Common Stock: Sabina Gold and Silver Corporation (TSX:SBB)

Current Market Price: $1.88 CAD

Market Capitalization: $560 million CAD

**Note: All values in this article are expressed in Canadian Dollars (CAD) unless otherwise noted.

Sabina Gold – Summary of the Company

Sabina Gold and Silver Corporation is a junior resource company focused on the acquisition, exploration, and development of mineral properties in Canada. Their major project is the Black River Project in Canada. They also own a significant silver royalty on the Hackett River Property in Canada, which they sold to Glencore in 2011. In addition, they have several other exploration stage properties in Canada. Sabina was founded in 1966 and is headquartered is Vancouver Canada. They have 26 full time employees.

Revenue and Cost Analysis

Sabina does not own any producing properties, therefore they do not have any revenue. They also own a significant silver royalty, but this property has not been developed yet, so it does not currently provide revenue. The company consistently runs a net loss and is likely to continue to do so for the foreseeable future.

In 2019 Sabina had a net loss of $8 million, slightly more that 2018’s net loss of $6.1 million. However, the company incurred a one-time impairment charge on $5 million in 2019.

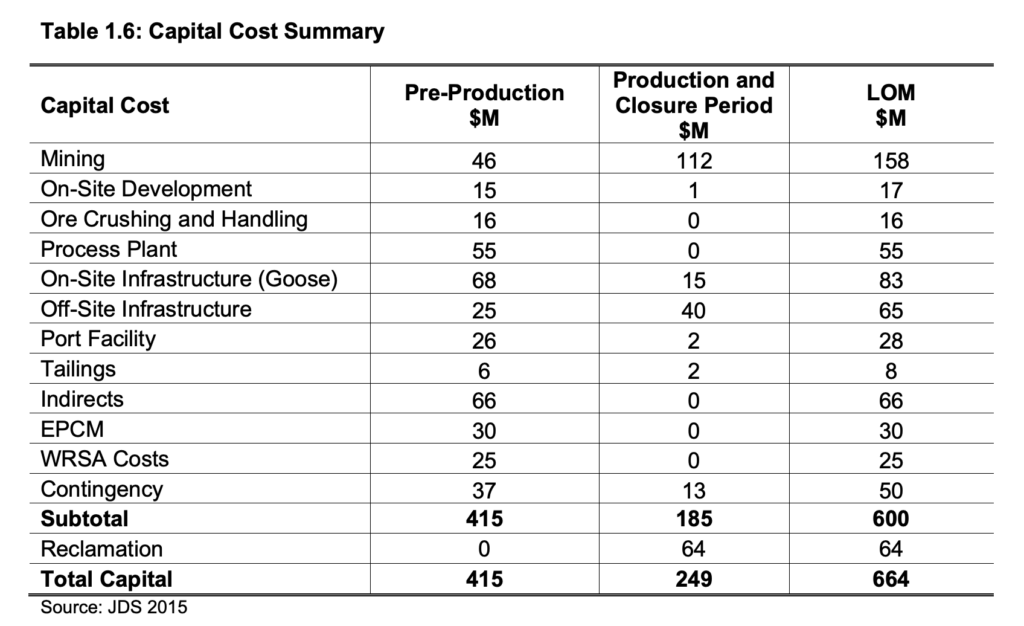

The initial capital costs to develop the Black River Property are estimated to be $415 million, meaning Sabina will require significant additional financing to bring the mine into production.

Sabina Gold – Royalty and Streaming Agreements

The company has the right to receive silver royalties from the Hackett River Property of 22.5% on the first 190 million ounces of silver and 12.5% thereafter.

They will pay net smelter royalties on certain deposits at The Black River Property. They will also pay a significant royalty to The Northwest Territories based on net income, however these royalties are deductible from income taxes.

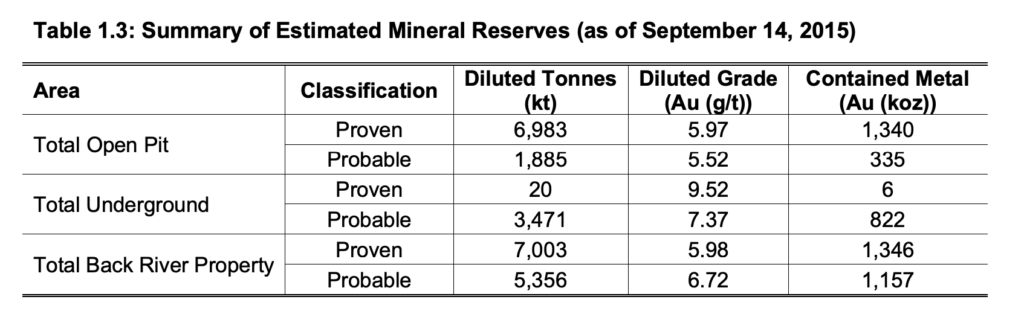

Sabina Gold – Mineral Resources

The Black River Property has significant proven and probable gold resources that total 1.3 million ounces and 1.1 million ounces respectively.

Balance Sheet Analysis

Sabina has a strong balance sheet with sufficient liquidity. At the end of 2019 current assets totaled $29.8 million, including $21.2 million in cash. Current liabilities were $6.8 million, made up mostly of accounts payable.

The company has a strong long term asset base, including property, equipment, and a silver royalty. Total assets were $500 million at the end of 2019. Total liabilities were $43.8 million, including a $33 million deferred tax liability.

Sabina Gold – Debt Analysis

The company does not have any debt outstanding, but does have a small lease obligation.

Sabina Gold Stock – Share Dynamics and Capital Structure

As of March 2020, the company has 296.6 million common shares outstanding. They also have 13.1 million options outstanding and 9 million unvested warrants. Fully diluted shares outstanding is around 318.7 million.

Sabina has a dilutive capital structure and will likely need to further dilute shareholders to raise capital in the future. Investors should carefully consider their place in the capital structure and the effects of further dilution.

Sabina Gold Stock – Dividends

The company has never paid a dividend and plans to retain future earnings.

Management – Skin in the game

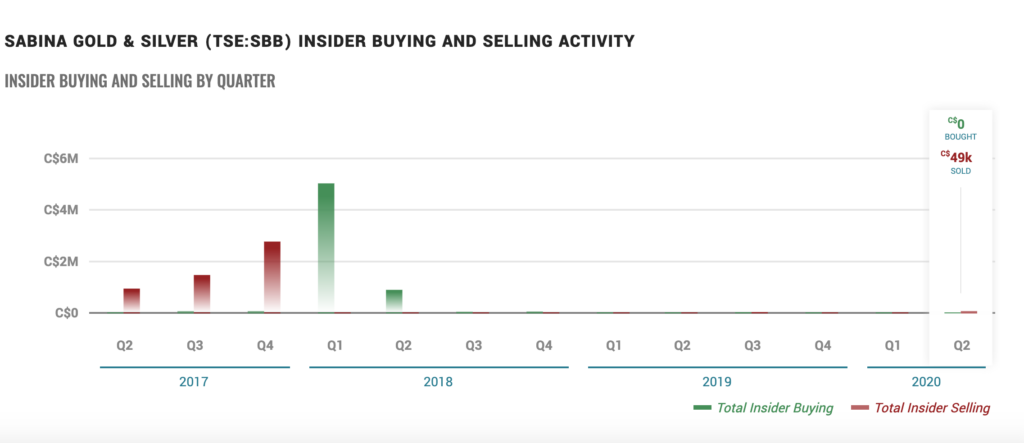

There has not been any relevant insider trading of Sabina stock recently.

Sabina Gold Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$43.8 million/$456 million = .09

A debt to equity ratio of .09 indicates that Sabina uses very little debt in its capital structure and is mostly dependent on equity financing.

Price to Book Ratio

Current Share Price/Book Value per Share.

$1.88/$1.43 = 1.3

Based on fully diluted shares outstanding, Sabina has a book value per share of $1.43. At the current market price this implies a price to book ratio of 1.3. A price to book ratio of 1.3 means Sabina stock currently trades at a slight premium to the book value of the company.

Working Capital Ratio

Current Assets/Current Liabilities

$29.8 million/$6.8 million = 4.3

A working capital ratio of 4.3 indicates a strong liquidity position. Sabina should not have a problem meeting its near-term obligations.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

Sabina Gold – Summary and Conclusions

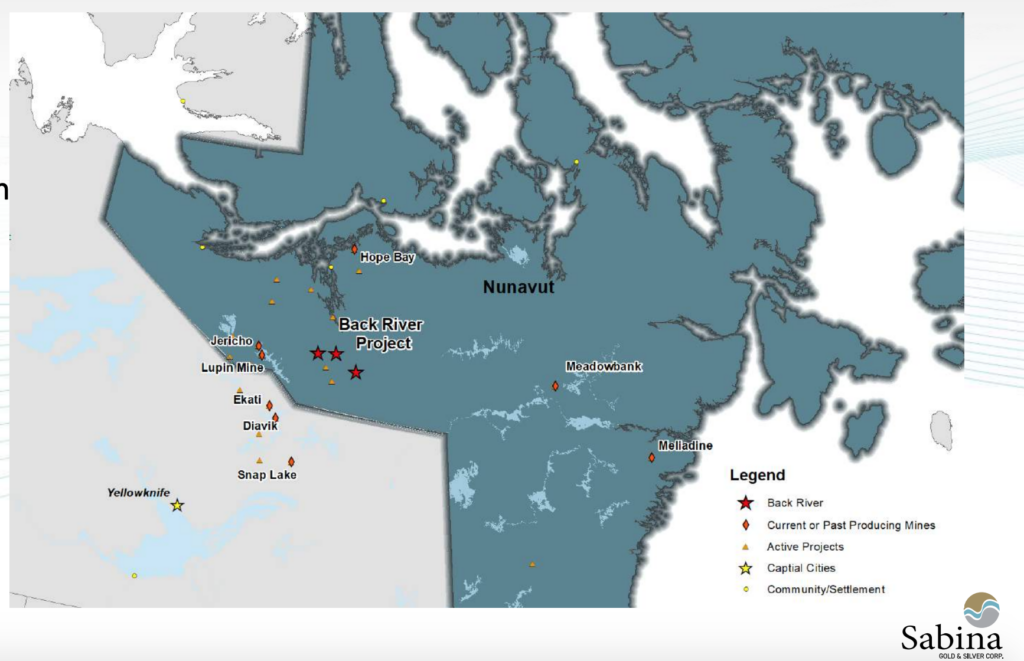

The Black River Project is a high potential property that could hold millions of ounces of gold. However, the property is in an extremely remote location and developing a fully functioning mine would be an ambitious undertaking. The company would need to build infrastructure including a port and winter ice roads.

Sabina has sufficient liquidity in the short term, but is likely to need further financing in the medium term, and will certainty need significant financing to develop the project. Existing shareholder are very likely to be diluted further. It is unclear if and when the company will have revenues.

Although Sabina stock is trading at a fair value relative to its assets, the project is too ambitious and risky for me to feel comfortable investing in the stock. However, I would consider gaining exposure through Dundee Precious Metals stock (DPM), who owns a significant amount of Sabina stock. Owning Dundee will still allow you to participate in the potential upside of Sabina, while providing protection via Dundee’s producing mines.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.