Common Stock: Vangold Mining (TSXV: VGLD)

Current Market Price: $0.31 CAD

Market Capitalization: $32.4 million CAD

**Note: All values in this article are expressed in Canadian Dollars (CAD) unless otherwise noted.

Vangold Mining Stock – Summary of the Company

Vangold Mining is a precious metals exploration company focused on the acquisition, exploration, and development of precious metals properties. They are focused on assets in Mexico and Canada, and their flagship property is the El Pinguico property in Mexico, which has historically produced significant amounts of silver. Vangold was founded in 1978 and is headquarters in Vancouver Canada.

Revenue and Cost Analysis

Vangold does not have any properties that are currently producing and therefore does not have any revenue. The company consistently runs a net loss and is likely to continue to do so for the foreseeable future.

In 2019 Vangold had a net loss of $509 thousand, significantly less than a net loss of $1.3 million in 2018. This improvement is due to decreased spending across the board, including exploration expenses, which dropped from $309 thousand in 2018 to $15 thousand in 2019.

Vangold Mining – Royalty and Streaming Agreements

The El Pinguico property is subject to a 4% NSR and a 15% Net Profits Interest on minerals recovered from an existing surface and underground stockpiles of mineralized rock and a 3% NSR and 5% NPI on all newly mined mineralization. The Company may repurchase 1% (one-third) of the 3% NSR on all newly mined mineralization for USD$1,000,000.

The company’s other properties are subject to net smelter royalty’s ranging from 1.5% to 2.5%.

Balance Sheet Analysis

Vangold has a simple and sound balance sheet. Liquidity is sufficient and liability levels are low.

Vangold Mining – Debt Analysis

As of year-end 2019 the company does not have any debt outstanding.

Vangold Mining Stock – Share Dynamics and Capital Structure

Vangold has 104.5 million common shares outstanding, around 20% of which are owned by the company’s directors and advisors. In addition they have 31 million warrants and 2.9 million options outstanding. Fully diluted shares outstanding is around 138.4 million shares.

Vangold has a dilutive capital structure. Investors should consider the effects of dilution before investing.

Vangold Mining Stock – Dividends

The company does not pay a dividend and is unlikely to do so for the foreseeable future.

Management – Skin in the game

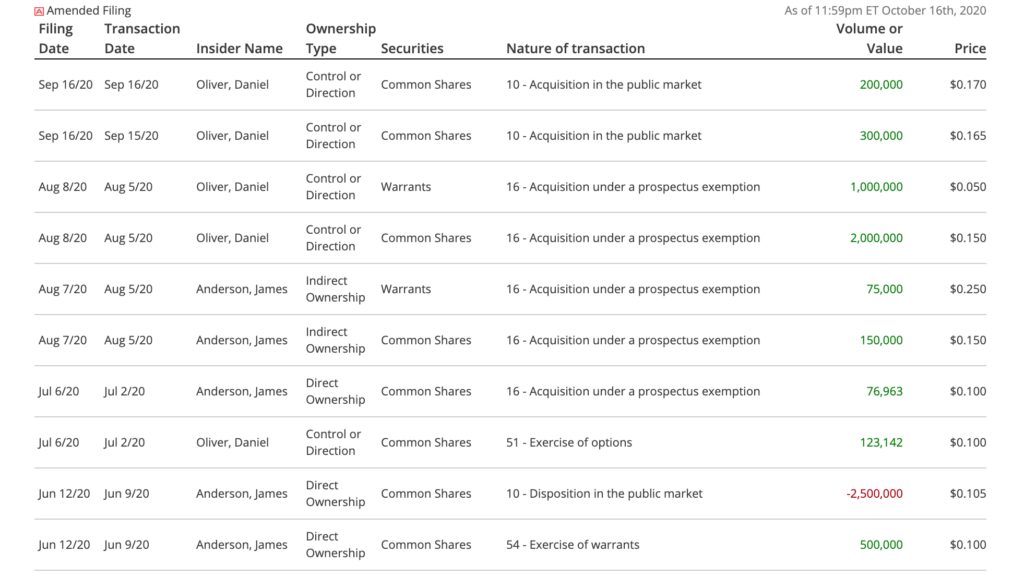

Insiders at Vangold Mining have been net buyers of the company’s stock recently. This is generally viewed as a bullish signal for a stock.

Vangold Mining Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$331 thousand / $2 million = .16

A debt to equity ratio of .16 indicates that Vangold uses a small amount of debt in its capital structure, but relies mostly on equity financing to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

$575 thousand / $331 thousand = 1.7

A working capital ratio of 1.7 indicates sufficient liquidity. Vangold should not have a problem meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

$0.31/$.01 = 31

Based on fully diluted shares outstanding Vangold has a book value per share of $.01. At the current market price this implies a price to book ratio of 31, meaning Vangold stock currently trades at a significant premium to the book value of the company.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

Vangold Mining Stock – Summary and Conclusions

Vangold is a decent exploration play. The positives are their property portfolio, which includes the El Pinguico property, a property that has historically produced significant amounts of silver. Their financial position is sound, but they will need to raise capital for additional exploration. Management interests appear to be well aligned with shareholders, as insider ownership is high and insiders have been net buyers in the open market.

The negatives are a dilutive capital structure, very low exploration expense, and significant royalty and profit sharing agreements, which give away a lot of value.

Vangold is worth adding to the watch list. Should the El Pinguico project advance, I will reconsider investing. But for now I am not willing to allocate to Vangold stock. I would prefer to invest in more promising Mexican projects, such as Chesapeake Gold, or Canadian projects such as O3 Mining.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.