Common Stock: Orvana Minerals (TSX:ORV)

Current Market Price: $ 0.28 USD

Market Capitalization: $ 38.2 million

**Note: All values in this article are expressed in United States Dollars (USD) unless otherwise noted.

Orvana Minerals Stock – Summary of the Company

Orvana Minerals is a mining company focused on the acquisition, exploration, development, and operation of gold, silver, and copper properties. They currently have two mines in northern Spain and one in Bolivia. They also own an exploration stage property in Argentina. The company was founded in 1992 and is headquartered in Toronto, Canada. They have 521 full time employees and 148 contractors.

Revenue and Cost Analysis

In 2020 the company produced 53,421 ounces of gold, a significant decrease from 97,259 ounces in 2019. This decrease is due to the deterioration of mining results at the company’s Orovalle property in Spain and their Bolivian mine being placed in care and maintenance.

Copper production increased to 5.6 million pounds in 2020 compared to 5 million in 2019. However this still represents a significant decrease from 8.2 million tons in 2018.

Orvana had total revenue of $ 102 million in the fiscal year end September 2020, a significant decrease from $ 136.4 million in 2019. Their mining operations had a loss in each of the past two years. In 2020 they had a net loss of $1.6 million. However this figure is overly positive, as it reflects a $ 12.2 million deferred tax credit. Their net operating loss was $13.7 million in 2020, a significant deterioration from a $7 million loss in 2019.

Orvana Minerals – Royalty and Streaming Agreements

The Orovalle property has a net smelter royalty of 2.5%, which increases to 3% if gold prices are above $1,100 per ounce.

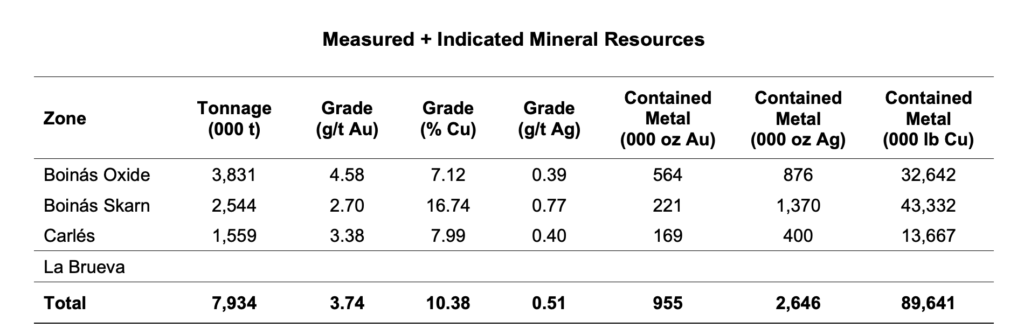

Orvana Minerals – Mineral Resources

The company’s Orovalle property has proven and probable reserves of 307 thousand ounces of gold, 756 thousand ounces of silver, and 27.6 million pounds of copper. Measured and indicated resources total 955 thousand ounces of gold, 2.6 million ounces of silver, and 89.6 million pounds of copper.

Balance Sheet Analysis

Orvana has a weak balance sheet. Several of their key assets are showing signs of impairment, including a property in care and maintenance. They are leveraged, with debt outstanding and a weak liquidity position.

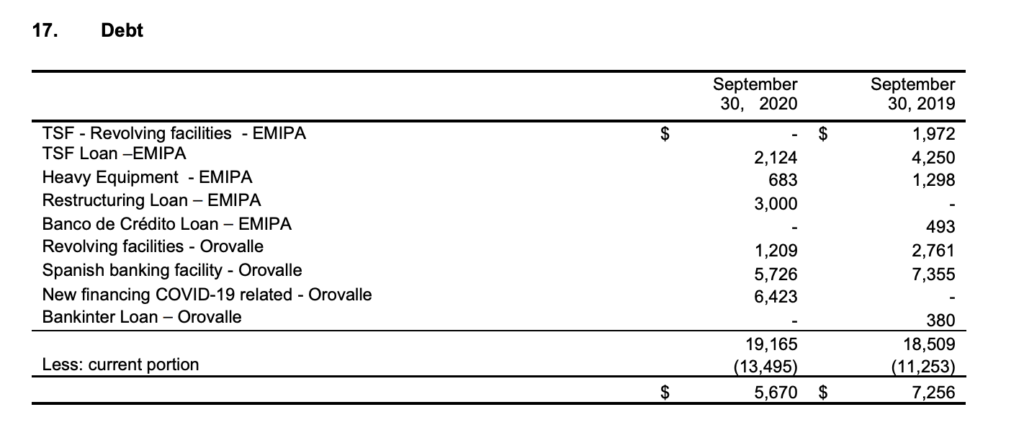

Orvana Minerals – Debt Analysis

As of the fiscal year end September 30, 2020 the company has $19.2 million in total debt outstanding, $13.5 million of which is classified as current.

Orvana Minerals Stock – Share Dynamics and Capital Structure

As of September 2020 the company has 136.6 million common shares outstanding. 52% of the company’s outstanding shares are owned by Fabulosa Mines. Orvana has 646,000 options and no warrants outstanding.

Orvana Minerals Stock – Dividends

The company does not currently pay a dividend.

Management – Skin in the game

Insiders at Orvana Minerals have not made any relevant transactions in the company’s stock recently, providing no signal to investors.

Orvana Minerals Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$ 80 million / $71 million = 1.13

A debt to equity ratio of 1.13 indicates that Orvana uses a mix of debt and equity in its capital structure, but relies slightly more on debt financing to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

$ 37 million / $48.1 million = .77

A working capital ratio of .77 indicates a weak liquidity position. Orvana may have problems meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

$ 0.28 / $ 0.52 = .54

Orvana has a book value per share of $ 0.52. At the current market price this implies a price to book ratio of .54, meaning Orvana Minerals stock currently trades at a significant discount to the book value of the company.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

Orvana Minerals Stock – Summary and Conclusions

Orvana Minerals stock is an intriguing investment opportunity. It is a high risk, high reward play. The company is currently in poor financial health. Liquidity is weak and mining results have deteriorated significantly over the past several years. Their all in sustaining cost per ounce is high relative to other mining companies.

However a rising tide floats all boats. Sustained higher gold and silver prices may make the company’s assets more attractive, and given the company’s low valuation, provide significant leverage to these commodity prices for investors. Additionally their shares are tightly held and their capital structure is not dilutive.

I do not have a sufficient understanding of the geology of the company’s mines to determine if they will or will not be able to recover from their deteriorating results. But based solely on the company’s valuation and mineral resources, it may merit a tail position in my portfolio. I will leave Orvana stock at the top of my watchlist and continue to study the company before taking a position. I will continue to allocate the bulk of my portfolio to more promising long term projects such as Fortuna Silver.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.