Common Stock: Pretium Resources (PVG)

Current Market Price: $8.54

Market Capitalization: $1.58 billion

Pretium Resources – Summary of the Company

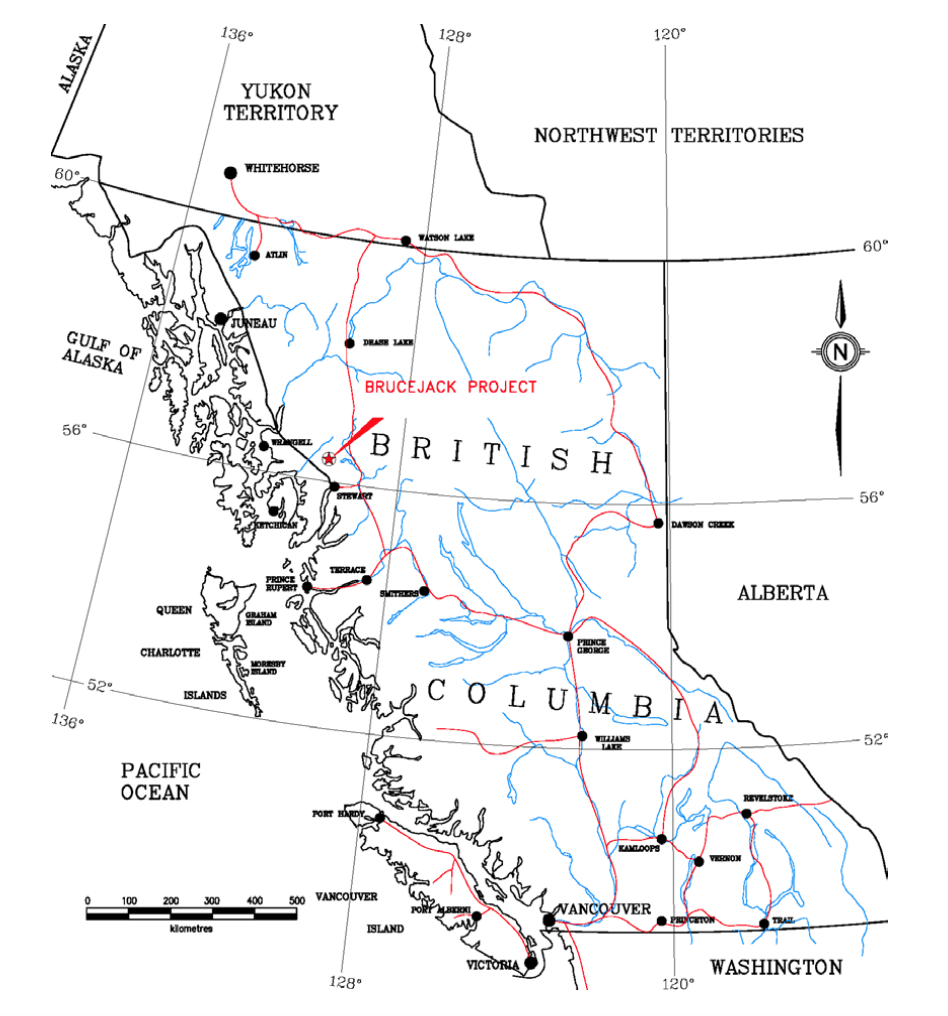

Pretium Resources is a mining company focused on the acquisition, development, exploration, and operation of precious metals mining properties throughout the Americas. They have one keystone property, The Brucejack property, located in northwest British Colombia. The company also has several other exploration stage projects. Pretium Resources was founded in 2010. Its headquarters are in Vancouver Canada. The company currently employees over 1,200 people, including contractors.

Revenue and Cost Analysis

In 2019 Pretium produced 354,405 ounces of gold and 516,977 ounces of silver. This represented a slight decrease in gold ounces produced, down from 376,012 ounces in 2018. But it also represented a significant increase in silver production, increasing from 422,562 ounces in 2018.

Total revenue in 2019 was $484.5 million, an increase over 2018 revenue of $454.5 million. The company earned net income of $40.9 and $36.6 million in 2019 and 2018 respectively.

Cash flow from operating activities was $225 million in 2019, a significant increase over the 2018 figure of $197.2 million.

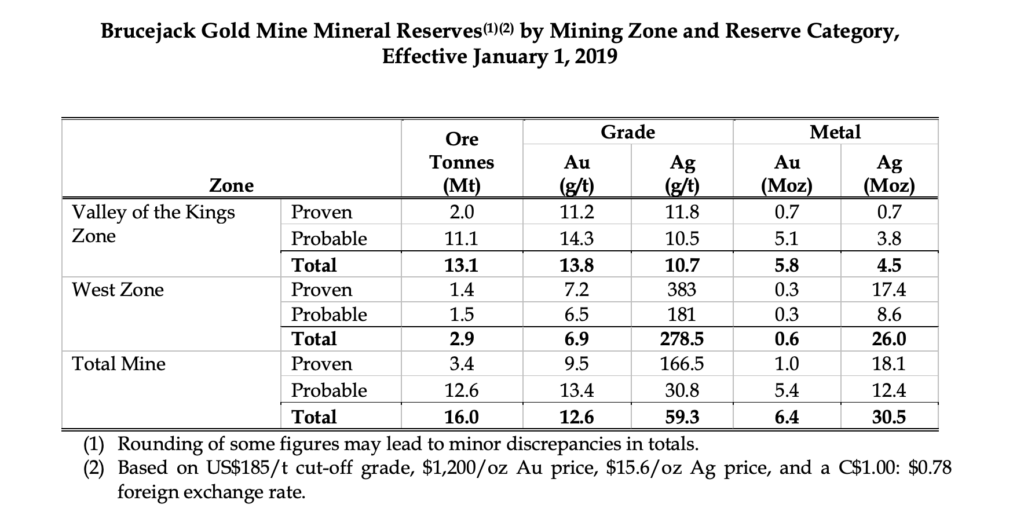

Pretium Resources – Reserves

The company has proven and probable reserves totaling 6.5 million ounces of gold and 30.5 million ounces of silver.

Royalty and Streaming Agreements

In 2017, the company entered a construction financing package to finance the building of the BruceJack mine. As part of this package the company agreed to significant streaming and “Offtake” agreements.

However, in 2019 the company exercised their option to repurchase these options, and repurchased 100% of the streaming and 100% of the offtake arrangements.

Balance Sheet Analysis

Pretium Resources does not have a particularly strong balance sheet. The company has high levels of debt, totaling $463.9 million and constrained short term liquidity. Short term assets total $62 million, including $23 million in cash. While short term liabilities total $129 million

Debt Analysis

In 2017, the company issues $100 million in convertible notes. The notes pay 2.25% annual interest (semiannual coupons) and are convertible at a rate of 62.5 shares per $1 in principal, at a conversion price of $16 per common share.

The company’s debt facility includes some restrictive covenants related to interest coverage, maximum leverage, and minimum absolute liquidity requirements. The most important covenant for common shareholders is a limit on the amount of dividends that can be paid out. Pretium cannot pay more that $40 million in dividends per year.

PVG Stock – Dividends

The company has never paid a dividend and has no plans to do so in the near future. As mentioned above, the company has debt covenants limiting the amount of capital it can return to shareholders via dividends or share repurchases to $40 million per year.

PVG Stock – Share Dynamics and Capital Structure

At year end 2019, there were 185.3 million shares of PVG outstanding. The company also has a significant convertible note outstanding, that could result in the issuance of hundreds of millions of additional shares.

Considering the highly dilutive nature of the company’s convertible debt, coupled with restrictive debt covenants. Pretium resource’s capital structure is not acceptable for common shareholders.

Management – Skin in the game

Insider ownership is low, totaling .39% of the issued and outstanding common shares. In addition, insiders have been net sellers over the past 2 years.

Low insider ownership and insider selling is generally viewed as a bearish signal.

Pretium resources- 3 Metrics to Consider

Price to Book Ratio

Current price of PVG stock/Book value per share

$8.54/$5.15=1.66

Based on the undiluted common stock outstanding PVG has a book value of $5.15 per share. At the current market price this implies a price to book ratio of 1.66, meaning PVG stock trades at a premium to the book value of its assets.

Working Capital Ratio

Current Assets/Current Liabilities

$62 million/$129 million = .48

A working capital ratio of .48 indicates a weak short term liquidity position. Given the high levels of short term liabilities relative to assets, the company may have difficulties meeting its short-term obligation.

Debt to Equity Ratio

Total Liabilities/Total Shareholder equity

$618.8 million/$954.3 million= .65

A debt to equity ratio of .65 implies the company uses mostly equity financing to fund itself and is not overly reliant on debt.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

Pretium Resources- Summary and Conclusions

Pretium resources has a strong asset in the BruceJack mine. The property is producing and the company is managing it profitably.

However, the company has a weak liquidity position and high debt levels. The capital structure is highly unfavorable to common shareholder, with debt covenants putting a cap on returns, as well as a highly dilutive convertible note.

Regardless of how well gold markets and the BrucJack mine preform in the future, the value Pretium resources is able to accrue, will likely be captured by the company’s debt holders. Equity holders are unlikely to participate in any upside. I would not invest in PVG common stock.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.