Common Stock: Portobello (PTBL3)

Current Market Price: R$ 7.08

Market Capitalization: R$ 1.1 billion

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Portobello Stock – Summary of the Company

Portobello is a Brazilian ceramic tile manufacturer. They sell their tiles through 3 distinct channels; Portobello Shop, which are franchised stores that sell Portobello products direct to the consumer. The company has 130 stores throughout Brazil; Resellers, which are home good stores that sell the company’s products; and Construction where the company sells its products directly to large construction companies to be used in new buildings. The company exports to over 60 countries and employs around 2,600 people worldwide. Portobello was founded in 1979 and is headquartered in the state of Santa Catarina Brazil.

Revenue and Cost Analysis

Portobello had net revenue of R$ 1.1 billion in 2019, an increase from R$ 1 billion in 2018. Their COGS was R$ 751.6 million in 2019, representing a gross margin of 32.5%, a decrease from 38.4% in 2018.

Portobello has been profitable in each of the last 3 years. In 2019 the company had net income of R$ 13.2 million, representing a profit margin of 1.1%, a significant deterioration compared to 12.7% in 2018.

Balance Sheet Analysis

Portobello has a decent, but leveraged balance sheet. Liquidity if sufficient in the near term, however liability levels, including debt, are high.

Portobello – Debt Analysis

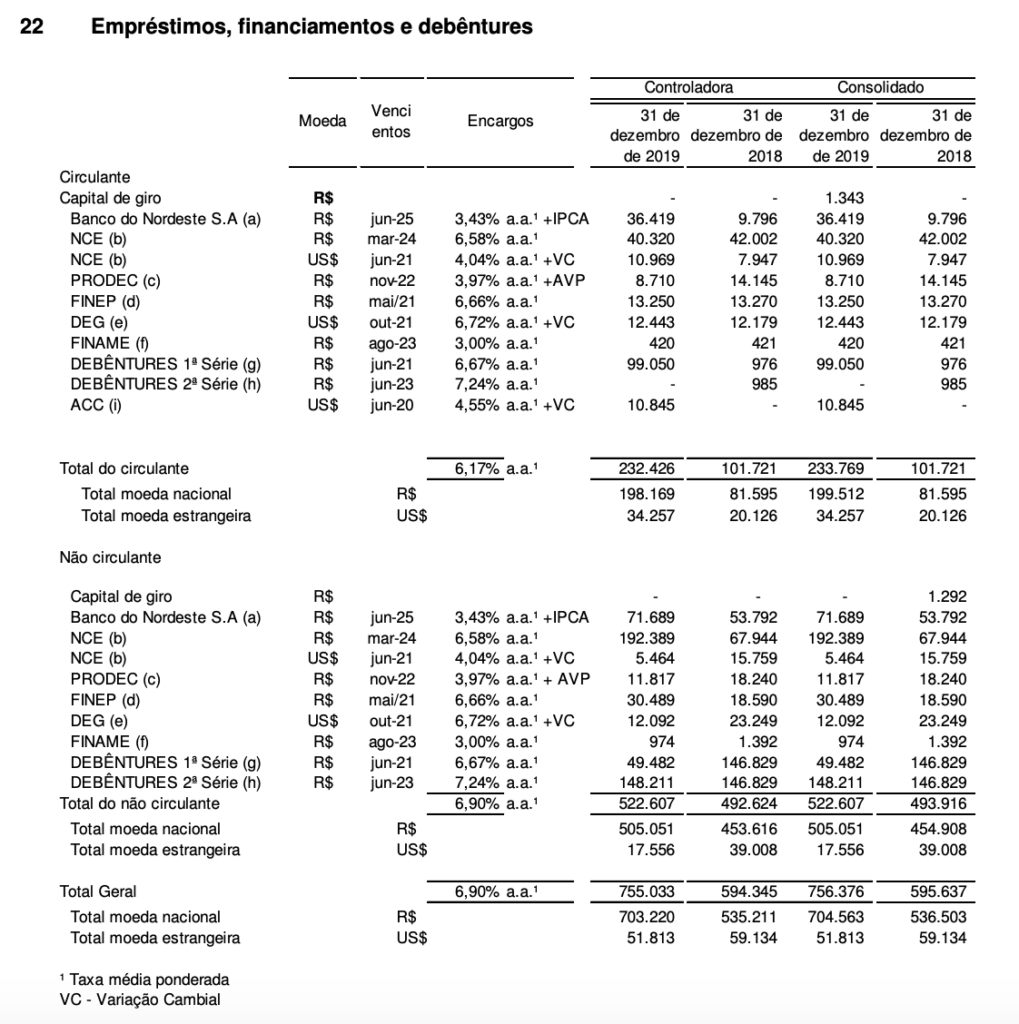

As of year-end 2019 Portobello has R$ 756.3 million in total debt outstanding, R$ 233.7million of which is classified as current. Around R$ 51.7 million of this debt is denominated in US dollars, exposing the company to the negative effects of a depreciating Brazilian Real.

Portobello Stock – Share Dynamics and Capital Structure

As of year-end 2019 Portobello has 158.5 million common shares outstanding. Insiders and institutional investors own around 92% of the company, with the remaining 8% being owned by PBG which trades publicly.

Portobello Stock – Dividends

Based on 2019’s results, Portobello paid a dividend of R$ 0.04 cents per share. At the current market price this implies a dividend yield of 0.6%.

Portobello Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 1.5 billion / R$ 367.6 million = 4

A debt to equity ratio of 4 indicates that Portobello has a leveraged balance sheet and relies heavily on debt financing in its capital structure to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 854.5 million / R$ 613.7 million = 1.4

A working capital ratio of 1.4 indicates a sufficient, but not strong liquidity position. Portobello should not have a problem meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

R$ 7.08 / R$ 2.32 = 3.05

Portobello has a book value per share of R$ 2.32. At the current market price this implies a price to book ratio of 3.05, meaning Portobello stock currently trades at a premium to the book value of the company.

Portobello Stock – Summary and Conclusions

Portobello is an interesting company. They are the largest ceramics manufacturer in Brazil. They are expanding aggressively and now have over 130 store locations, in addition to a strong presence via resellers and direct sales to builders. The company exports to over 60 countries. Portobello is in a decent, but not strong position financially. They have been consistently profitable and have sufficient liquidity. However their balance sheet is leveraged, increasing risk to shareholders.

At its current valuation, Portobello stock is by no means cheap, and provides little margin of safety for investors. I will add Portobello stock to my watchlist and wait to make an investment decision until their 2020 financials are available. Investors can compare portobello stock to other Brazilian home goods manufacturers, such as the refrigerator manufacturer Metalfrio.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.