Common Stock: Roxgold (TSX:ROXG, OTC: ROGFF)

Current Market Price: $.96

Market Capitalization: $356 million

Roxgold Stock – Summary of the Company

Roxgold is a gold mining company focused on West Africa. They have 2 major properties; The Yaramoko mine in Burkina Faso, which is currently producing and The Seguela Project in Cote d Ivoire, which is currently in the exploration and development stage. Roxgold was founded in 1983 and is headquartered in Toronto, Canada. They have around 460 employees.

Revenue and Cost Analysis

In 2019 Roxgold had revenues of $196.2 million, a significant increase from 2018 sales of $169.1 million. They produced 142,204 ounces of gold in 2019, also a significant increase from 2018 production of 132,656 ounces.

The company’s “all in sustaining cost” per ounce sold was $844 in 2019 and they had a net profit of $5.6 million.

Roxgold invests heavily in exploration. In 2019 exploration expenses totaled $16.1 million, more than double the $8 million spent in 2018.

Roxgold – Royalty and Streaming Agreements

The Burkina Faso government has a 10% ownership stake in the exploitation company and receives a 3% to 5% royalty in addition.

Royalty expenses totaled $10 million in 2019.

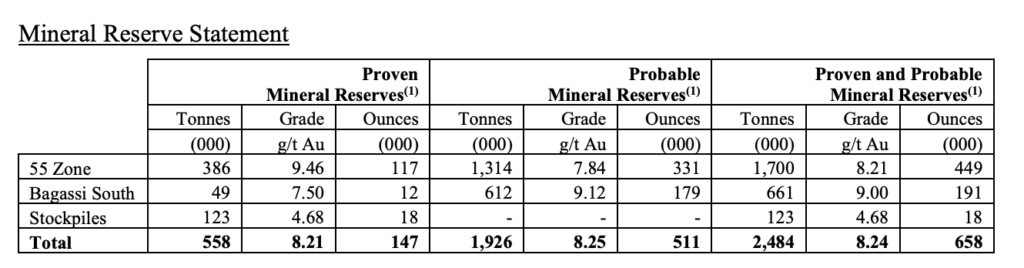

Roxgold – Reserves

The Yaramoko Mine has “proven and probable” gold reserves totaling 658,000 ounces.

Balance Sheet Analysis

The company has an OK, but not strong balance sheet. Liquidity is sufficient, but not great. Liability levels are not excessive, but are mostly current.

At the end of 2019 current assets totaled $72.2 million, including $41 million in cash. Current liabilities totaled $76.4 million made up mostly of accounts payable and current debt obligations.

Total assets were $291.6 million compared to total liabilities of $110 million. The company’s long term asset base is comprised mostly of property and equipment, which totaled $202 million at the end of 2019.

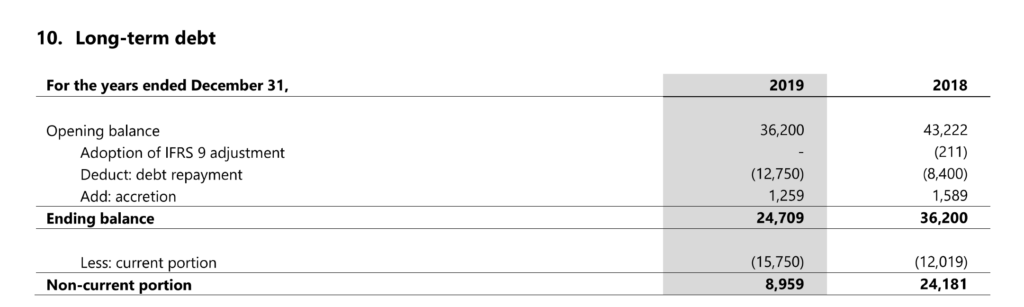

Roxgold – Debt Analysis

As of year-end 2019 the company had debt outstanding totaling $24.7 million, which is to be fully repaid by June 2021. They also had a current lease liability of $7.1 million.

Roxgold Stock – Share Dynamics and Capital Structure

As of year-end 2019 the company had 371.5 million common shares outstanding. They also have a significant amount of dilutive instrument outstanding including options and deferred share units. Fully diluted shares outstanding is around 390.3 million shares.

Roxgold has senior debt in its capital structure in addition to dilutive instruments. Their capital structure increases risk for common shareholders and investors should think carefully about their place in the capital structure before investing.

Roxgold Stock – Dividends

The company has never paid a dividend.

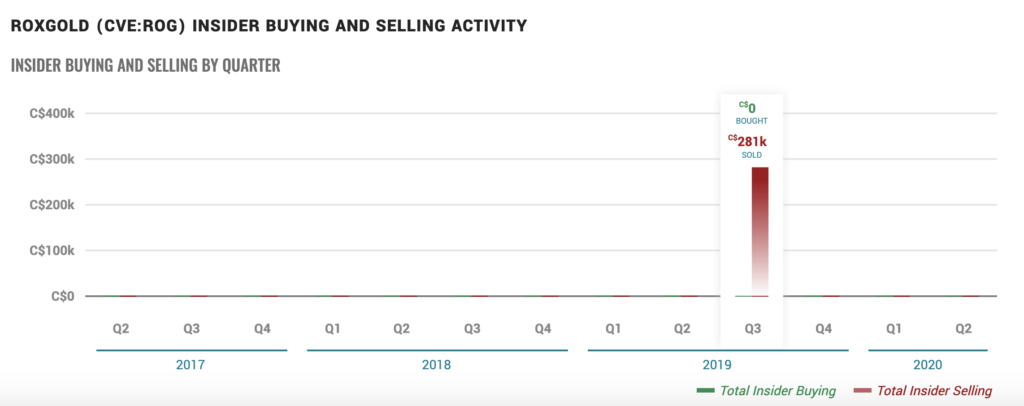

Management – Skin in the game

There has not been any relevant insider activity related to Roxgold stock recently.

Roxgold Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$110.2 million/$181.4 million = .6

A debt to equity ratio of .6 indicates that the company uses both debt and equity in its capital structure, with slightly more equity than debt. They should not be overly reliant on any one form of financing in the future.

Price to Book Ratio

Current Share Price/Book Value per Share.

$.96/$.46 = 2

Based on fully diluted shares outstanding Roxgold has a book value per share of $.46. Based on the current market price of their stock this implies a price to book ratio of 2. A price to book ratio of 2 means the stock currently trades at a premium to the value of the company’s assets.

Working Capital Ratio

Current Assets/Current Liabilities

$72.2 million/$76.4 million = .95

A working capital ratio of .95 indicates a sufficient but not a strong liquidity position. The company should be able to meet its short-term obligations, but has little margin for error.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

Roxgold Stock – Summary and Conclusions

The Yaramoko mine is a strong asset that the company is able to operate profitably. The Seguela property is still uncertain with additional exploration required. Roxagold should be able to produce profitably for the medium term, but will need to find additional production to grow long term.

Their current financial positon is OK, but not strong. Debt levels are manageable, but mostly current, meaning debt will be a drag on earnings for the next year or so. Their current debt load also weakens their short-term liquidity position.

The company has a dilutive capital structure. Although the company does not appear to need additional financing in the short term, if they eventually develop a second mine, they are sure to need additional funding. This will result in increased dilution or debt, to the detriment of existing shareholders.

Although Roxgold has a strong mine, the property only has several more year of production. The stock currently trades at a premium to the value of these assets. Although Roxgold is a good company that is operating profitably, I don’t think the current valuation provides enough protection to invest comfortably. The risks associated with a single asset company is a risky jurisdiction that has an unfavorable capital structure are too high to merit an allocation at the current price.

However, I will continue to monitor the company and would consider investing at a much lower price or if there are positive developments related to new production.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.