Common Stock: Superior Gold (TSXV: SGI)

Current Market Price: $.63 USD

Market Capitalization: $44 million USD

Superior Gold Stock – Summary of the Company

Superior Gold is a mineral mining company focused on the acquisition, exploration, development, and operation of gold mining properties in Australia. Their flagship property is the Plutonic Gold Mine, which has been in continuous production since 1990. They continue to actively explore the Plutonic mine in addition to other exploration stage properties. Superior Gold was founded in 2016 and is headquartered in Toronto, Canada.

Revenue and Cost Analysis

In 2019, Superior Gold produced 83,000 ounces of gold and had revenues of $115.6 million. All in sustaining costs were $1,387, which was right around the breakeven level. After considering exploration and administrative expenses, Superior Gold had a net loss of $12 million in 2019. This is a slight improvement from 2018’s net loss of $13.3 million, due mostly to reduced administrative expenses.

Superior Gold – Royalty and Streaming Agreements

The Plutonic Mine has a 2% net smelter royalty attached on gold produced in excess of 300,000 ounces. Superior Gold retains the right to repurchase this royalty.

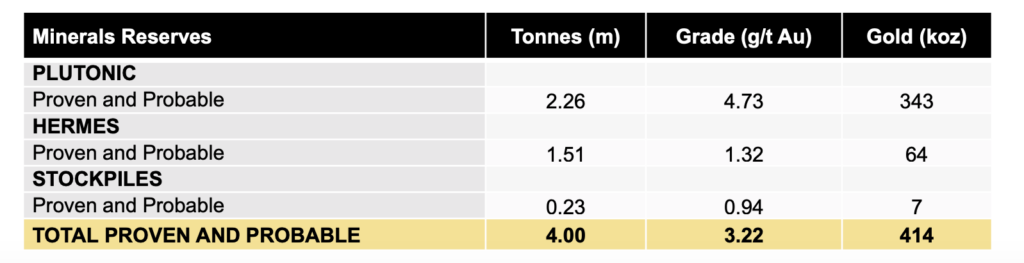

Superior Gold – Mineral Resources

The company has proven and probable reserves totaling 414,000 ounces of gold.

Balance Sheet Analysis

Superior Gold has a weak balance sheet. They have low liquidity levels and high liabilities, including debt.

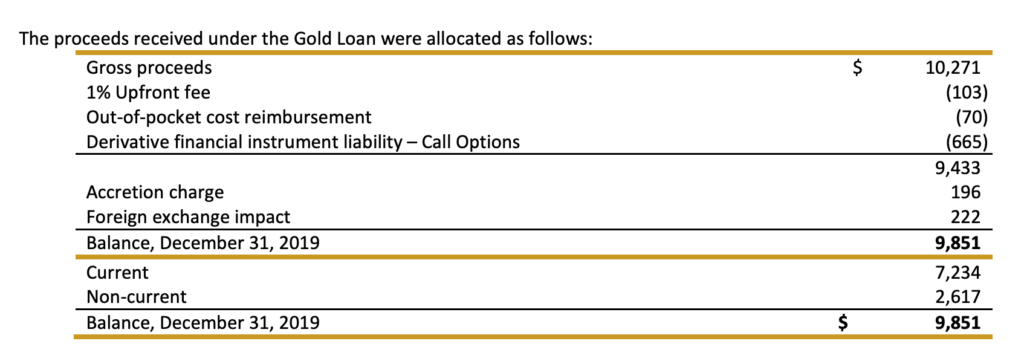

Superior Gold – Debt Analysis

In November 2019, the company took out a gold loan valued at AUD 15 million. They will repay the 7,920 ounces of gold in equal monthly installments ending in June 2021.

Superior Gold Stock – Share Dynamics and Capital Structure

As of March 2020, the company had 97.1 million common shares outstanding. In addition, the have options, warrants, and performance share units outstanding. Fully diluted shares outstanding is 118.8 million.

Superior has a dilutive capital structure. Investors should carefully consider their place in the capital structure before investing.

Superior Gold Stock – Dividends

The company does not pay a dividend and plans to retain its future earnings. Therefore, it is unlikely to pay a dividend for the foreseeable future.

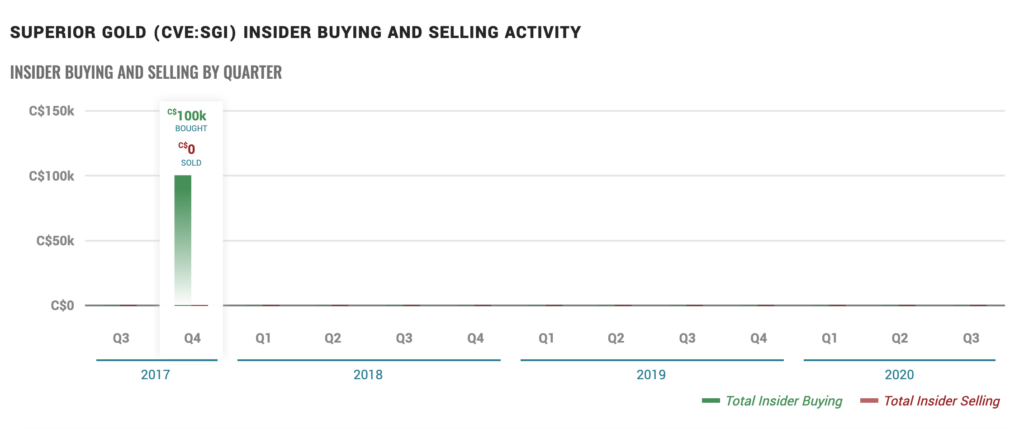

Management – Skin in the game

Insiders at Superior Gold have not made any relevant transactions related to the company’s stock recently, providing no signal to investors.

Superior Gold Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$69.4 million/$27.5 million = 2.5

A debt to equity ratio of 2.5 means that Superior Gold uses a significant amount of debt in its capital structure and relies on this debt to finance itself.

Price to Book Ratio

Current Share Price/Book Value per Share.

$.63/$.23 =2.7

Based on fully diluted shares outstanding, Superior Gold has a book value per share of $.23. At the current market price this implies a price to book ratio of 2.7, meaning the company’s stock currently trades at a premium to the book value of the company.

Working Capital Ratio

Current Assets/Current Liabilities

$34 million/ $37.1 million = .92

A working capital ratio of .92 indicates a weak liquidity position. Superior could potentially have problems meeting its short-term obligations.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

Superior Gold Stock – Summary and Conclusions

The Plutonic mine is a strong and proven asset. It has been in continuous production since 1990 and continued exploration has found new reserves. It is located in a stable and proven mining jurisdiction.

However, management has yet to operate the mine profitably, and the all in sustaining cost is rising year over year. The company is not in a strong financial position and the capital structure is dilutive. A significant amount of upside has been given away via a gold loan and royalty’s.

I’m torn on Superior Gold stock. On the one hand, it is a proven and producing mine that appears to be undervalued relative to its peer group. But on the other hand, operational performance has been poor and the capital structure is not particularly friendly to common shareholders.

I would consider only a small starting position in the stock, and if operational performance improves, I would consider increasing my position size. But given the risks discussed above, I would not make this a core position in my portfolio.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.