Common Stock: Randon (RAPT3)

Current Market Price: R$ 11.44

Market Capitalization: R$ 3.7 billion

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Randon Stock – Summary of the Company

Randon is a Brazilian vehicles, trailers, and auto parts manufacturer. They are the largest trailer and semi-trailer manufacturer In Latin America and one of the largest in the world. The company has 22 industrial plants globally and is present in over 100 countries. They currently employee over 11,000 people. Randon was founded in 1949 and is headquartered in the state of Rio Grande do Sul, Brazil.

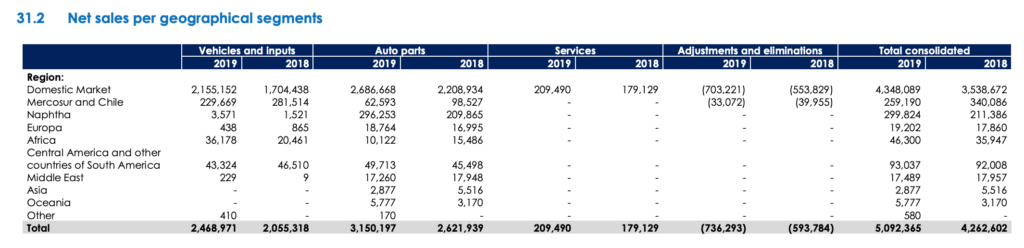

Revenue and Cost Analysis

Randon had revenue of R$ 5.1 billion in 2019, a significant increase from R$ 4.3 billion in 2018. Their COGS was R$ 3.8 billion in 2019, representing a gross margin of 25%, on par with their gross margin of 24% in 2018.

The company was profitable in each of the last two years. In 2019 Randon had net income of R$ 301 million, representing a profit margin of 6%, on par with their profit margin of 5% in 2018.

Balance Sheet Analysis

Randon has a decent but leveraged balance sheet. They have a solid base of long term assets and good liquidity. But they have high liability levels, including debt.

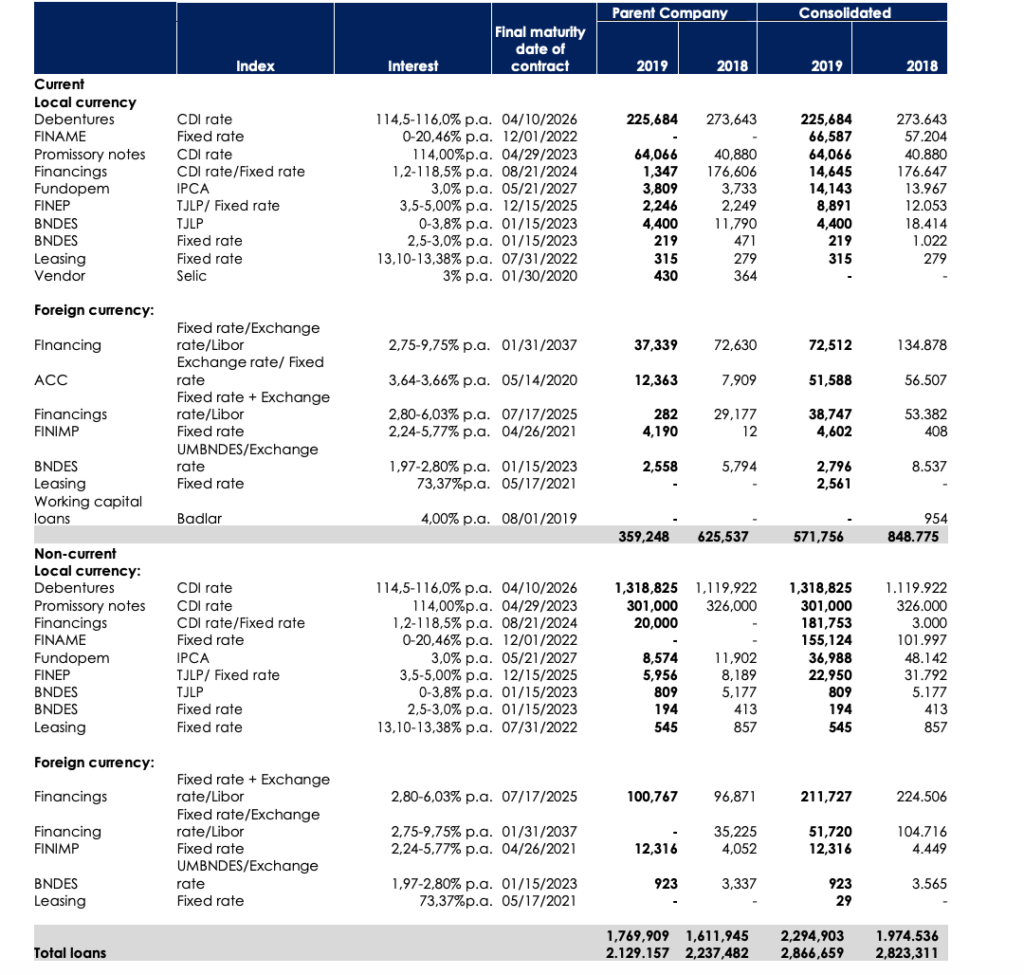

Randon – Debt Analysis

As of year-end 2019 Randon has R$ 2.9 billion in total debt outstanding, R$ 572 million of which is classified as current. A relevant portion of this debt is denominated in foreign currency, however given the global scale of Randon’s operations, they have a natural hedge to this carry trade.

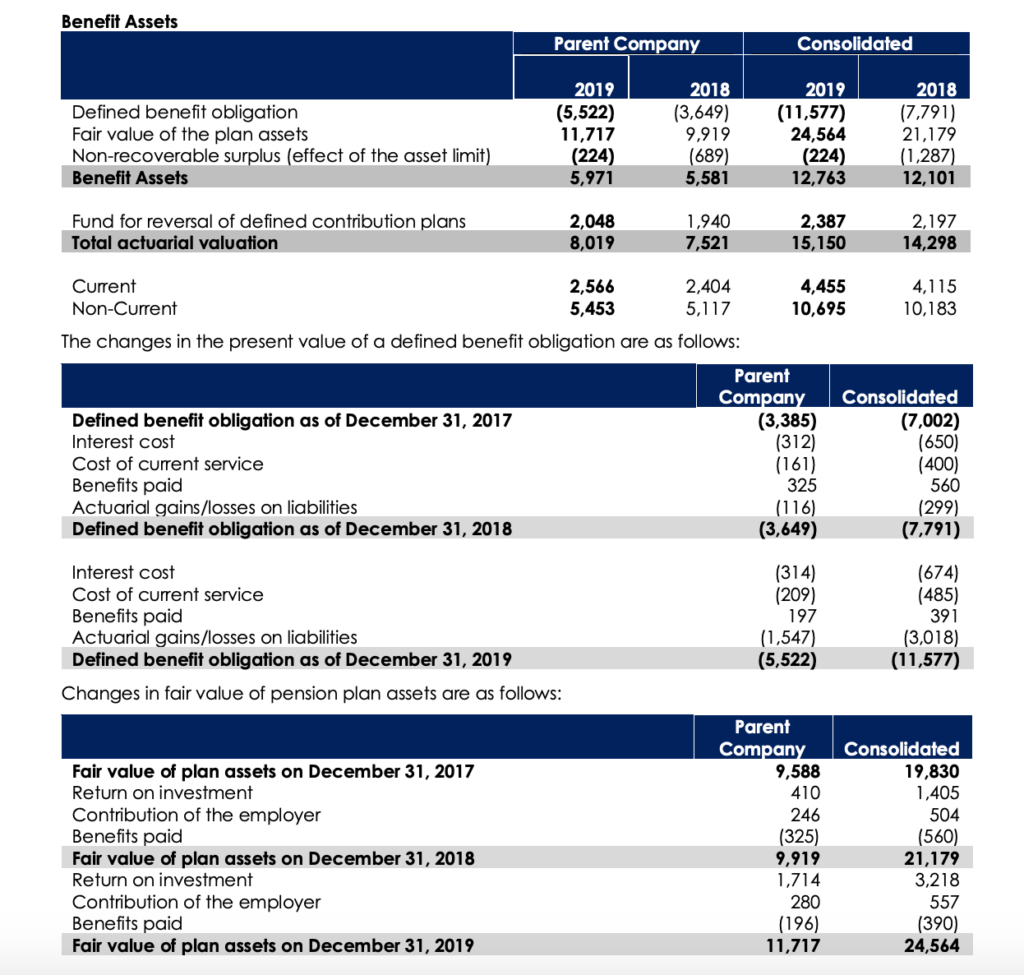

Randon – Pension Obligation

Randon has a significant defined benefit pension obligation. As of year-end 2019 the plan appears to be overfunded, so this obligation should not be overly concerning to investors. However it should be monitored none the less.

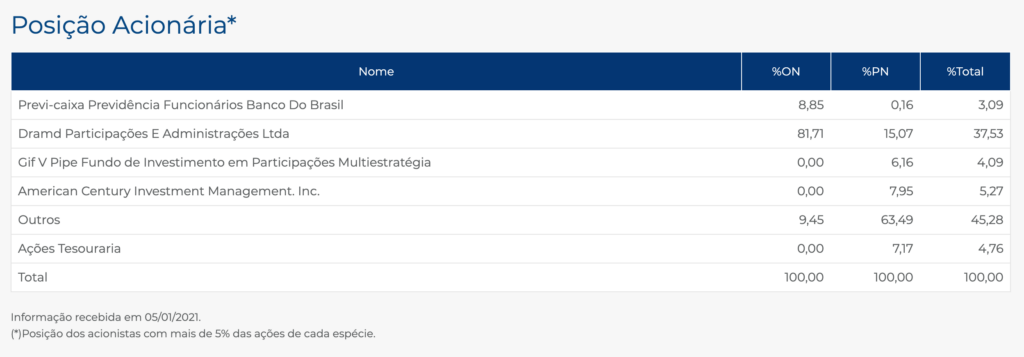

Randon Stock – Share Dynamics and Capital Structure

As of year-end 2019 Randon has 116.5 million common shares outstanding and 229.3 million preferred shares outstanding. Insiders, institutional investors, and the company’s treasury own around 55% of the company. The remaining 45% is owned by smaller shareholders with an ownership position of less than 5%.

Randon Stock – Dividends

Randon paid total dividends of R$ 0.19 cents per share to common shareholders in 2019. At the current market price this implies a dividend yield of 1.7%

Randon Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 4.1 billion / R$ 2.2 billion = 1.9

A debt to equity ratio of 1.9 indicates that Randon uses a mix of debt and equity in its capital structure, but is leveraged, and relies more heavily on debt financing to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 3.8 billion / R$ 1.5 billion = 2.5

A working capital ratio of 2.5 indicates a sound liquidity position. Randon should not have a problem meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

R$ 11.44 / R$ 6.29 = 1.8

Based on total shares outstanding Randon has a book value per share of R$ 6.29. At the current market price this implies a price to book ratio of 1.8, meaning the company’s stock currently trades at a premium to the book value of the company.

Randon Stock – Summary and Conclusions

Randon is an impressive company. They are a regional and global leader in many of the segments in which they operate, including trailers, semi-trailers and fifth wheels, among others. The company is sound financially having been profitable in each of the past two years. They have sufficient liquidity in the near term. Although long term debt levels are relatively high. Management returns capital to shareholders via a dividend.

Although I am impressed by Randon and the global scale at which they operate, I have concerns about the about sector, particularly in Brazil. For example Ford recently announced they will be closing all three of their plants in Brazil. I am not willing to invest in Randon stock at this time, although I will leave them on my watchlist and revisit their 2020 financials when available. Investors can compare Randon stock to other Brazilian auto parts companies, such as Fras-le.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.