Common Stock: São Martinho (SMTO3)

Current Market Price: R$ 31.85

Market Capitalization: R$ 11.3 billion

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

São Martinho Stock – Summary of the Company

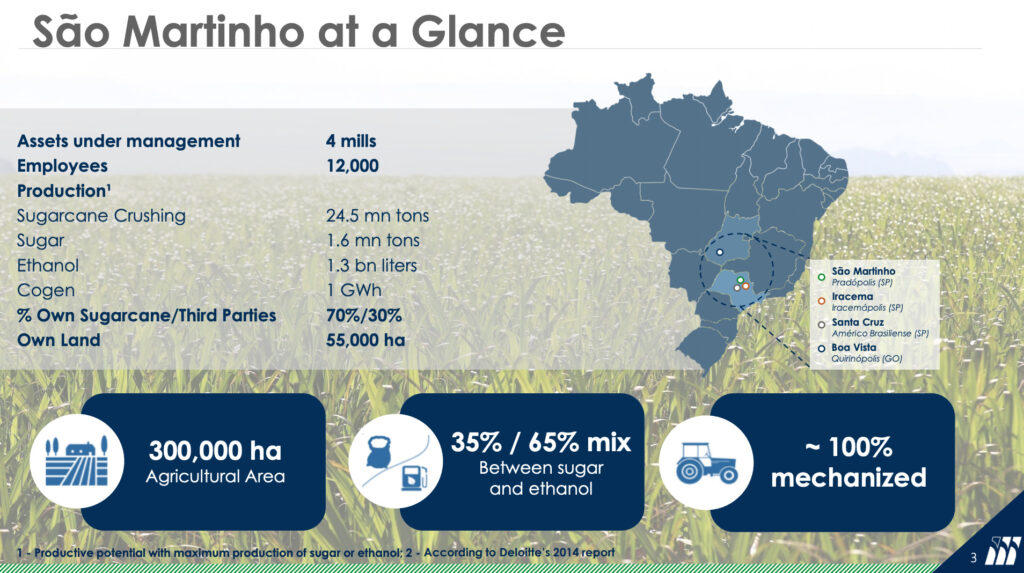

São Martinho is a Brazilian company whose primary activity is the cultivation of sugarcane, as well as the production and sale of sugar, ethanol, and other sugarcane byproducts. In addition the company has operations in the co-generation of electric power and real estate ventures. 70% of the company’s sugarcane comes from land owned by the company, which total around 300,000 hectares. They have four plants and employee around 12,500 people. São Martinho was founded in 1907 and is headquartered in the state of São Paulo, Brazil.

Revenue and Cost Analysis

For the fiscal year end March 2020 São Martinho had revenue of R$ 3.7 billion, an increase from R$ 3.3 billion the previous year. Their COGS was R$ 2.5 billion, representing a gross margin of 32%, also an improvement compared to 26% in 2019.

The company was profitable in each of the last two years. In 2020 São Martinho had net income of R$ 639 million, representing a profit margin of 17%, a significant improvement compared to 9% in 2019.

Balance Sheet Analysis

São Martinho has a decent but leveraged balance sheet. They have a solid base of long term assets, as well as sufficient liquidity in the short term. However they have a significant amount of debt outstanding, including foreign currency denominated debt.

It is also worth noting São Martinho uses derivatives to hedge both its commodity and currency exposures. This derivatives book should be analyzed in detail by investors before investing.

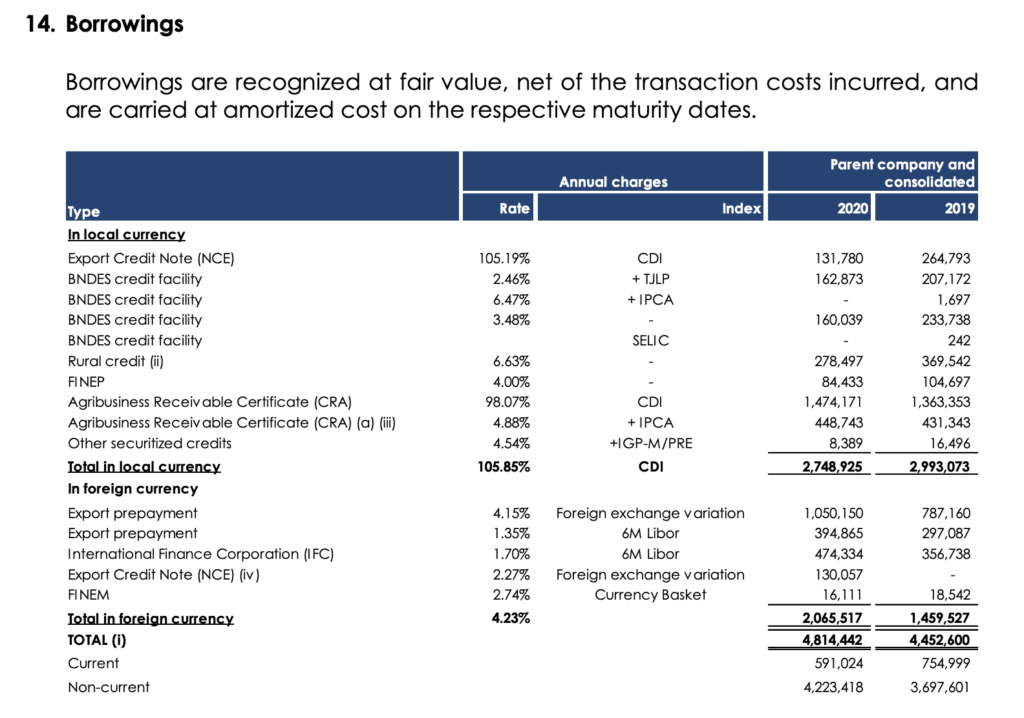

São Martinho – Debt Analysis

As of the fiscal year end March 2020, São Martinho has R$ 4.8 billion in total debt outstanding, R$ 591 million of which is classified as current. R$ 2 billion of this debt is denominated in foreign currency, exposing the company to the negative effects of a depreciating Brazilian Real.

São Martinho Stock – Share Dynamics and Capital Structure

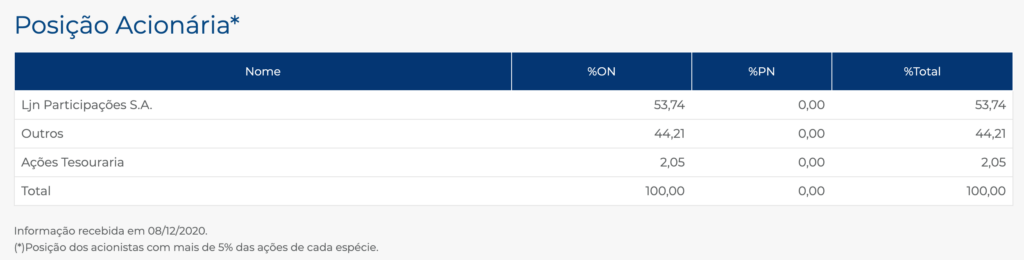

As of July 2020 São Martinho has 354 million common shares outstanding. One institutional investors owns 54% of the company’s outstanding shares and an additional 2% are owned by the company’s treasury. The remaining 44% of their outstanding shares are owned by smaller shareholders with an ownership position of less than 5%.

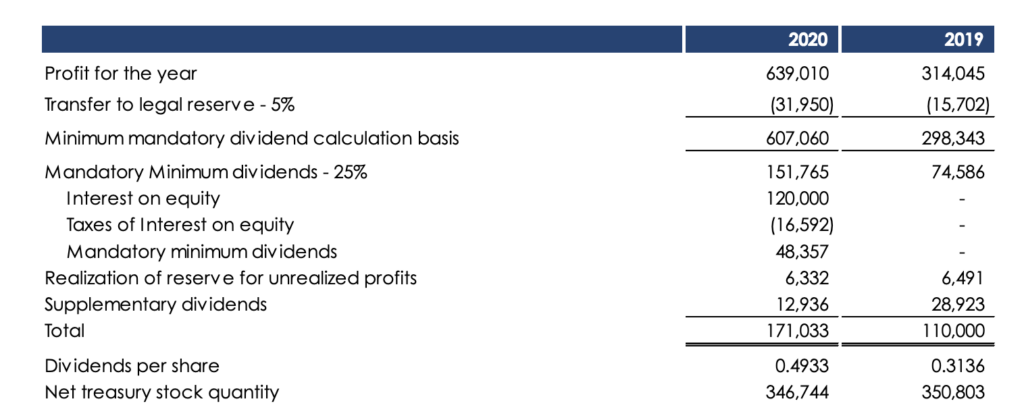

São Martinho Stock – Dividends

Based on 2020’s results São Martinho paid a dividend of R$ 0.49 cents per common share. At the current market price this implies a dividend yield of 1.5%.

São Martinho Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 8.8 billion / R$ 3.3 billion = 3

A debt to equity ratio 3 indicates that São Martinho has a leveraged balance sheet and relies heavily on debt financing to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 3.5 billion / R$ 1.7 billion = 2

A working capital ratio of 2 indicates a sound liquidity position. São Martinho should not have a problem meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

R$ 31.85 / R$ 9.5 = 3.4

São Martinho has a book value per share of R$ 9.5. At the current market price this implies a price to book ratio of 3.4, meaning the company’s stock currently trades at a premium to the book value of the company.

Brazilian Agriculture Market – Economic Factors and Competitive Landscape

Brazil is an agricultural powerhouse, it ranks 5th in the world in terms of arable land. Agriculture is a large and important industry for the Brazilian economy. Brazil is the world’s largest producer of oranges, sugarcane, and coffee. They also compete globally in the production of soy, meat, and corn. Brazils’ diverse geography allows it to produce a wide variety of crops.

Global agricultural is a highly competitive market subject to large swings in global commodity prices. Brazilian agricultural companies will have to compete fiercely on a global stage for exports. However, given the scale of the industry in Brazil, I believe it is reasonable to assume that there are many well run, investable agriculture companies in Brazil.

São Martinho Stock – Summary and Conclusions

São Martinho stock is an intriguing investment opportunity. The company has a large asset base of land and four operating plants. They are profitable, with improving operating and net margins. Their balance sheet is leveraged, but they appear to be healthy financially. Management returns capital to shareholders via a dividend.

My biggest concern is their debt levels, particularly foreign denominated debt. I do not like to invest in Brazilian companies exposed to a carry trade. Although most other aspects of the company are appealing and the stock is clearly in a long term uptrend, I am not comfortable enough with the sugarcane and ethanol business to take a position given the company’s debt.

For now I will leave São Martinho stock at the top of my watch list and revisit my decision when their next annual report is available. I will be comparing São Martinho stock to other Brazilian agriculture companies, such as Brasil Agro.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.