Dollar cost averaging is a simple but powerful investment strategy. It involves dividing the total amount you want to invest into smaller portions, and investing those smaller portions incrementally over an extended period.

Let’s look at an example.

Assume you have $12,000 you want to invest in GE stock.

You have already done your analysis of the company, and determined how GE stock will fit into your total portfolio. You have decided $12,000 is the correct allocation, so now it is time to buy.

But there is a problem.

The market has been volatile lately. You are confident GE is a good buy over a long-time horizon, say 10 years. But you are worried the price may fall further in the short term.

On the one hand, you don’t want to invest the full $12,000 now, only to have the stock dip 10% right after.

But on the other hand, you aren’t sure if the stock will dip, so you don’t want to sit on the sidelines and miss out on a move upwards.

So, what do you do? Dollar Cost Average!

Instead of investing the $12,000 in a lump sum, you can break it up into smaller amounts, say $2,000 and make numerous purchases, say once per month for 6 months, until you invest the full $12,000.

By spreading the purchases out over several months, you reduce the effects of short term price volatility and end up paying a price close to the average price over the investment period.

I’ll illustrate the power of dollar cost averaging with 2 scenarios.

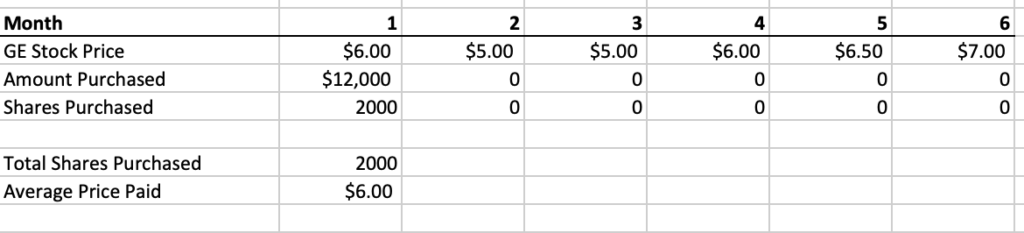

Scenario 1 – Lump Sum Purchase

In this scenario, you invest the full $12,000 in one purchase at the current market price of $6. You end up with a total of 2,000 shares of GE stock.

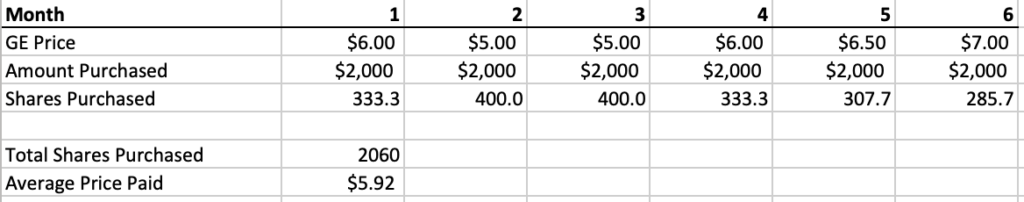

Scenario 2 – Dollar Cost Averaging

In this scenario, you spread your purchases out over 6 months. Making a $2,000 purchase once per month. Although the stock does dip in months 2 and 3, you still have capital to buy more. Even though you make purchases in months 5 and 6 that are above the current market price, you still end up with an average purchase below $6 and 2060 shares of GE stock.

So now that we know what dollar cost averaging is, let’s look at the benefits.

2 Major Benefits of Dollar Cost Averaging

It Reduces The Effects Price Volatility

By spreading out your purchases over a longer period of time you reduce the effects of short term market volatility. It is very difficult to time the market and making a lump sum purchase on the wrong day can be a long term drag on your portfolio.

Dollar cost averaging reduces the negative consequences of poor market timing.

It Is A Disciplined And Mechanical Strategy

Our emotions can be one of the most difficult aspects of investing. Often our gut instinct is wrong and can cause us to make poor investing decisions.

A dollar cost average strategy is a mechanical, emotionless strategy. By purchasing X dollars’ worth of the stock on the 2nd day of the month, you can remove emotion from the investing equation. Reducing the effects emotions on your portfolio can help improve long term results.

Final Thoughts

Dollar cost averaging is best suited for long term, buy and hold investors. If implemented correctly it can significantly improve long term investing results.