Common Stock: Taurus Armas (TASA3)

Current Market Price: R$ 7.35

Market Capitalization: R$ 654.5 million

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Taurus Armas Stock – Summary of the Company

Taurus Armas is a Brazilian firearms manufacturer. They produce 4 different types of firearms; revolvers, pistols, tactical, and sport hunting, under 3 different brands; Taurus, Heritage, and Rossi. Taurus is the largest revolver manufacturer in the world. The company produced over 1.2 million firearms in 2019, exporting them to over 100 countries. In addition they recently opened a new factory in The United States, where they were already the 4th largest pistol company. Taurus was founded in 1939 and is headquartered in the state of Rio Grande do Sul Brazil. They currently have around 2,100 employees.

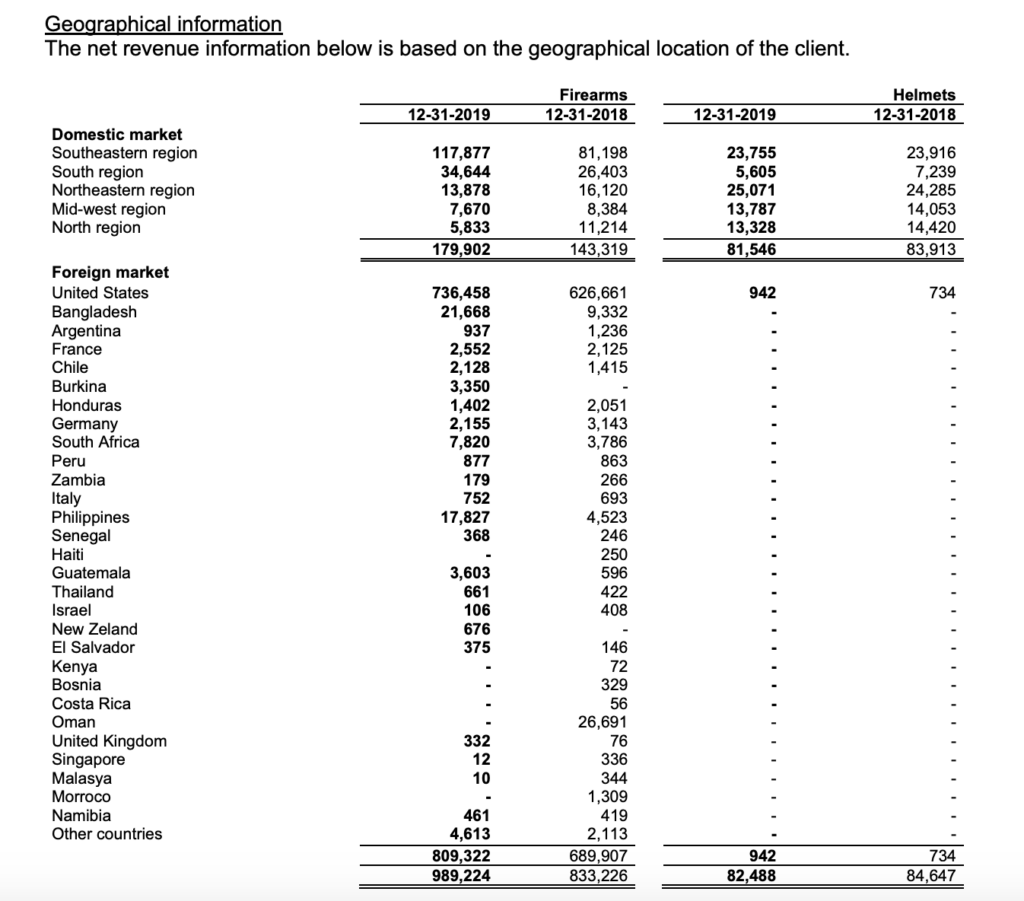

Revenue and Cost Analysis

Taurus had sales of R$ 999.5 million in 2019, a significant increase from R$ 845 million in 2018 and R$ 695 million in 2017. 81% of 2019 revenue was denominated in US Dollars. Their COGS in 2019 was R$ 659 million, representing a gross margin of 34%. In 2019 Taurus was profitable for the first time in several years, with net income of R$ 43.4 million, representing a profit margin of 4.3%. This is a significant improvement from net losses of R$ 59.9 million and R$ 286 million in 2018 and 2017 respectively. This improvement is due mostly to improvements in the company’s financial income and expenses.

Balance Sheet Analysis

Taurus has a weak, but improving balance sheet. The company recently restructured its debt, however it still has significant debt liabilities. Its liquidity position is sufficient, but not strong and its shareholders equity position has been negative for several years.

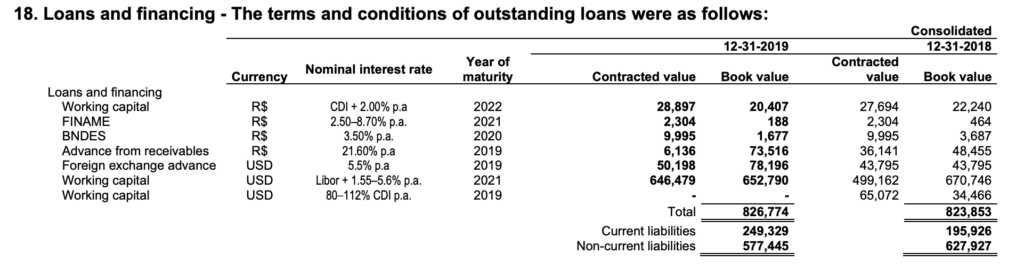

Taurus Armas – Debt Analysis

As of year-end 2019 Taurus has R$ 826.7 million in total debt outstanding, R$ 249.3 million of which is classified as current. 81% of this debt is denominated in US dollars, exposing the company to the negative effects of a depreciating Brazilian Real, however this risk is well hedged due to the company’s significant revenue in US dollars.

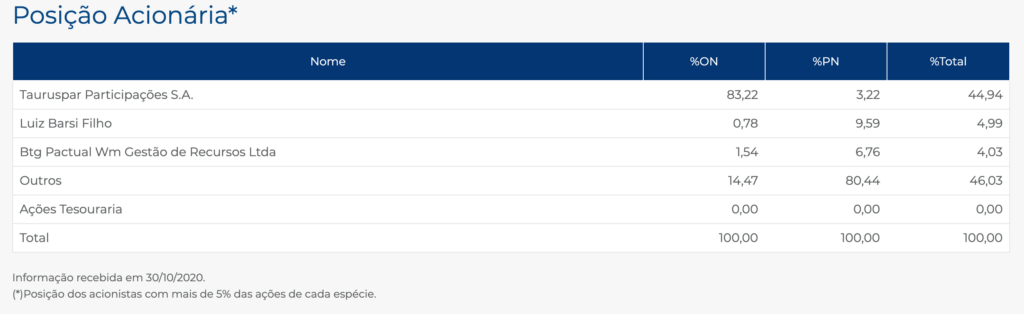

Taurus Armas Stock – Share Dynamics and Capital Structure

As of year-end 2019 Taurus has 46.4 million common shares outstanding and 42.6 million preferred shares outstanding. Total shares outstanding is around 89 million shares. 54% of the company’s shares are held by a holding company, insiders, and one institutional investor. The remaining 46% of the shares are held by smaller investors owning less than a 5% interest.

Taurus Armas Stock – Dividends

The company does not currently pay a dividend.

Taurus Armas Stock – 2 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 1.3 billion / -R$ 304.6 million = -4.5

A debt to equity ratio of negative 4.5 indicates that Taurus has accumulated losses and has significantly more liabilities than shareholder equity. The company faces the possibility of insolvency and investors should carefully analyze the company’s liabilities before investing.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 694.5 million / R$ 630 million = 1.1

A working capital ratio of 1.1 indicates a sufficient, but not strong liquidity position. Taurus should not have problems meeting its near term obligations.

Taurus Armas Stock – Summary and Conclusions

Taurus is a solid company with too much debt. They have a long history and are already a global leader in the firearms market. They continue to grow internationally, for example in early 2020 they entered the Indian market via a joint venture. In addition, they are uniquely positioned to in Brazil, and would likely dominate the Brazilian market should gun restrictions be eased.

The company recently underwent a restructuring and it financial position has improved significantly, although it is by no means strong. Liquidity appears sufficient and debt levels are still too high, but improving. I have said many time I don’t invest in Brazilian companies exposed to the US dollar carry trade. However Taurus may be an exception, since the company derives the majority of its business internationally, particularly in the US. Its debt in USD is hedged almost exactly to its revenue in USD, which are both 81% of total debt and revenue.

For now I will leave Taurus Armas stock on the top of my Brazilian watchlist. I will revisit the company when their 2020 financials a published. I would like to see continued improvement in the company’s financial position, particularly its debt and liquidity positions. If the company was able to continue improving its finances during 2020, then I will seriously consider investing. I will compare Taurus Armas stock to other global Brazilian manufacturers, such as Metalfrio.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.