Common Stock: Trevali Mining (OTC:TREVF)

Current Market Price: $0.19 USD

Market Capitalization: $150.8 Million USD

**Note: All values in this article are expressed in United States Dollars (USD) unless otherwise noted.

Trevali Mining Stock – Summary of the Company

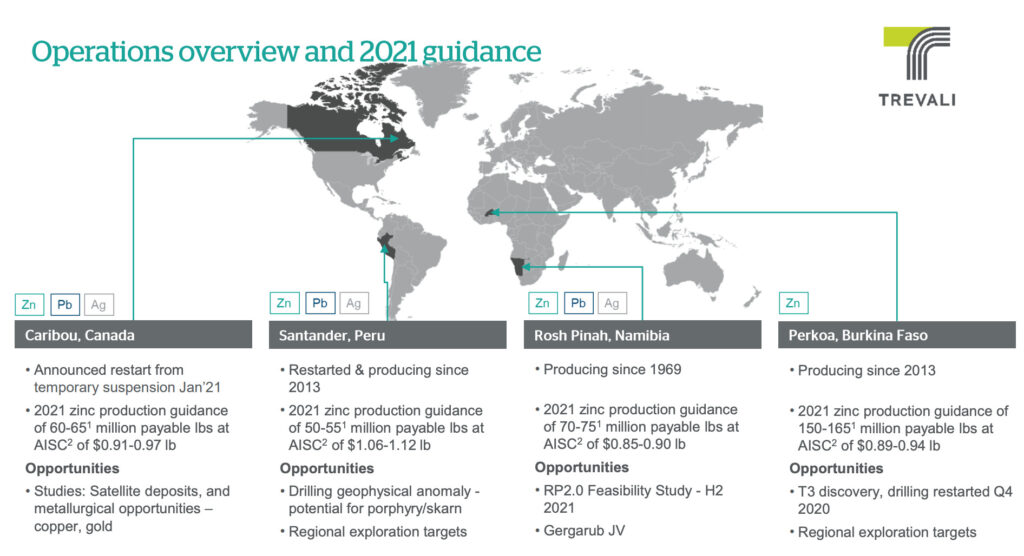

Trevali Mining is a base metals mining company focused on the acquisition, explorations, development, and operation of base metals properties globally. They have ownership interests in four operating assets locates in Burkina Faso, Namibia, Canada, and Peru. The company is highly focused on zinc, with roughly 90% of its revenue coming from zinc production. The remainder of their revenue comes from lead production and a very small amount of silver.

Trevali Mining was founded in its current form in 2006 and is headquartered in Vancouver, Canada. The company employs over 2,300 people including contractors.

Revenue and Cost Analysis

In 2019 Trevali had revenue of $386.1 million, a significant decrease from $464.3 million in 2018. This decrease is due mostly to a ~13% decrease in zinc prices. Their COGS was $355.1 million in 2019, representing a gross margin of 8%, also a significant decrease compared to 30% in 2018.

The company had a net loss in both 2018 and 2019. In 2019 Trevali Mining had a net loss of $35.4 million.

Trevali Mining – Royalty and Streaming Agreements

The company’s Burkina Faso mine is subject to a 3% net smelter royalty payable to the government. Their Namibian mine is subject to a 3% royalty on net sales. Their Canadian mine is subject to a 2% provincial royalty on annual net revenue.

Balance Sheet Analysis

Trevali has a decent balance sheet. They have a solid base of long term assets in their four operating mines, and sufficient liquidity in the near term. Liability levels are reasonable, however their debt is relevant.

Trevali Mining – Debt Analysis

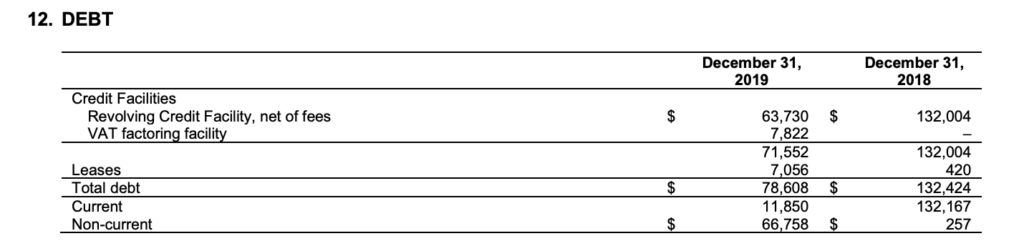

As of year-end 2019 the company has $78.6 million in total debt outstanding, $11.9 million of which is classified as current.

Trevali Mining Stock – Share Dynamics and Capital Structure

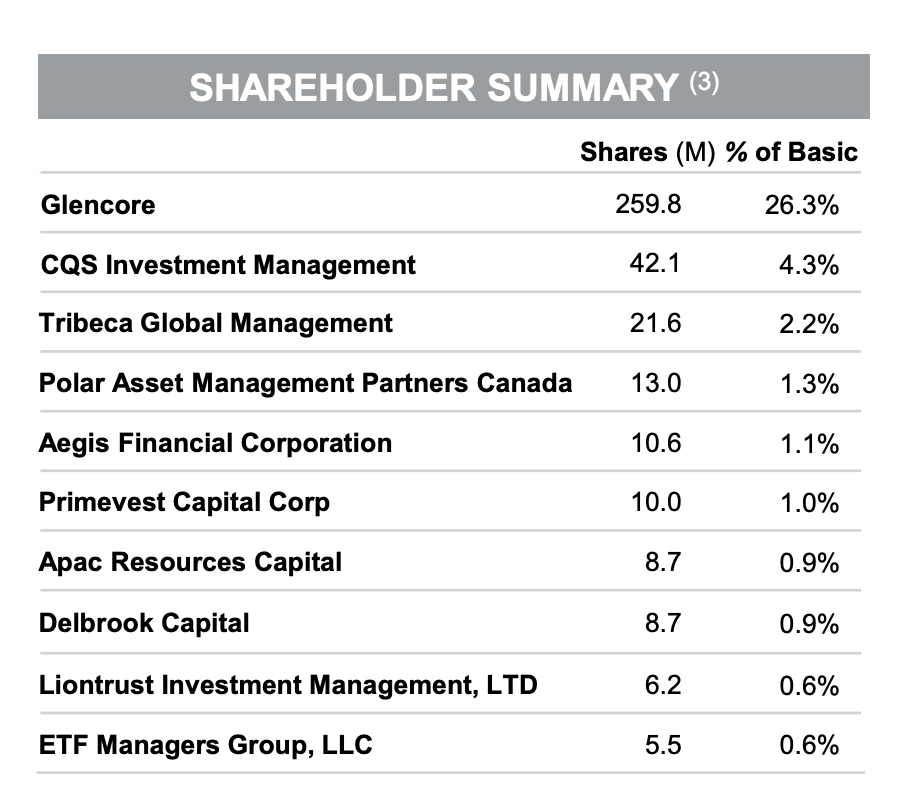

As of year-end 2019 the company has 802.6 million common shares outstanding. In addition they have 9.8 million options and 700 thousand warrants outstanding. Fully diluted shares outstanding is around 813.1 million.

The company’s largest shareholder in Glencore, who owns 26.3% of the company.

Trevali Mining Stock – Dividends

The company did not pay a dividend in 2019.

Management – Skin in the game

Insiders at Trevali Mining have increased their holdings recently. This is generally viewed as a bullish signal by investors.

Trevali Mining Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$296.1 million / $448.4 million = .66

A debt to equity ratio of .66 indicates that Trevali uses a mix of debt and equity in its capital structure, but is not leverages, and relies more heavily on equity financing.

Working Capital Ratio

Current Assets/Current Liabilities

$128.7 million / $79 million = 1.6

A working capital ratio of 1.6 indicates that Trevali has a sufficient, but not strong liquidity position. The company should not have problems meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

$0.19 / $0.55 = .34

Based on fully diluted shares outstanding Trevali has a book value per share of $0.55. At the current market price this implies a price to book ratio of .34, meaning Trevali Mining stock currently trades at a significant discount to the book value of the company.

Trevali Mining Stock – Summary and Conclusions

Trevali Mining is an impressive company. They are almost a pure play zinc investment, which is not common, and they have a scale and geographical diversity that is also unique. However the company is in poor financial health. They had a net loss in both 2018 and 2019 and they have a relevant amount of debt outstanding.

I am not interested in investing in zinc companies right now. I would prefer to allocate to precious metals miners, such as Calibre Mining.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.