Common Stock: Aya Gold & Silver (TSX: AYA)

Current Market Price: $ 2.13 USD

Market Capitalization: $ 169.5 million USD

**Note: All values in this article are expressed in United States Dollars (USD) unless otherwise noted.

Aya Gold & Silver Stock – Summary of the Company

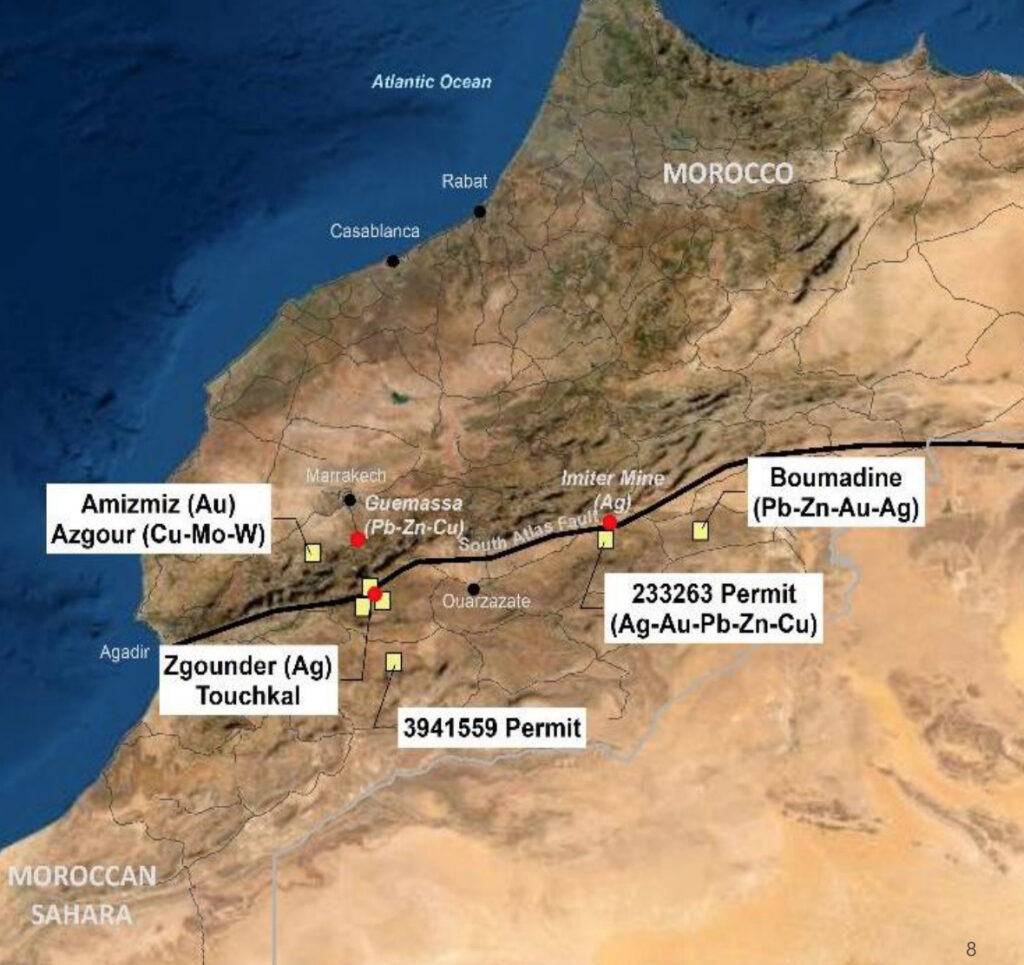

Aya Gold & Silver is a mining and exploration company focused on the acquisition, exploration, development, and operation of precious metals properties. The company’s main focus is Morocco and in 2019 they brought their first mine, the Zgounder mine, into commercial production. They also own several other exploration stage properties in Morocco. Aya was founded in 2007 and is headquartered in Quebec Canada.

Revenue and Cost Analysis

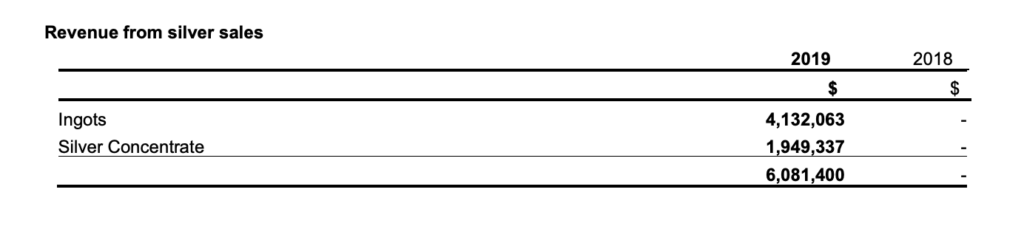

In 2019 Aya brought its first mine into production, meaning 2019 was the first year the company had any revenue. Total revenue in 2019 was $6 million and the company produced 452,416 ounces of silver. Production costs totaled $4.7 million, implying a gross margin of 22%. Although bringing their first mine into production improved the company’s finances significantly, Aya still had a net loss of $577 thousand in 2019.

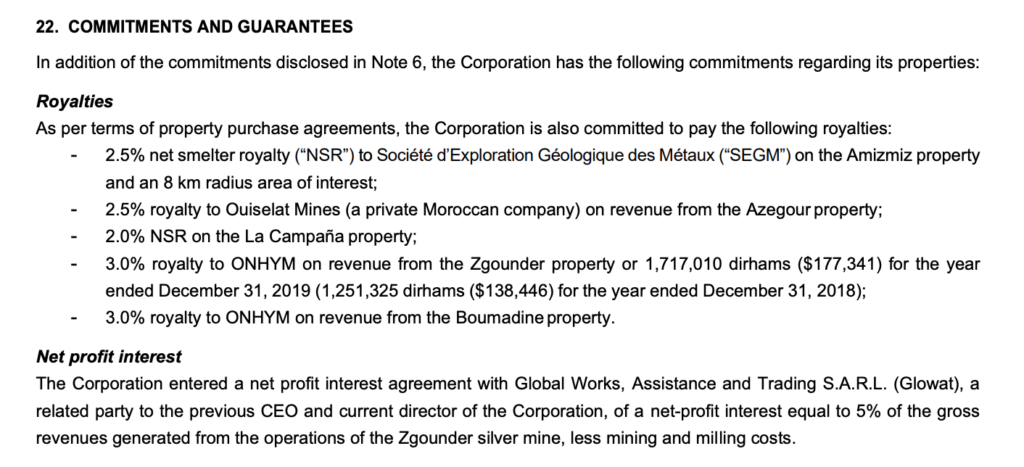

Aya Gold & Silver – Royalty and Streaming Agreements

The company has significant royalty agreements on several properties. Their producing Zgounder mine is subject to a 3% net smelter royalty in addition to a 5% net profit interest.

Aya Gold & Silver – Mineral Resources

The Zgounder property has 10 million ounces of silver classified as “Measured and Indicated” and an additional 28 million ounces of silver classified as “Inferred”

Balance Sheet Analysis

Aya has a solid balance sheet. They have a strong liquidity position and a good base on long term assets. Liability levels are low relative to the company’s assets and operations.

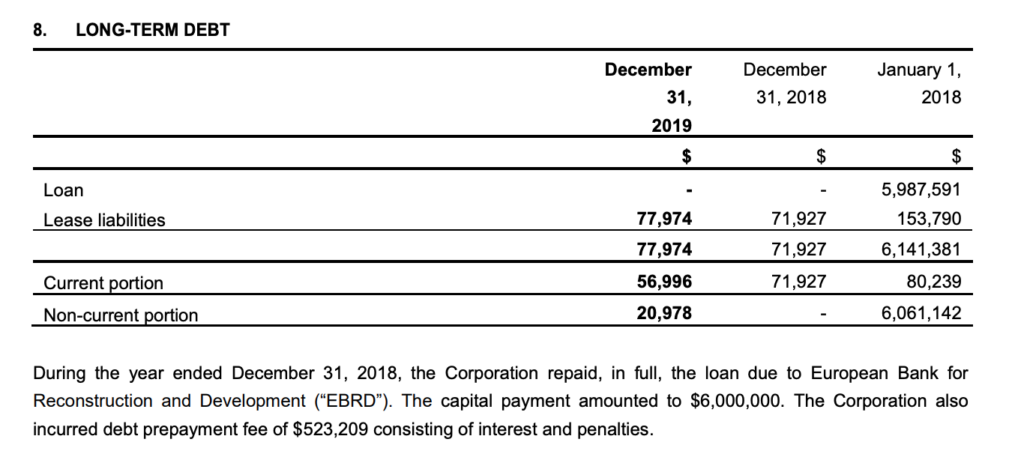

Aya Gold & Silver – Debt Analysis

The company paid off the majority of its debt in 2018. As of year-end 2019 Aya has a small, nonsignificant amount of debt outstanding.

Aya Gold & Silver Stock – Share Dynamics and Capital Structure

As of year-end 2019 Aya has 79.6 million common shares outstanding. In addition they have 890 thousand options outstanding. Fully diluted shares outstanding is around 80.5 million shares.

Aya Gold & Silver Stock – Dividends

The company does not currently pay a dividend.

Management – Skin in the game

Insiders at Aya Gold & Silver have not made any relevant transactions in the company’s stock recently, providing no signal to investors.

Aya Gold & Silver Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$7.2 million / $40.9 million = .18

A debt to equity ratio of .18 indicates that Aya uses a small amount of debt in its capital structure, but relies mostly on equity financing to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

$21 million / $5.5 million = 3.8

A working capital ratio of 3.8 indicates a sound liquidity position. Aya should not have problems meeting its obligations in the near term.

Price to Book Ratio

Current Share Price/Book Value per Share.

$2.13 / $0.50 = 4.2

Based on fully diluted shares outstanding Aya has a book value per share of $0.50. At the current market price this implies a price to book ratio of 4.2, meaning the company’s stock currently trades at a premium to the book value of the company.

Silver Market – Economic Factors and Competitive Landscape

Silver mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear silver companies are poised to benefit from a strong economic tailwind.

Aya Gold & Silver Stock – Summary and Conclusions

Aya Gold & Silver is an intriguing project. The company recently brought their first silver mine into commercial production, they also own several promising exploration stage assets. Their finances are solid and a higher silver price in 2020 should improve their finances further. Their capital structure is not very dilutive and therefore shareholder friendly.

My biggest concern is jurisdictional risk. That is not to say Morocco is a risky jurisdiction, just that I know nothing about the risks associated with mining there. Aya stock could be interesting as a jurisdictional diversifier, since I have not seen many Morocco focused precious metals companies. However I will need to learn a bit more about doing business in Morocco before am willing to allocate. For now I will put Aya stock at the top of my watchlist and continue to allocate to projects I am more comfortable with, such as Fortuna Silver.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.