Common Stock: Argonaut Gold (TSX:AR, OTC:ARNGF)

Current Market Price: $1.20

Market Capitalization: $216 million

Argonaut Gold Stock – Summary of the Company

Argonaut Gold is a gold exploration and mining company. Their keystone project is the El Castillo property in Mexico. They also have several other exploration stage properties throughout North America. Argonaut was founded in 2007 and is headquartered in Reno, Nevada. Including contractors, they currently have around 1,500 employees.

Revenue and Cost Analysis

In 2019 Argonaut produced 187,000 gold equivalent ounces, a 13% increase over 2018. This production equated to total revenue of $268.8 million in 2019.

The company had an all in sustain cost of $1,181 per gold equivalent ounce in 2019. They had a loss from operations of $10 million and a comprehensive net loss of $93 million. However, a large part of this loss is attributable to a write down of the company’s San Antonio property, which encountered licensing issues with the Mexican government.

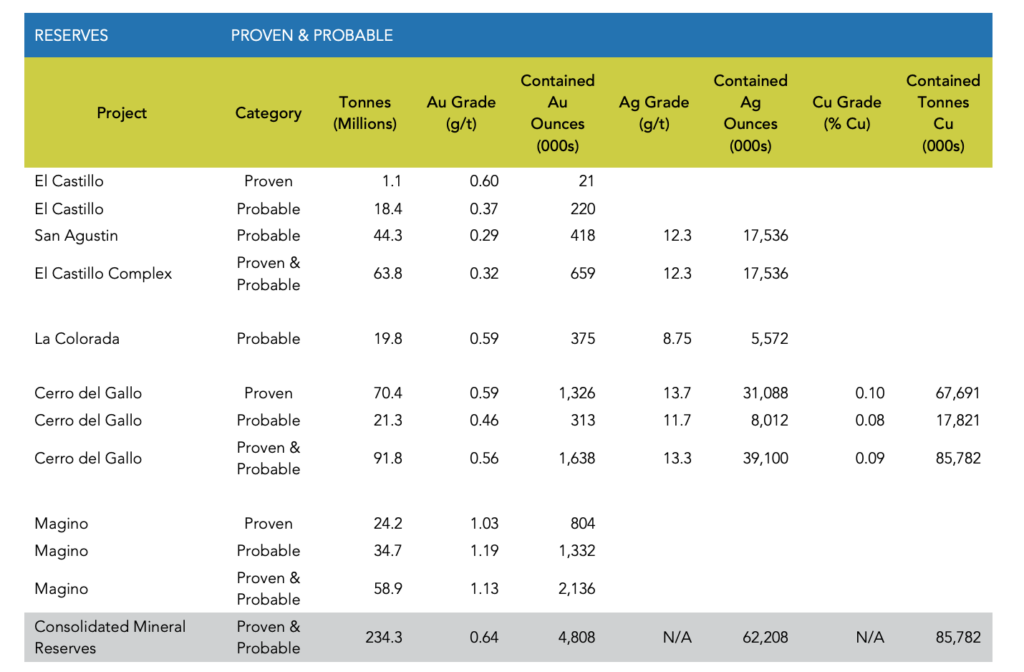

Argonaut Gold Stock – Reserves

Argonaut Gold has proven and probable reserves totaling 4.8 million ounces.

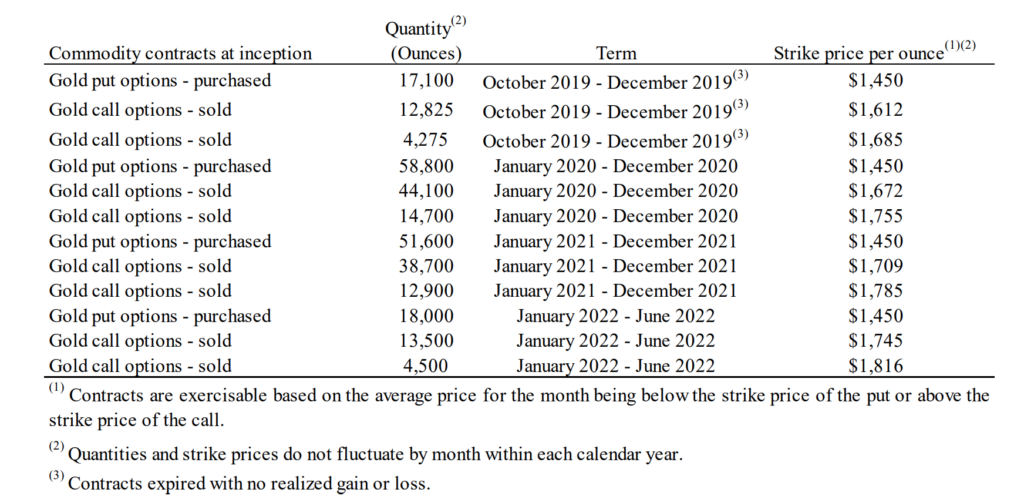

Derivative Instruments

The company has entered a zero-cost collar on the gold price, extending to 2022.

Balance Sheet Analysis

Argonaut has a fairly strong balance sheet. Current assets totaled $119 million at the end of 2019, including $38.8 million in cash. Current liabilities were $41 million.

Most of the company’s assets are long term assets such as property and equipment. Total assets at the end of 2019 were $606.6 million, compared to total liabilities of $75.7 million.

Debt Analysis

The company has a revolving credit facility totaling $50 million. As of year-end 2019 they had utilized $10 million of the facility, a reduction from $13 million at year end 2018.

The debt bears an interest rate of LIBOR plus 2.25% to 3.25% on drawn amounts and 0.51% to 0.73% on undrawn amounts.

Argonaut Gold Stock – Dividends

The company does not pay a dividend.

Argonaut Gold Stock – Share Dynamics and Capital Structure

As of year-end 2019 Argonaut had 179.5 million common shares outstanding. They also have dilutive shares outstanding such as options and share based compensation. Fully diluted shares outstanding amount to 185.4 million.

Although Argonaut does have some debt and dilutive instruments, neither are excessive. Therefore, I believe the capital structure is acceptable for common shareholders.

Management – Skin in the game

There has not been any significant insider trading recently and insiders do not own a significant portion of the outstanding common stock.

Argonaut Gold Stock – 3 Metrics to Consider

Price to Book Ratio

Current price of the common stock/ Book Value per Share

$1.20/$2.86=.42

Based on fully diluted shares outstanding the company has a book value per share of $2.86. At the current market price this implies a price to book ratio of .42, meaning Argonaut currently trades at a significant discount to the book value of its assets.

Working Capital Ratio

Current Assets/Current Liabilities

$119 million/$41 million = 2.9

A working capital ratio of 2.9 indicates sufficient short term liquidity, meaning the company shouldn’t have a problem financing itself in the near term.

Debt to Equity Ratio

Total Liabilities/Total Shareholder Equity

475.7 million/$530.9 million =.14

A debt to equity ratio of .14 indicates the company is financed mostly with equity capital, meaning they are not heavily reliant on debt financing.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

Argonaut Gold Stock – Summary and Conclusions

Argonaut has a strong keystone project, El Castillo, however it is also their shortest life project. They had a significant delay and write down of the San Antonio project in 2019, a property they were counting on to contribute to future growth. For common shareholders to prosper in the long term, the company will need to bring exploration and development stage properties into production, which is highly uncertain at this time.

They have a strong balance sheet, with sufficient liquidity and reasonable debt levels. The capital structure is not overly dilutive and acceptable for common shareholders. It seems reasonable to assume they will be able to continue to explore and develop their properties in the short term.

The major risks are exploration risk and jurisdictional risk. If their exploration stage projects don’t pan out, then production at El Castillo is likely to drop off, and shareholders are likely to lose. Most of their assets are in Mexico, which has already proven a difficult jurisdiction based on the San Antonio write down. Any adverse events in Mexico could seriously impact shareholders.

Overall Argonaut is a descent company with one keystone property and uncertain prospects after that. They appear to be well run, but a large write down and large derivative position certainty raise eyebrows. There is nothing exceptional about Argonaut, but due to its low price relative to its assets it may have a place in some diversified gold stock portfolios.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.