Common Stock: Suzano (SUZB3)

Current Market Price: R$ 50.10

Market Capitalization: R$ 68.5 billion

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Suzano Stock – Summary of the Company

Suzano is a Brazilian pulp and paper company. They have 11 industrial units located throughout Brazil and employee around 37,000 people globally. The company exports to 127 countries. Suzano was founded in 1924 and is headquartered in Salvador in the state of Bahia, Brazil.

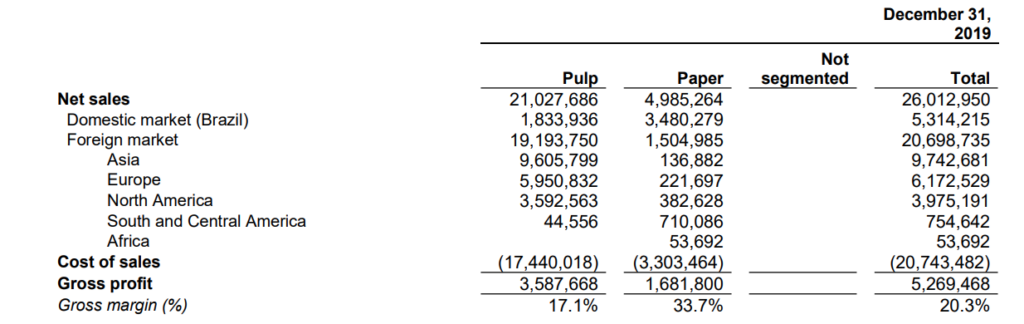

Revenue and Cost Analysis

Suzano had net revenue of R$ 26 billion in 2019, a large increase compared to R$ 13.4 billion in 2018 and R$ 10.5 billion in 2017. A large portion of this increase can be attributed to their acquisition of Fibra (discussed below). Their COGS in 2019 was R$ 20.7 billion, representing a gross margin of 20%, a significant decrease from 48.5% in 2018 and 38.6% in 2017.

Although Suzano had an operating profit in each of the last 3 years, they had a net loss of R$ 2.8 billion in 2019, due to financial expenses, including exchange rate variations. This is a significant deterioration compared to a profit of R$ 319.8 billion in 2018 and R$ 1.8 billion in 2017.

Around 80% of the company’s net sales are from exports, with the remaining 20% being derived domestically.

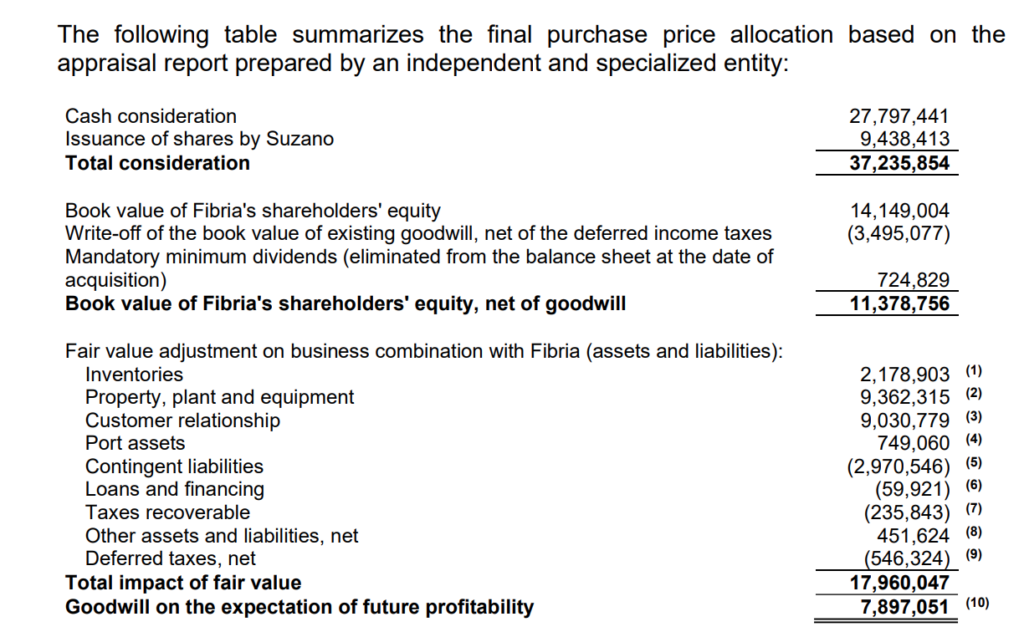

Suzano – Acquisitions

In January 2019 Suzano acquired Fibra for a total acquisition price of R$ 37.2 billion in cash and Suzano shares.

Balance Sheet Analysis

Suzano has a decent, but leveraged balance sheet. They have a solid base of long term assets and sufficient liquidity in the near term. However they have high liability levels, mainly debt.

It is worth noting that Suzano has a derivative book comprised of several types of complex derivatives it uses in an attempt to hedge its exposure to commodity and currency prices. Investors should analyze these derivatives in detail before investing, as the company had an expense of R$ 1 billion in 2019 related to these derivatives.

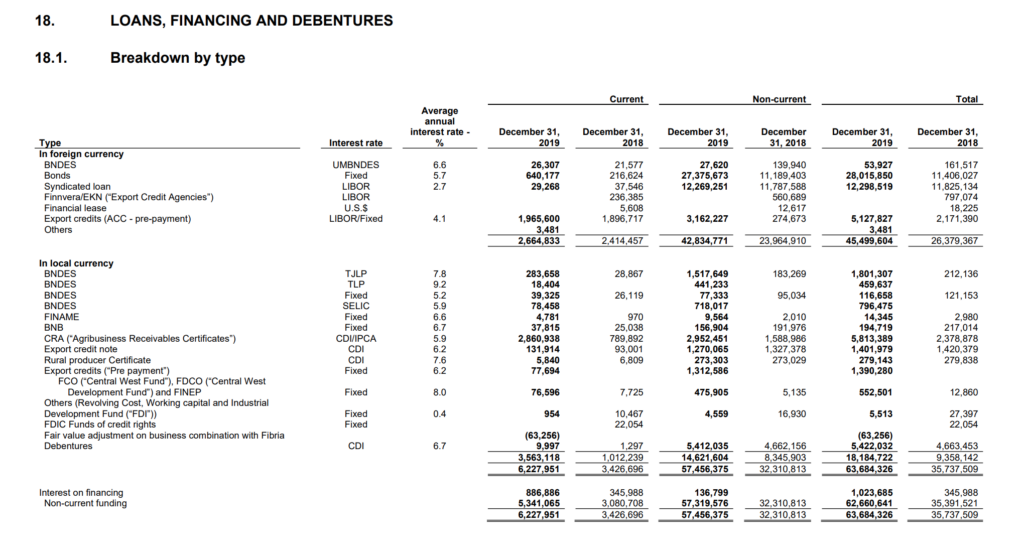

Suzano – Debt Analysis

As of year-end 2019 Suzano has R$ 63.6 million in total debt outstanding, R$ 6.2 billion of which is classified as current. R$ 45.5 billion of this debt is denominated in foreign currency, exposing the company to the negative effects of a depreciating Brazilian Real.

In August 2019 Moody’s completed a review of Suzano’s credit rating and maintained a rating of Ba1, just below investment grade status.

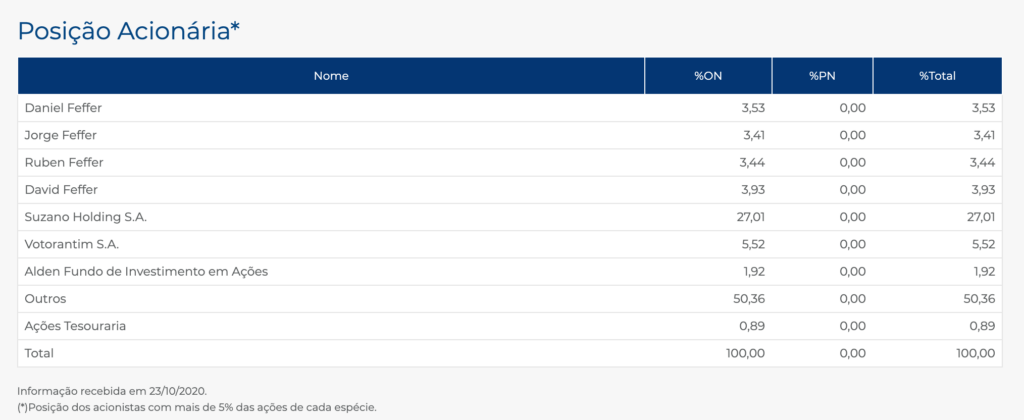

Suzano Stock – Share Dynamics and Capital Structure

As of year-end 2019 Suzano has 1.36 billion common shares outstanding. Insiders and institutional investors own around 50% of the company, with the remaining 50% being held by shareholders with an ownership stake of less than 5%.

Suzano Stock – Dividends

Suzano did not pay a dividend based on 2019’s results. They did pay a dividend of R$ 0.44 cents per share based on 2018’s results.

Suzano Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 79.9 billion / R$ 18 billion = 4.4

A debt to equity ratio of 4.4 indicates that Suzano is leveraged and relies heavily on debt in its capital structure to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 18.9 billion / R$ 11.5 billion = 1.6

A working capital ratio of 1.6 indicates a sufficient, but not strong liquidity position. Suzano should not have problems meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

R$ 50.10 / R$ 13.23 = 3.8

Suzano has a book value per share of R$ 13.23. At the current market price this implies a price to book ratio of 3.8, meaning Suzano stock currently trades at a premium to the book value of the company.

Suzano Stock – Summary and Conclusions

After the merger with Fibra, Suzano has become one of the largest pulp and paper companies in the world. They derive the majority of their revenue internationally, exporting to 127 countries. However in order to achieved this scale via merger, it appears Suzano sacrificed its margins. Post-merger the company’s gross margin declined significantly and it had a net loss compared to a profit in the previous two years.

Suzano is highly leveraged and its debt levels are concerning. Their foreign currency denominated debt has been a serious drag on earnings due to a depreciating Brazilian Real, and their attempt to hedge this exposure also generated significant expenses. For this reason I am not willing to invest in Suzano stock at this time.

I am curious to see what the company looks like in its first full year post merger, so I will leave Suzano on my watch list and revisit their 2020 financial results. Should their debt position improved significantly, I will reconsider my investment decision. Investors can compare Suzano stock to other Brazilian forestry companies such as Klabin.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.