Common Stock: The Palace Amusement Company

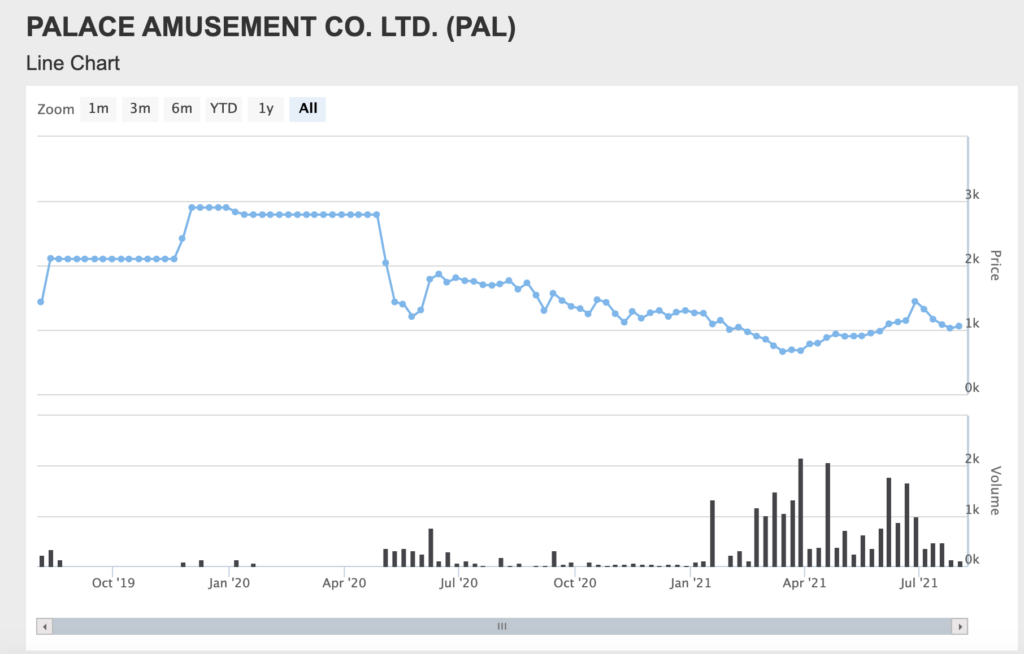

Current Market Price: $1,062 JMD

Market Capitalization: $1.5 billion JMD ($9.9 million USD)

*All values in this article are expressed in Jamaican Dollars (JMD) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

The Palace Amusement Company Stock – Summary of the Company

The Palace Amusement Company is a Jamaican movie theater operator. The company was founded in 1921 and is headquartered in Kingston, Jamaica.

Revenue and Cost Analysis

2020 was an extremely difficult year for the company due to the corona virus shut downs. Total revenue declined from $1.1 trillion in 2019 to $920 billion in 2020. The company’s COGS in 2020 was $881 billion, representing a gross margin of 4%, a significant decline from 19% in 2019.

The company had a net loss of $99.6 billion in 2020, a significant decline from a profit of $70.3 billion in 2019, which represented a profit margin of 6.3%.

Balance Sheet Analysis

The Palace Amusement Company has a weak balance sheet. Their liquidity position is very weak and they have significant liabilities, including debt.

Debt Analysis

As of the fiscal year end June 2020 the company has $92.2 million in total debt outstanding, $11.9 million of which is classified as current. The debt carries interest ranging from 7% to 9%.

The Palace Amusement Company Stock – Share Dynamics and Capital Structure

As of the fiscal year end June 2020 the company has 1.4 million common shares outstanding.

Dividends

The company does not pay a dividend.

The Palace Amusement Company Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$635.1 billion / $402.2 billion = 1.6

A debt to equity ratio of 1.6 indicates that the company uses a mix of debt and equity in its capital structure, but is leveraged, and relies more heavily on debt financing.

Working Capital Ratio

Current Assets/Current Liabilities

$99.6 billion / $299 billion = .33

A working capital ratio of .33 indicates a very weak liquidity position. The company may have problems meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

$1,062 / $280 = 3.8

The Palace Amusement Company has a book value per share of $280. At the current market price this implies a price to book ratio of 3.8, meaning the company’s stock currently trades at a significant premium to the book value of the company.

The Palace Amusement Company Stock – Summary and Conclusions

The Palace Amusement Company is in a very difficult position and faces the real possibility of bankruptcy. It is hard enough being a brick and mortar theater and trying to compete with Netflix and Amazon, but the corona virus shut downs seriously impaired the company’s financials, and it may not recover.

The company’s liquidity position is extremely weak and it is not profitable. Aggressive investors can consider shorting the stock, but given its extremely small market cap, low share count, and low liquidity, this may be more risk than it’s worth.

Short sellers can also consider Jamaican real estate company 138 Student Living.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.