Preferred Stock: Schulz (SHUL4)

Current Market Price: R$ 13.93

Market Capitalization: R$ 1.2 billion

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Schulz Stock – Summary of the Company

Schulz is a Brazilian automotive parts manufacturer and the largest manufacturer of air compressors in Latin America. The company has two divisions; Schulz automotive and Schulz compressors. Their main factory is located in Joinville, Santa Catarina, Brazil, which has over 120,000 square meters of built area. They employ over 2,700 people. Schulz was founded in 1963 and is headquartered in the state of Santa Catarina, Brazil.

Revenue and Cost Analysis

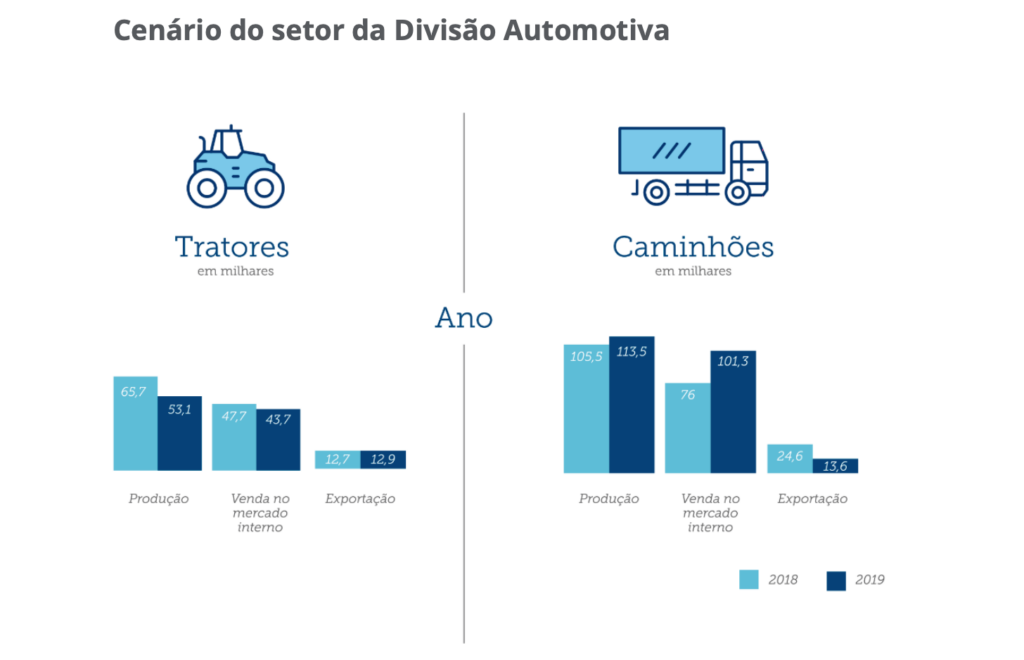

For the year end 2019 Schulz had revenue of R$ 1 billion, an increase from R$ 947 million the previous year. Their COGS was R$ 830 million in 2019, representing a gross margin of 22%, a slight decrease compared to 24% in 2018. Around 25% of the company’s revenue comes from exports, the company has distribution in over 70 countries.

Schulz has been profitable in each of the past 3 years. In 2019 the company had net income of R$ 97 million, representing a profit margin of 9.2%, an improvement compared to 7.4% in 2018. This improvement in net income can be attributed in large part to a reduction in financing expenses.

Balance Sheet Analysis

Schulz has a decent balance sheet. The have a solid base of long term assets and sufficient liquidity in the near term. Liability levels appear reasonable, although the company is slightly leveraged, with a relevant amount of debt outstanding.

Schulz – Debt Analysis

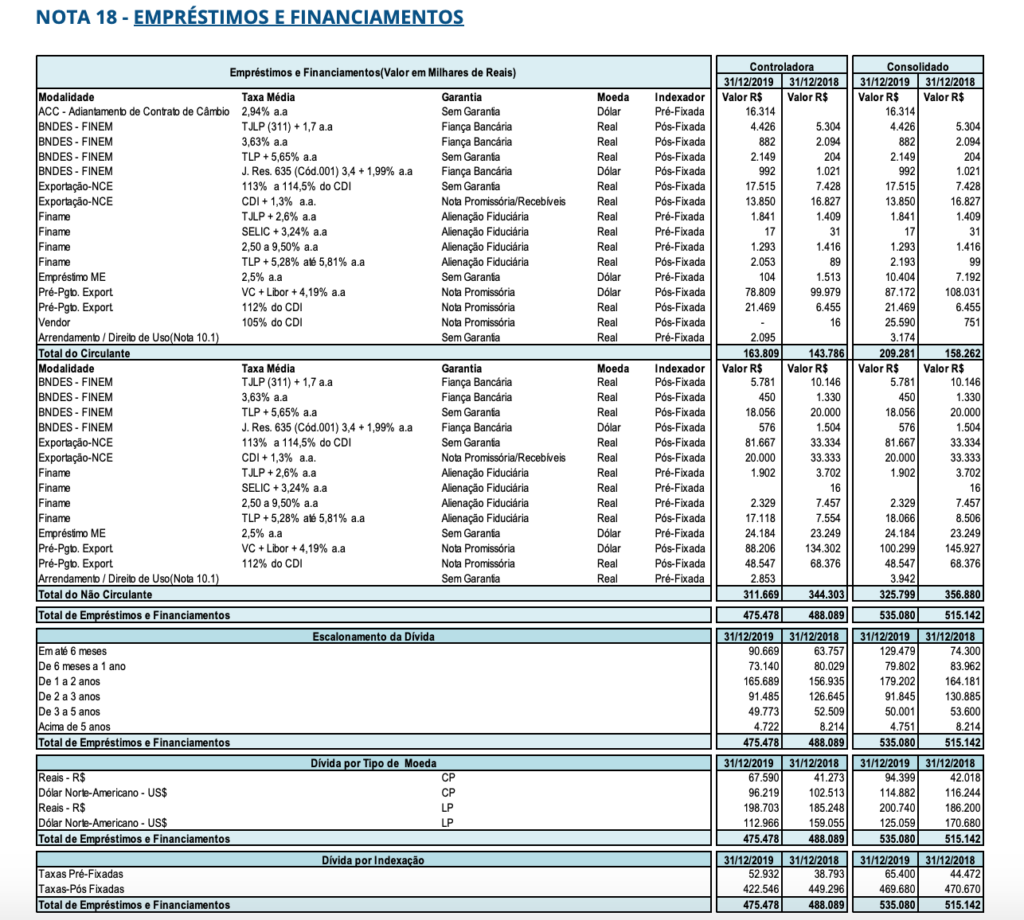

As of the year end 2019 Schulz has R$ 535 million in total debt outstanding, R$ 209 million of which is classified as current. The majority of their long term debt will be due within 3 years.

Schulz Stock – Share Dynamics and Capital Structure

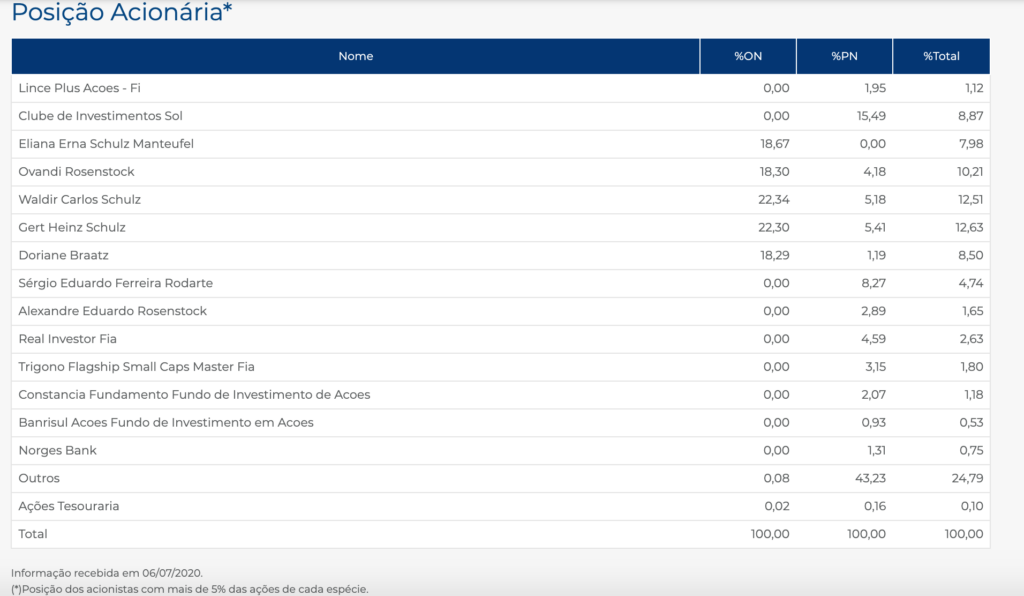

As of the year end 2019 Schulz has 38.2 million common shares outstanding and 51.2 million preferred shares outstanding. Total shares outstanding is around 89.4 million shares.

Insiders and institutional investors own around 75% of the company, with the remaining 25% being held by smaller investors with an ownership position of less than 5%.

Schulz Stock – Dividends

Schulz regularly returns capital to shareholders via a dividend. Based on 2019’s results the company paid total dividends of R$ 0.15 cents per share. At the current market price this implies a dividend yield of 2%.

Schulz Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 777 million / R$ 620 million = 1.25

A debt to equity ratio of 1.25 indicates that Schulz uses a mix of debt and equity in its capital structure, but relies slightly more on debt financing to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 858 million / R$ 342 million = 2.5

A working capital ratio of 2.5 indicates a solid liquidity position. Schulz should not have problems meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

R$ 13.93 / R$ 6.94 = 2

Based on total shares outstanding Schulz has a book value per share of R$ 6.94. At the current market price this implies a price to book ratio of 2, meaning Schulz stock currently trades at a slight premium to the book value of the company.

Schulz Stock – Summary and Conclusions

Schulz stock looks like a classic value stock. The company has a long history of successful operations. It is the market leader in the Latin American air compressor market, with a relevant amount of revenue coming from exports. The company uses some debt, but is not over leveraged, especially when compared with other Brazilian manufacturers. Schulz has been consistently profitable, has a solid liquidity position, and currently trades at a reasonable price to book. Management regularly returns capital to shareholders via dividends.

However the Brazilian automotive market is facing significant difficulties, for example Ford announcing the closing of all its Brazilian plants. This may be a case of a value stock being cheap for a reason, as the long term prospects for the Brazilian automotive market are uncertain at best.

That being said I am still quite intrigued by Schulz stock. The Brazilian stock market is trading around its all-time high, and Schulz stock still looks reasonable. I will need to do a little more research about the air compressor market. But Schulz stock will remain at the top of my watchlist. I will revisit the company when its full year 2020 financials are available.

Investors can compare Schulz stock to other Brazilian auto parts manufacturers, such as Randon.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.