Company Name: Common Stock: Gold Resources Corporation (GORO)

Current Market Price: $4.21

Market Capitalization: $296 million

GORO Stock – Summary of the Company

Gold Resources Corporation (“GORO”) is a mining stock that produces gold, silver, copper, and zinc. GORO has 2 producing properties, one in Oaxaca Mexico, and the other in Nevada. They also have several exploration and development stage properties. The company was founded in 1998 and is headquartered in Colorado. They have 64 full time employees and over 500 contractors.

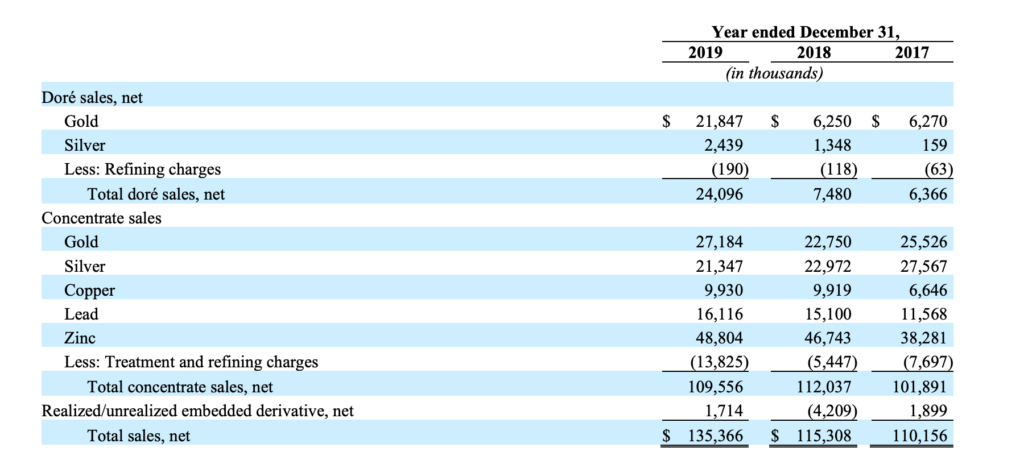

Revenue and Cost Analysis

GORO had total revenues of $135.4 million in 2019, a substantial increase over 2018 revenues of $115 million. The company’s revenues are highly concentrated, with 89% of its 2019 revenue coming from the Oaxaca property in Mexico.

The company estimates an “all in sustaining cost” of $646 per gold equivalent ounce at the Oaxaca mine. Although production costs are relatively low, the company has tight margins. Net income in 2019 was $5.8 million, a significant decrease from 2018 net income of $9.3 million.

GORO also has a highly-concentrated client base, with 2 customers accounting for 91% of sales in Mexico and 1 customer accounting for 100% of sales in Nevada.

The company sales are spread between gold, sliver and zinc. The company also has some revenue from the sale of copper and lead.

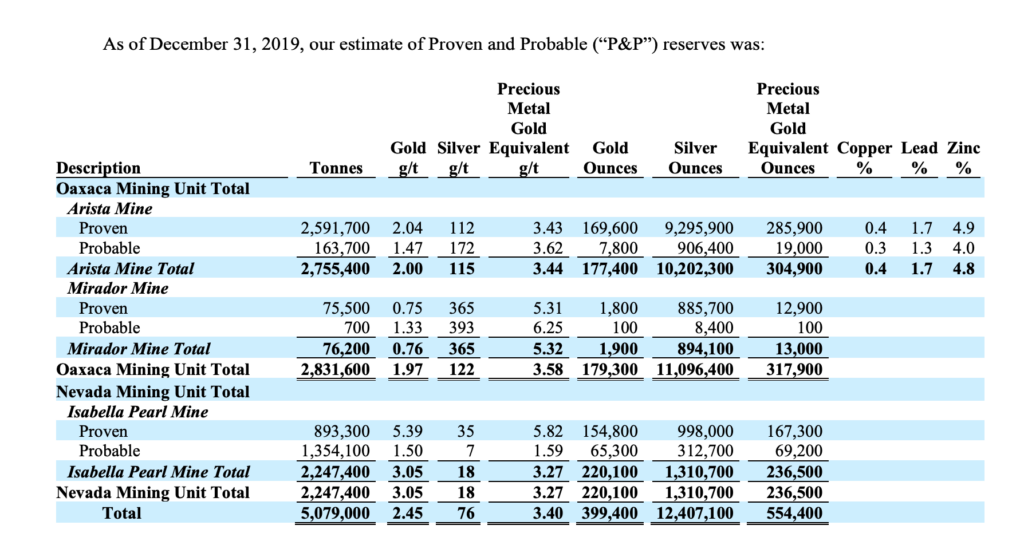

Gold Resources Corp. – Reserves

The company has “proven and probable” reserves of 554,400 gold equivalent ounces.

Royalty and Streaming Agreements

GORO has significant royalty agreements. Certain parts of the company’s Mexico property are subject to various royalty agreements. These range from 2%-5%, depending on the property.

GORO Stock – Balance Sheet Analysis

GORO has a strong balance sheet with sufficient short term liquidity and low levels of liabilities. The company had $50 million in current assets, including $11 million in cash at year end 2019. They had $35 million in total liabilities at the end of 2019.

Most the company’s assets are long term fixed assets such as property and equipment. At the end of 2019 GORO had total balance sheet assets of $193 million.

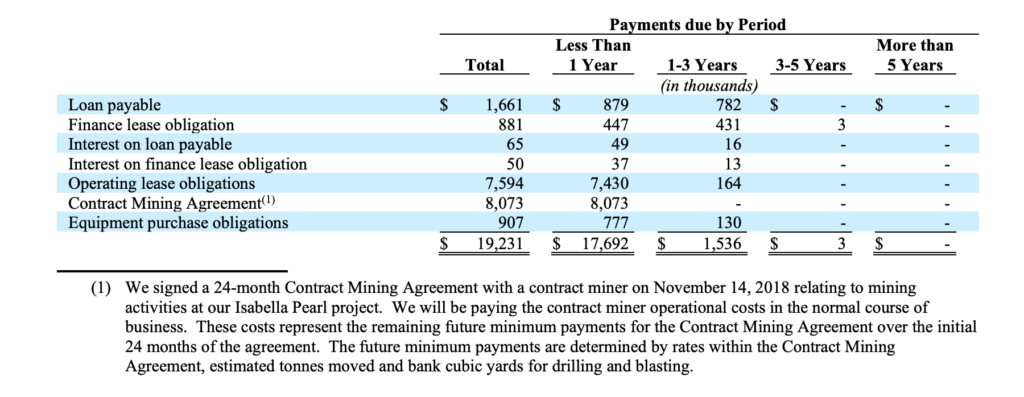

Debt Analysis

The company has low debt levels, totaling $1.6 million, all of which is due within 3 years. The company also has a $7.5 million operating lease obligation due in 2020.

Additionally, the company has an off-balance sheet reclamation bond valued at $6.7 million.

GORO Stock – Share Dynamics and Capital Structure

GORO had 65.6 million common shares outstanding at year end 2019, with an additional 4.5 million options outstanding. Fully diluted shares outstanding are around 70.1 million.

Given the low level for potential dilution and lack of senior debt, I believe GORO’s capital structure is acceptable for common stock holders.

Gold Resources Corp. – Dividends

Management has stated their goal is to return capital to shareholders via monthly dividends. Since production began in 2010, GORO has returned over $113 million to shareholders via consecutive monthly dividends.

Management structure – Skin in the game

Over the last 12-18 months’ insiders at GORO have been net buyers of the stock. Furthermore, insiders own a significant portion of the outstanding shares, between 3%-4%. This suggests long term alignment between the interests of management and the interests of shareholders.

GORO Stock – 3 Metrics to Consider

Working Capital Ratio

Current Assets/Current Liabilities

$50 million/$30 million = 1.8

A working capital ratio of 1.8 indicates sufficient short term liquidity. The company should not have issues meeting its obligations in the near term.

Price to Book Ratio

Price of common stock/Book Value per share

$4.21/$2.25 = 1.87

Based on my estimate of fully diluted shares outstand, GORO has a book value per share of $2.25. At the current market price of the common stock this implies a price to book ratio of 1.87. A price to book ratio of 1.87 means GORO stock is currently trading at a premium to the book value of its assets. However, many investors would not consider this to be an excessive premium.

Debt to Equity Ratio

Total Liabilities/ Total Shareholder Equity

$35 million/ $158 million = .22

A debt to equity ratio of .22 implies low levels of debt and implies that the company is primarily financed through equity capital. This means the company is not likely to be dependent on debt financing in the future.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

GORO Stock – Summary and Conclusions

GORO is a high risk, high upside stock. The risk to investors is clear, concentrated revenue. Currently GORO is almost completely dependent on revenue from one property in Mexico, with the property’s sales coming from a concentrated client base. If the Mexico property is impaired, then common stock holders will surely suffer losses.

However, if GORO can maintain its production and margins at it Mexico property, while bringing some of its exploration stage properties into production, then the upside for investors could be significant. In the meantime, management is likely to continue to pay a small monthly dividend to investors.

The company’s strong liquidity and very low debt levels make it well positioned to capitalized on future opportunities. Given its concentration risk, GORO is not suitable to be held as a single issue. However, its significant upside potential make it a nice addition to a well-diversified gold stock portfolio, with the potential to outperform.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.