Common Stock: Productos Familia

Current Market Price: $ 3,900 COP

Market Capitalization: $ 4.3 trillion COP

*All values in this article are expressed in Colombian Pesos (COP) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Productos Familia Stock – Summary of the Company

Productos Familia is a Colombian grooming and hygiene products manufacturing company. They operate under a wide range of brands focused on different segments of society, including baby products, feminine hygiene, institutional cleaning products, and pet products, among others. The company has operating facilities in 8 countries and exports to an additional 13 countries. Productos Familia was founded in 1958 and is headquartered in Medellin, Colombia.

Revenue and Cost Analysis

Productos Familia had total revenue of $ 2.6 trillion in 2019, an increase from $ 2.4 trillion in 2018. Their revenue was split roughly 50/50 between domestic and international sales in both years. In 2019 The company’s COGS was $ 1.4 trillion, representing a gross margin of 46%, on par with their gross margin of 45% in 2018.

The company was profitable in each of the last two years. In 2019 Productos Familia has net income of $ 457.5 billion, representing a profit margin of 9.3%, an improvement compared to 8.6% the previous year.

Balance Sheet Analysis

Productos Familia has a sound balance sheet. They have a base of long term assets, mainly property, plant, and equipment, as well as a sound liquidity position in the near term. The company is not over leveraged as liability and debt levels are reasonable.

Productos Familia – Debt Analysis

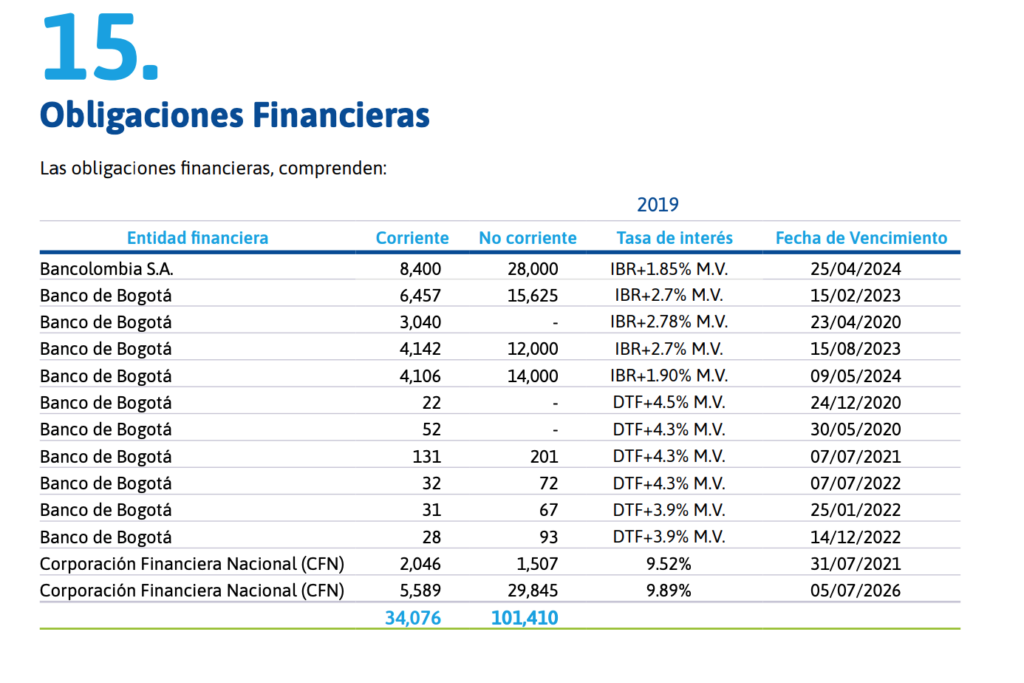

As of year-end 2019 the company has $ 135.5 billion in total debt outstanding, $ 34 billion of which is classified as current.

Productos Familia Stock – Share Dynamics and Capital Structure

As of year-end 2019 the company has 1.1 billion common shares outstanding.

Productos Familia Stock – Dividends

In 2019 the company paid total dividends of $ 94.54 per common share. This is a decrease compared to a dividend of $ 128.75 per share in 2018. At the current market price this implies a dividend yield of 2.4%.

Productos Familia Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$ 765.2 billion / $ 1.7 trillion = .46

A debt to equity ratio of .46 indicates that Productos Familia uses a mix of debt and equity in its capital structure, but is not heavily leveraged and relies more heavily on equity financing for funding.

Working Capital Ratio

Current Assets/Current Liabilities

$ 1.1 trillion / $ 490 billion = 2.3

A working capital ratio of 2.3 indicates a sound liquidity position. Productos Familia should not have a problem meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

$ 3,900 / $ 1,498 = 2.6

Productos Familia has a book value per share of $ 1,498. At the current market price this implies a price to book ratio of 2.6, meaning Productos Familia stock currently trades at a premium to the book value of the company.

Productos Familia Stock – Summary and Conclusions

Productos Familia is an impressive company. They have a diversified product portfolio and a strong presence throughout the LATAM region. The company is financially healthy with strong profit margins in the last two years, as well as a sound liquidity position. They are not over leveraged, debt levels are reasonable. In addition the company returnees capital to shareholders via a dividend.

I will wait for the company’s 2020 financials to be made available before making any investment decisions. But Productos Familia stock looks investable from what I have seen so far. Investors can compare Productos Familia to a Brazilian company is the same industry, Bombril.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.