Common Stock: Arezzo (ARZZ3)

Current Market Price: R$ 70.42

Market Capitalization: R$ 6.4 billion

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Arezzo Stock – Summary of the Company

Arezzo is a Brazilian retailer that sells high end women’s shoes, handbags, and accessories through 7 unique brands. The company is present throughout all of Brazil and also has a presence in The United States and Italy. At the end of 2019 they had 699 franchise locations, 53 fully owned stores, and were present in 2,646 additional points of sale. Arezzo was founded in 1972 and is headquartered in Belo Horizonte in the state of Minas Gerais, Brazil.

Revenue and Cost Analysis

Arezzo had revenue of R$ 1.7 billion in 2019, an increase from R$ 1.5 billion in 2018 and R$ 1.4 billion in 2017. Their COGS was R$ 903 million in 2019, representing a gross margin of 46%, equal to their gross margin in both 2018 and 2017.

The company was profitable in each on the last three years. In 2019 Arezzo had net income of R$ 162.1 million, representing a profit margin of 9.6%, on par with their profit margin from the year prior and a slight decrease from 11.3% in 2017.

Arezzo – Acquisitions

In 2019 Arezzo acquired the exclusive rights to sell Vans brand products in Brazil, via acquisition. The transaction was valued at R$ 50 million.

Balance Sheet Analysis

Arezzo has a solid balance sheet. They have a sound liquidity position, a good base of long term assets, and reasonable liability levels.

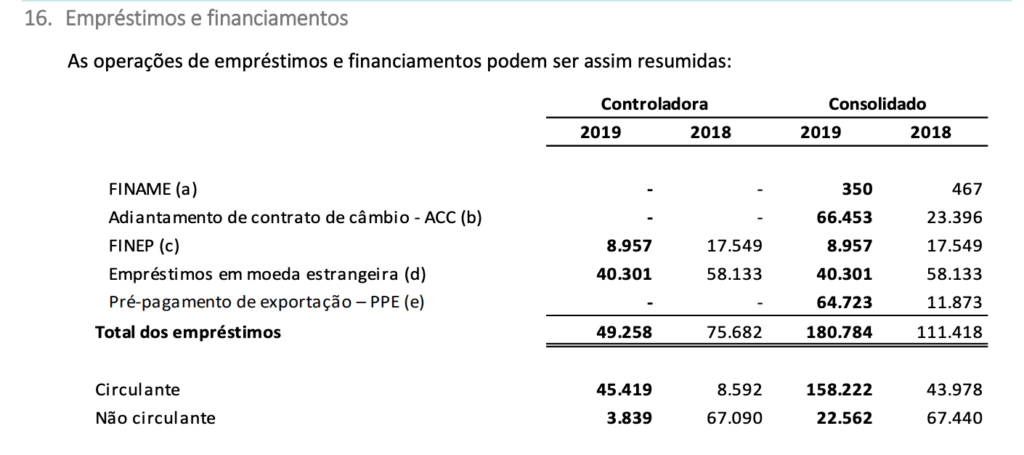

Arezzo – Debt Analysis

As of year-end 2019 Arezzo has total debt outstanding of R$ 180.7 million, R$ 158.2 million of which is classified as current. R$ 101 million of the company’s debt is denominated in US dollars, exposing the company to the negative effects of a depreciating Brazilian Real.

Arezzo Stock -Share Dynamics and Capital Structure

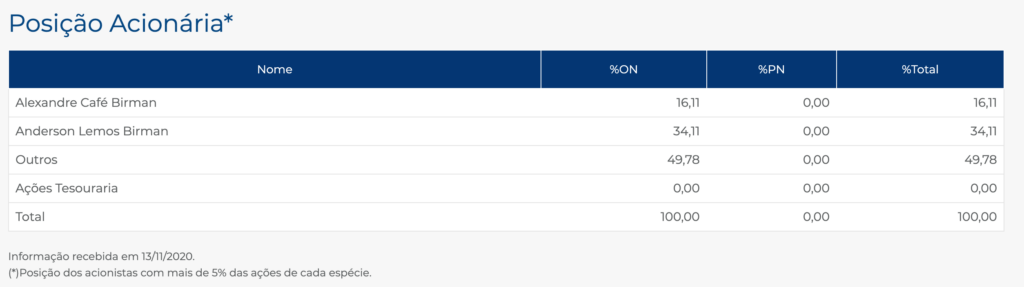

As of year-end 2019 the company has 91 million common shares outstanding. The founding family owns around 51% of the outstanding shares with the remaining 49% being held by smaller shareholders with an ownership position of less than 5%.

Arezzo Stock – Dividends

Arezzo paid total dividends of R$ 1.33 per share based on 2019’s results. At the current market price this represents a dividend yield of 1.9%.

Arezzo Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 667.1 million / R$ 746 million = .89

A debt to equity ratio of .89 indicates that Arezzo uses a mix of debt and equity in its capital structure but relies slightly more on equity financing to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 980.6 million / R$ 464.6 million = 2.1

A working capital ratio of 2.1 indicates a sound liquidity position. Arezzo should not have problems meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

R$ 70.42 / R$ 8.20 = 8.5

Arezzo has a book value per share of R$ 8.20. At the current market price this implies a price to book ratio of 8.5, meaning Arezzo stock currently trades at a significant premium to the book value of the company.

Arezzo Stock – Summary and Conclusions

There is a lot to like about Arezzo. The company has a large footprint in Brazil and is growing its presence internationally. Topline revenue has been growing steadily for the past several years and the company has remained profitable while doing so. Their balance sheet is sound, with a strong liquidity position and reasonable liability levels. Although US dollar denominated debt is always concerning for Brazilian companies. Arezzo returns capital to shareholders regularly via a dividend.

However the market appears to be overly optimistic about the company’s prospects moving forward. The corona virus shut downs will surely have a negative impact on the company’s 2020 results and a depreciating Brazilian Real will also be a drag on earnings moving forward due to the company’s US dollar denominated debt. In spite of this Arezzo stock is currently trading at an all-time high.

There is nothing wrong with Arezzo as a company, but the valuation is simply too high for me and offers no margin of safety. The stock would need to decline significantly for me to consider investing. Investors should compare Arezzo stock to other Brazilian retailers such as Alpargatas.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.