Common Stock: Comstock Mining ( NYSE: LODE)

Current Market Price: $.54

Market Capitalization: $13.5 million

Comstock Mining – Summary of the Company

Comstock mining is a gold and silver mining company focused on the exploration, development and operation of gold and silver properties. They have numerous claims in the Comstock district of Nevada. This region is their sole focus, they began acquiring property in the region in 2003. The company was founded in 1999 and is headquartered in Virginia City, Nevada. They have 10 full time employees.

Revenue and Cost Analysis

Comstock did not have any mining production in 2019. They had a very small amount of revenue from leasing agreements, but no revenues from mining. The company consistently runs a net loss and is likely to continue to do so for the foreseeable future.

In 2019 Comstock had a net loss of $3.8 million. This was an improvement from a net loss of $9.4 million in 2018. Their largest expense is general and administrative expenses, which totaled $3.3 million in 2019.

The Company produced 59,515 ounces of gold and 735,252 ounces of silver from September 2012 through December 2016. They have not produced since.

Comstock Mining – Royalty and Streaming Agreements

Many of the company’s properties have net smelter royalties attached. These range from .5% to 5%, with most being under 3%.

Balance Sheet Analysis

Comstock does not have a very strong balance sheet. Liquidity appears sufficient, but only because the company is planning to sell 6 properties. At the end of 2019 current assets totaled $13 million. $10 million of the current assets were properties classified as held for sale. Comstock only had $1 million in cash. Current liabilities were $4.4 million.

Most of the company’s assets are long term assets such as property and mineral rights. At year end 2019, total assets were $39.5 million compared to total liabilities of $16 million.

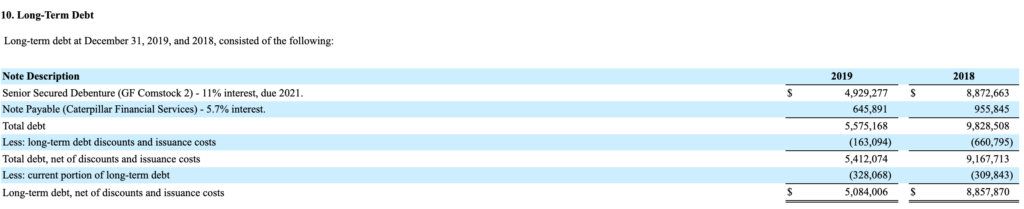

Comstock Mining – Debt Analysis

ComStock has senior debt that totaled $5 million at the end of 2019.

LODE Stock – Share Dynamics and Capital Structure

At the end of 2019 Comstock had 27.2 million common shares outstanding. They do not have any dilutive instrument outstanding.

Although there is senior debt in the capital structure, Comstock does not have a dilutive structure. Therefore, I believe the capital structure is acceptable for common stock holders, so long as the company is financially capable of meeting its debt obligations.

LODE Stock – Dividends

The company has never paid a dividend and is unlikely to do so for the foreseeable future.

Management – Skin in the game

There has not been any relevant insider activity related to LODE stock over the past year.

Comstock Mining – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$16 million/$23.4 million = .68

A debt to equity ratio of .68 means the company is financed with a mix of debt and equity, with slightly more equity. They should not be overly reliant on any one form of financing in the future.

Price to Book Ratio

Current Share Price/Book Value per Share.

$.54/$.86 = .62

At the current market price, Comstock has a price to book ratio of .62. A price to book ratio of .62 implies Comstock trades at a discount to the book value of its assets.

Working Capital Ratio

Current Assets/Current Liabilities

$13 million/$4.4 million = 3

A working capital ratio of 3 typically indicates strong near term liquidity. However most of Comstock’s current assets are properties held for sale. Although they should be able to meet their near-term liabilities, selling off assets to do so in not generally a sign of financial strength.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

Comstock Mining – Summary and Conclusions

Comstock has strong claims in a very strong jurisdiction. They have produced in the past, so clearly some of the claims are viable. However, they have not produced since 2016, and it doesn’t seem likely they will be restarting production any time soon.

Although Comstock equity appears cheap relative to its assets, I believe there are too many red flags to make the stock investable. For example, the lack of production since 2016 and the selling of assets to finance its operations. For these reasons, I am not willing to invest in Comstock equity.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.