasil Stock – Share Dynamics and Capital Structure

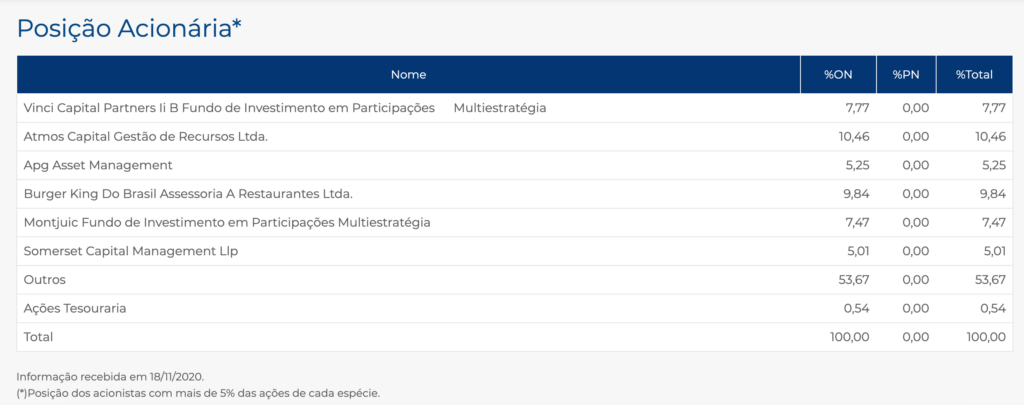

As of November 2020 the company has 275.3 million common shares outstanding. Institutional investors own around 46% of the company, with the remaining 54% being held by smaller shareholders with an ownership position of less than 5%.

BK Brasil Stock – Dividends

Based on 2019’s results BK Brasil paid a dividend of R$ 0.05 cents per share. At the current market price this implies a dividend yield of 0.5%.

BK Brasil Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 1.7 billion / R$ 1.7 billion = 1

A debt to equity ratio of 1 indicates that BK Brasil uses equal parts debt and equity in its capital structure and is not overly reliant on either form of financing.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 862 million / R$ 672 million = 1.2

A working capital ratio of 1.2 indicates a sufficient, but not strong liquidity position. BK Brasil should not have problems meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

R$ 10.70 / R$ 6.49 = 1.6

BK Brasil has a book value per share of R$ 6.49. At the current market price this implies a price to book ratio of 1.6, meaning BK Brasil stock currently trades at a slight premium to the book value of the company.

BK Brasil Stock – Summary and Conclusions

BK Brasil is a decent company. They are expanding both of their brands steadily and maintaining a sound financial position while doing so. Their liquidity position is sound and their liability levels are reasonable. The company was profitable in each of the last two years and returned capital to shareholders in 2019 via a dividend.

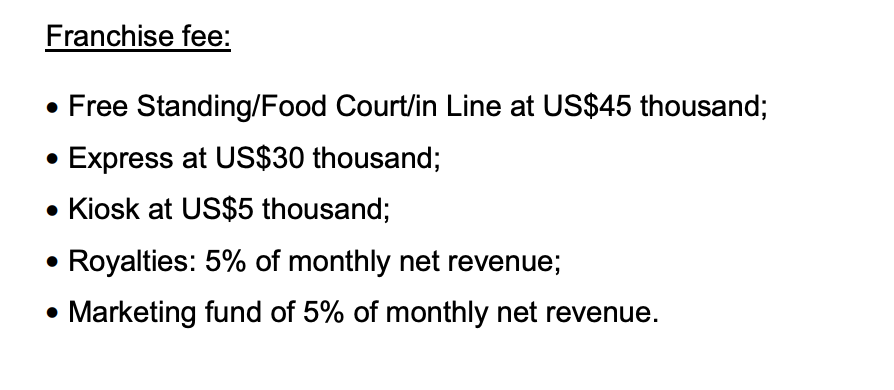

The company does have some USD exposure via their royalty payments, however this is not excessive. Their current valuation seems fair, although I don’t see anything exceptional about the company that would compel me to invest, especially considering I can’t and won’t eat 99% of the food they serve. That being said, I suspect long term investors in BK Brasil stock will do fine, but I won’t be one of them. Investors can compare BK Brasil to other Brazilian restaurant operators such as International Meal Company.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.