Common Stock: WEG (WEGE3)

Current Market Price: R$ 75.18

Market Capitalization: R$ 157.7 billion

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

WEG Stock – Summary of the Company

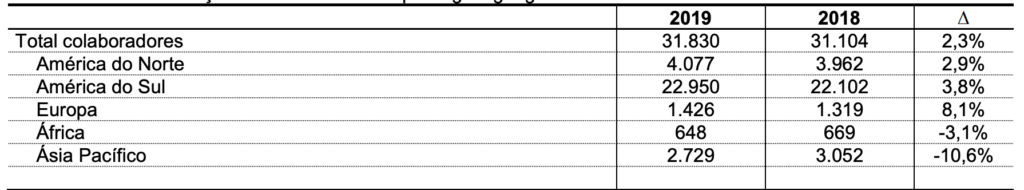

WEG is a Brazilian electrical products manufacturing company. They produce and sell a wide range of products including motors, generators, converters, turbines, traction systems, and paints among others. They have a commercial presence in 135 countries and operating plants in Brazil, Argentina, Colombia, Mexico, United States, Portugal, Spain, Austria, Germany, South Africa, India and China. The company has nearly 32,000 employees worldwide. WEG was founded in 1961 and is headquartered in Santa Catarina, Brazil.

Revenue and Cost Analysis

WEG has grown its sales significantly over the past several years. In 2017 the company had total sales of R$ 9.5 billion, which grew to R$ 12 billion in 2018, and further increased to R$ 13.3 billion in 2019. While growing revenue, WEG has been able to maintain a stable gross margin, which was around 29% in each of the last three years.

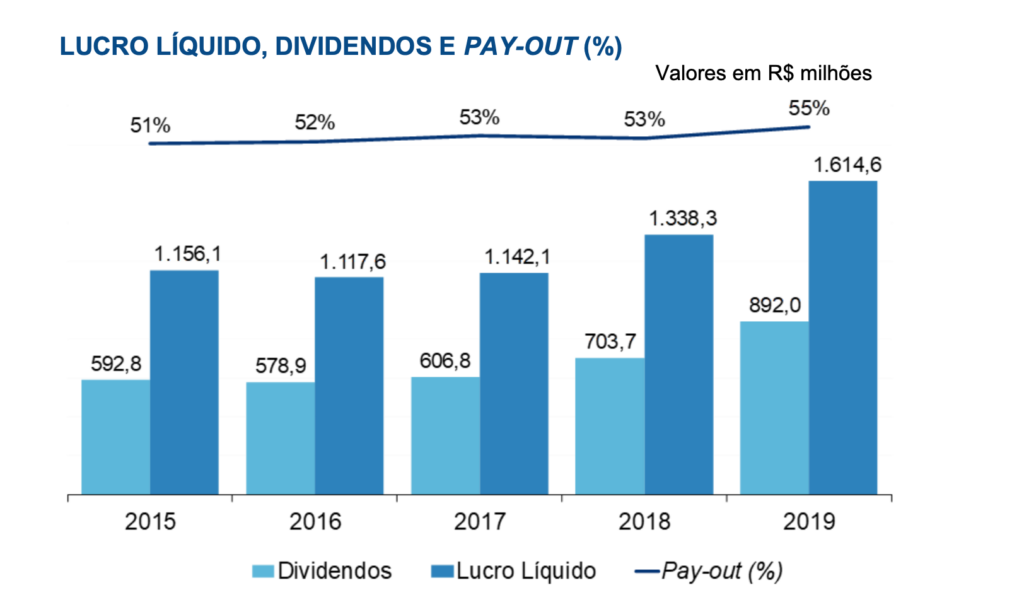

WEG has been profitable for each of the past three years. In 2019 the company had net income of R$ 1.6 billion, representing a profit margin of 12.2%. Their profit margin was around 12% in 2017 and 2018 also.

WEG – Acquisitions

In 2019 WEG purchased a battery energy storage system, including patents, from a company in Vermont. They also purchased a Brazilian auto parts manufacturer. The company has been and remains active in M&A.

Balance Sheet Analysis

WEG has a sound balance sheet. They have a solid base of long term assets and sufficient liquidity in the near term. Liability levels are reasonable.

WEG – Debt Analysis

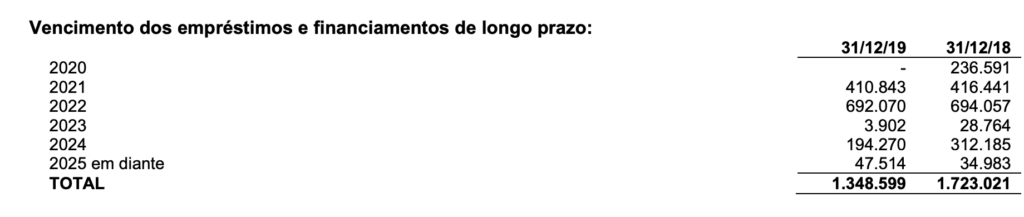

WEG has a significant amount of debt outstanding. As of year-end 2019 the company has around R$ 2.9 billion in total debt outstanding, of which R$ 936 million is classified as current. Furthermore around R$ 2.1 billion of this debt is denominated in foreign currency, mainly US Dollars and Euros. Although a large portion of the company’s revenue is in foreign currency, this debt exposes WEG to a depreciating Brazilian Real and could be a drag on earnings moving forward.

WEG Stock – Share Dynamics and Capital Structure

As of year-end 2019 the company has around 2.1 billion (yes, billion) common shares outstanding. Around 35% of the company’s shares are held by small outside shareholders.

WEG Stock – Dividends

In 2019 WEG paid out R$ 892 million in dividends, representing a dividend per share of R$ .425 cents. At the current market price this implies a dividend yield of 0.6%.

WEG Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 6.7 billion / R$ 8.9 billion = .76

A debt to equity ratio of .76 indicates that WEG uses a mix of debt and equity in its capital structure, but relies more heavily on equity financing to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 6 billion/ R$ 4.5 billion = 1.3

A working capital ratio of 1.3 indicates a sufficient but not strong liquidity position. WEG should not have problems meeting its short term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

R$ 75.18/ R$ 4.26 = 17.6

Based on total shares outstanding WEG has a book value per share of R$ 4.26. At the current market price this implies a price to book ratio of 17.6, meaning WEG stock currently trades at a significant premium to the book value of the company.

WEG Stock – Summary and Conclusions

WEG is an impressive company. They have achieved a size and international presence that is not common among Brazilian manufacturers. WEG is present in 135 countries and growing sales rapidly. The company has been able to maintain its gross margins and profitability while rapidly growing sales. Their balance sheet is decent, with sufficient liquidity in the near term and a solid base of assets.

Investors should be most concerned with their foreign denominated debt and the company’s current valuation. Although a good amount of the company’s revenue is in foreign currency, providing a natural hedge, WEG is still exposed to a depreciating Brazilian Real, and this trade has been devastating for many Brazilian companies. The stock currently trades at over 17 times book value and has increased significantly, over 300%, in the last 12 months.

I am going to add WEG to the top of my Brazilian watchlist. At a lower entry point the company’s stock could be a solid long term investment, but given the economic scenario caused by the coronavirus and the company’s relatively low yield/ high valuation, I don’t see a reason to chase WEG stock. I will be comparing WEG’s 2020 results to other Brazilian manufacturers on my watchlist that have similar profiles and financials, such as Metalfrio.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.

One Comment

Comments are closed.