Common Stock: Alpargatas (ALPA3)

Current Market Price: R$ 35.80

Market Capitalization: R$ 20.7 billion

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Alpargatas Stock – Summary of the Company

Alpargatas is a Brazilian manufacturing company engaged in the production and sale of footwear and related products. Their most famous brand is the Havaianas flip flop sandal. They also own the brands Osklen, Mizuna, and Dupe. The company has 13 production units in Brazil and international operations in Buenos Aires, Madrid, New York, Paris, London, and Bologna. Alpargatas was founded in 1907 and is headquartered in Sao Paulo Brazil.

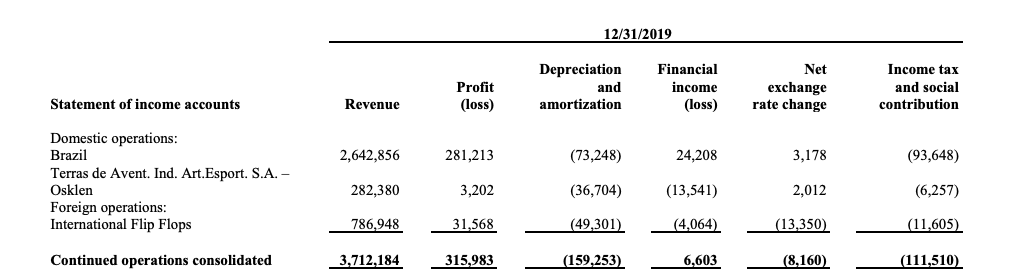

Revenue and Cost Analysis

Alpargatas had revenue of R$ 3.7 billion in 2019, an increase from R$ 3.4 billion in 2018. Their COGS was R$ 1.8 billion in 2019, representing a gross margin of 50%, on par with their gross margin of 49% in 2018.

Alpargatas was profitable in both 2019 and 2018. In 2019 the company had net income of R$ 259.3 million, representing a profit margin of 6.9%, a decrease from 9.5% in 2018.

The company has a diversified client portfolio with no single client accounting for more than 6% of revenue.

Balance Sheet Analysis

Alpargatas has a solid balance sheet. They have a strong base of assets and a sound liquidity position. Liability levels are reasonable and debt levels are manageable.

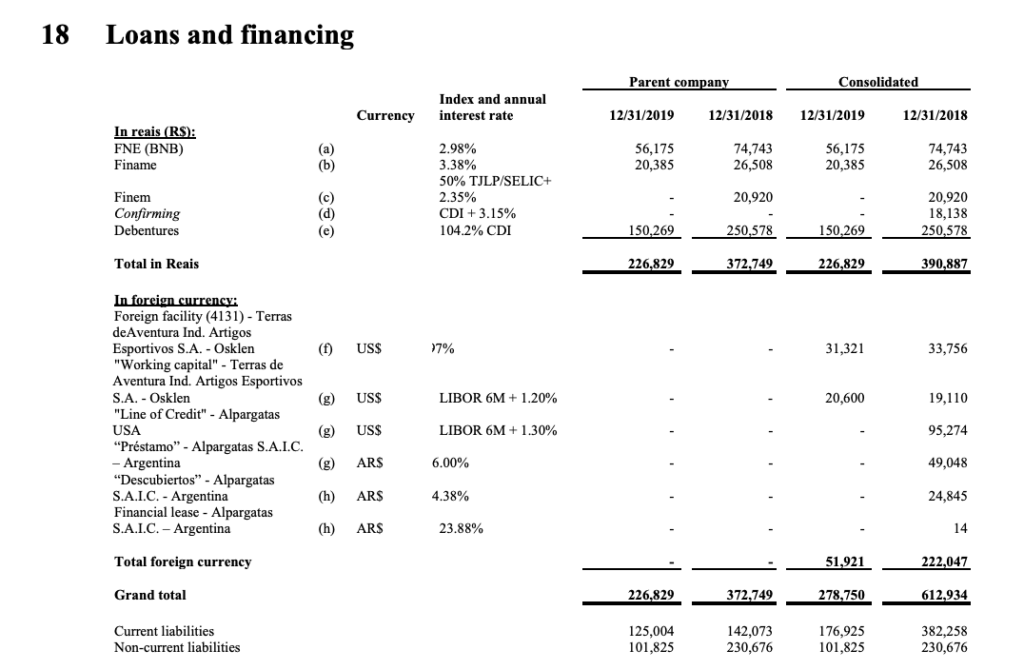

Alpargatas – Debt Analysis

As of year-end 2019 Alpargatas has R$ 278.7 million in total debt outstanding, R$ 176.9 million of which is classified as current. This represents a significant decrease in the company’s debt burden compared to 2018, when the company had R$ 612.9 million in total debt outstanding at year end.

A significant portion of the company’s debt is denominated in foreign currency, mainly the US dollar and the Argentinian peso. I am not concerned about the company’s foreign currency denominated debt because the company does have revenue denominated in foreign currency and because the Argentinian peso may be one of the only currencies in the world weaker than the Brazilian Real.

Alpargatas Stock – Share Dynamics and Capital Structure

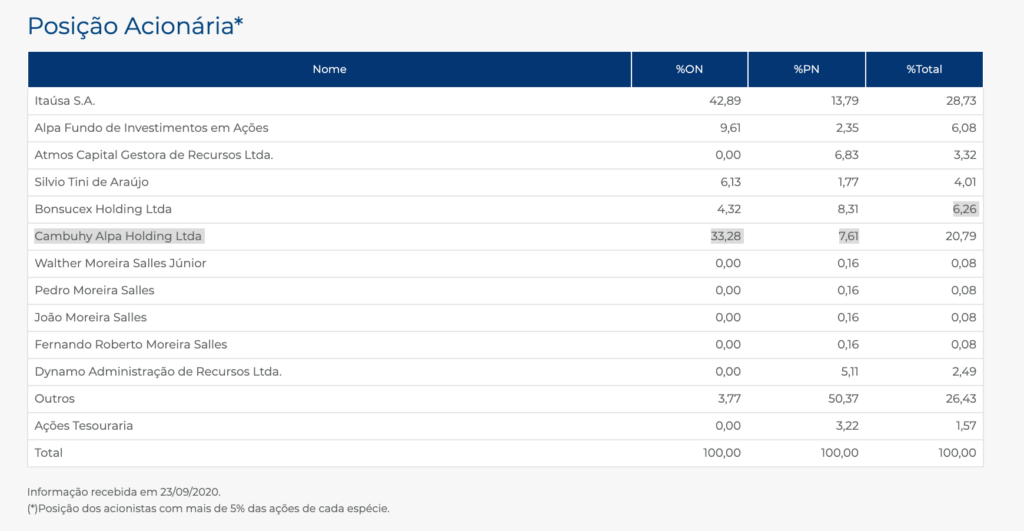

As of year-end 2019 Alpargatas has 302 million common shares outstanding and 286 million preferred shares outstanding. Total shares outstanding is around 588 million shares.

In September 2017 the investment groups Itaúsa, Cambuhy Investimentos and Brasil Warrant acquired around 54% of Alpargatas and became the controlling shareholders of the company. Around 26% of the company’s outstanding shares are held by non-controlling entities and non-insiders with a position of less than 5%.

Alpargatas Stock – Dividends

Based on 2019’s results Alpargatas paid a dividend of R$ 0.05 cents per share to common shareholders. At the current market price this implies a dividend yield of 0.1%.

Alpargatas Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 1.8 billion / R$ 2.7 billion = .65

A debt to equity ratio of .65 indicates that Alpargatas uses a mix of debt and equity in its capital structure, but relies most heavily on equity financing to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 2.6 billion / R$ 1.2 billion = 2.1

A working capital ratio of 2.1 indicates a sound liquidity position. Alpargatas should not have a problem meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

R$ 35.80 / R$ 4.65 = 7.7

Based on total shares outstanding Alpargatas has a book value per share of R$ 4.65. At the current market price this implies a price to book ratio of 7.7, meaning Alpargatas stock currently trades at a significant premium to the book value of the company.

Alpargatas Stock – Summary and Conclusions

Alpargatas is a solid, well-run company. They have a clean balance sheet with a sound liquidity position and reasonable liability levels. The company is profitable and its international operations make up a relevant portion of their revenue. The Havaianas brand has incredible brand recognition. In Brazil the company sells 1.1 pair per Brazilian, meaning the sell more flip flops in Brazil than there are people.

Although I like the business, I don’t like its current valuation. It trades at a significant premium to book and the capital it is returning to shareholders via dividends is almost irrelevant from an investment perspective. In my opinion the current valuation is rich and the current share price does not offer any margin of safety for investors. Alpargatas stock is at the top of my watchlist and should the share price decline significantly, I will seriously consider taking a position. I will be comparing Alpargatas stock to other Brazilian apparel companies, such as Grazziotin.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.

2 Comments

Comments are closed.