Common Stock: ParanaPanema (PMAM3)

Current Market Price: R$ 9.02

Market Capitalization: R$ 391.5 million

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

ParanaPanema Stock – Summary of the Company

ParanaPanema is a Brazilian copper refiner and producer of semi manufactured copper and copper alloy products. They manufacture and sell products including debars, draw wires, bars, tubes, and connections, among others. The company currently employees around 2,200 people. ParanaPanema was founded in 1956 and is headquartered in the state of Bahia, Brazil, where it is the 4th largest company in the state.

Revenue and Cost Analysis

The company had net sales of R$ 5.2 billion in 2019, an increase from R$ 4.8 billion in 2018. Their COGS was R$ 5.1 billion in 2019, representing a gross margin of 1.2%, a significant decrease compared to 5.7% in 2018.

ParanaPanema had a net loss in each of the last two years. In 2019 the company had a net loss of R$ 25 million, a significant improvement compared to a loss of R$ 323 million in 2018. Although their gross margin deteriorated in 2019, the company was able to significantly decrease its financing expenses, thus improving its net loss year over year.

A significant portion of the company’s revenue comes from exports, with Europe being their largest export market.

Balance Sheet Analysis

The company has a leveraged balance sheet. Liquidity appears sufficient in the near term, but they have high liability levels, including significant debt outstanding.

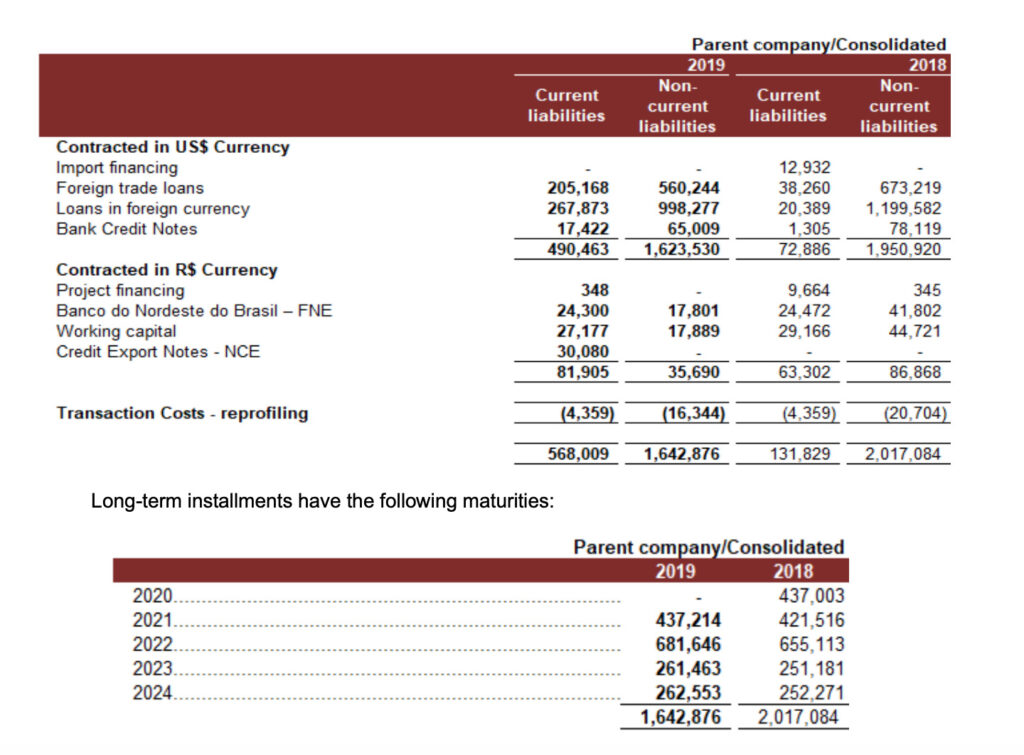

ParanaPanema – Debt Analysis

As of year-end 2019 the company has R$ 2.2 billion in total debt outstanding, R$ 568 million of which is classified as current. The majority of the debt is denominated in US Dollars, exposing the company to the negative effects of a depreciating Brazilian Real.

ParanaPanema Stock – Share Dynamics and Capital Structure

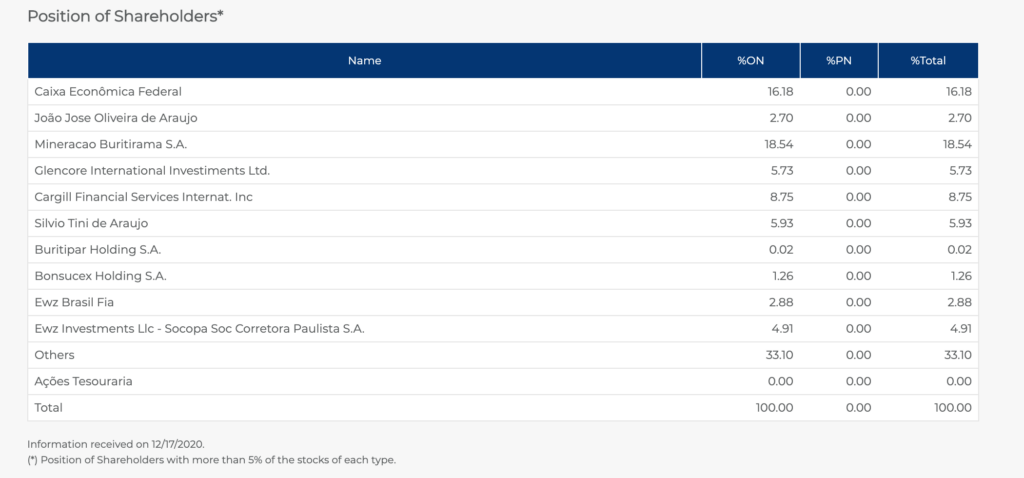

As of year-end 2019 ParanaPanema has total shares outstanding of 43.4 million shares. Insiders and institutional investors own around 67% of the company. The remaining 33% is owned by smaller shareholders with an ownership position of less than 5%.

ParanaPanema Stock – Dividends

The company does not currently pay a dividend.

ParanaPanema Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 3.2 billion / R$ 621.4 million = 5.2

A debt to equity ratio of 5.2 indicates that ParanaPanema is highly levered and relies heavily on debt financing to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 1.6 billion / R$ 1.4 billion = 1.2

A working capital ratio of 1.2 indicates a sufficient, but not strong liquidity position. Given the company’s high debt levels their liquidity position may deteriorate quickly. Investors should carefully monitor the company’s liquidity.

Price to Book Ratio

Current Share Price/Book Value per Share.

R$ 9.02 / R$ 14.32 = .63

Based on total shares outstanding the company has a book value per share of R$ 14.32. At the current market price this implies a price to book ratio of .63, meaning ParanaPanema stock currently trades at a discount to the book value of the company.

ParanaPanema Stock – Summary and Conclusions

ParanaPanema is interests me due to its size and importance in the state of Bahia, being the 4th largest company in the state. However the company is in poor financial health, with significant US dollar denominated debt and net losses in both 2018 and 2019. For these reasons I am not willing to invest in ParanaPanema stock.

I will revisit the company when its 2020 financials are available and reconsider should their debt position and operating results improve. For now I think investors should consider other Brazilian natural resource companies, such as gold miner Jaguar Mining.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.