Common Stock: Orla Mining (TSX:OLA)

Current Market Price: $3.32 CAD

Market Capitalization: $747.6 million CAD

**Note: All values in this article are expressed in Canadian Dollars (CAD) unless otherwise noted.

Orla Mining Stock – Summary of the Company

Orla Mining is a mineral exploration company focused on the acquisition, exploration and development of gold properties. They have 2 major exploration properties; The Camino Rojo project in Mexico and the Cerro Quema project in Panama. The company was founded in 2007 and is headquartered in Vancouver Canada.

Revenue and Cost Analysis

Orla does not have any properties which are currently producing and therefore does not have any revenue. The company has consistently run a net loss and will continue to do so until the Camino Rojo mine is built.

In 2019, the company had a net loss of $29.3 million, on par with 2018’s net loss of $29.9 million. Their largest expenses are exploration and drilling related. These expenses totaled $19.8 million in 2019 and $22.8 million in 2018.

Orla Mining – Royalty and Streaming Agreements

Newmont owns a 2% net smelter royalty on all mineral production at the Camino Rojo property.

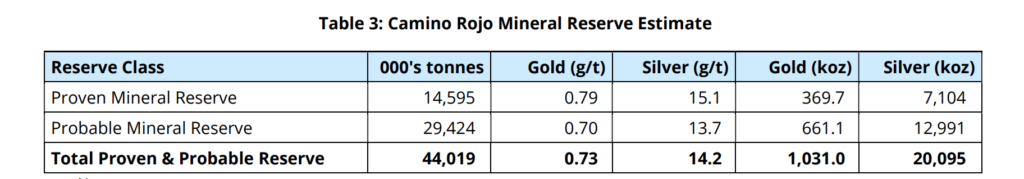

Orla Mining – Mineral Resources

The most recent mineral reserve estimate for the Camino Rojo projects estimates proven and probable reserves of 1.03 million ounces of gold and 20.1 million ounces of silver. The Cerro Quema Project has proven and probable reserves totaling 488 thousand ounces of gold.

Balance Sheet Analysis

Orla has a solid balance sheet with sufficient liquidity and manageable liability levels.

At the end of 2019 Orla had current assets totaling $30.2 million, made up almost entirely of cash. Current liabilities totaled $3 million.

The company has one major long term asset, an exploration and evaluation assets. At the end of 2019 this asset was valued at $163.3 million. Total assets were $196.3 million and total liabilities were $33.6 million.

Orla Mining – Debt Analysis

In December 2019, the company entered into a credit facility to start construction of the Camino Rojo Mine. The loan is valued at USD 125 million and carries an interest rate of 8.8% annually. Payments are made quarterly and the loan matures in December 2024.

Orla Mining Stock – Share Dynamics and Capital Structure

As of year-end 2019 the company had 187.1 million common shares outstanding. In addition, they had 9.8 million options, 50.7 million warrants, and 3 million share based units outstanding. Fully diluted shares outstanding is around 250.7 million shares.

Orla has an unfavorable capital structure with senior debt and significant dilutive instruments outstanding. Investors should carefully consider their place in the capital structure before investing.

Orla Mining Stock – Dividends

The company does not currently pay a dividend and is unlikely to do so in the near future.

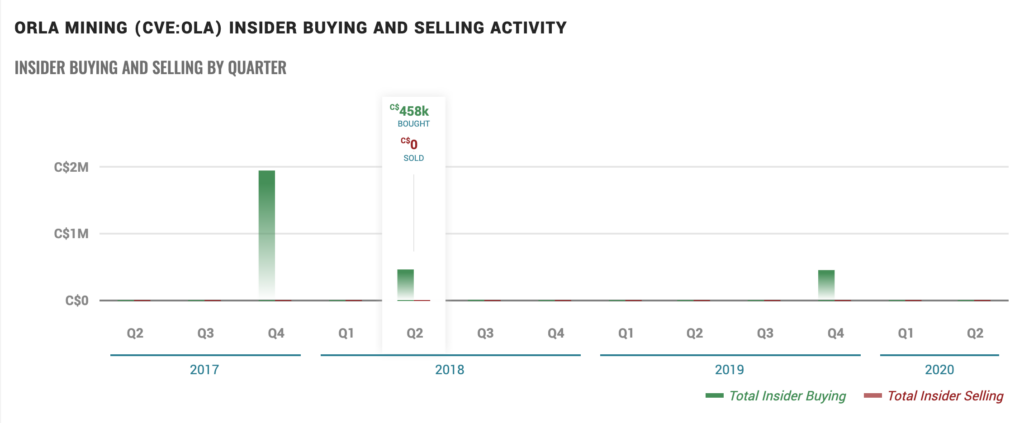

Management – Skin in the game

Insiders at Orla Mining have not purchased or sold relevant amounts of the stock recently, providing no signal for investors.

Orla Mining Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$33.6 million/$162.7 million = .2

A debt to equity ratio of .2 means Orla has some debt in its capital structure, but has relied mostly on equity financing to fund itself. This ratio is likely to increase as the company draws down on its new credit facility to build the Camino Rojo mine.

Price to Book Ratio

Current Share Price/Book Value per Share.

$3.32/$.65 = 5.1

Based on fully diluted shares outstanding, Orla has a book value per share of $.65. At the current market price this implies a price to book ratio of 5.1, meaning the company’s stock trades at a significant premium to the book value of the company.

Working Capital Ratio

Current Assets/Current Liabilities

$30.2 million/$3 million = 10

A working capital ratio of 10 indicates a strong liquidity position. Oral should not have problems meeting its near-term obligations.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

Orla Mining Stock – Summary and Conclusions

The company has made a significant discovery at their Camino Rojo property and managed to finance the construction of a mine with a debt facility. They are currently in the process of constructing the mine. Investors in Orla stock have limited exploration risk, but face risks such as financing, dilution, and valuation risk.

The company appears to have adequate liquidity and financing for the short to medium term. But should they incur unexpected construction costs and need to raise additional capital, this would be detrimental to existing shareholders, as the capital structure is already unfavorable and dilutive.

The Comino Rojo mine is certainty a high potential property. However, the current valuation is a little too high for me, based on the jurisdictional, financing, and construction risks involved. I will continue to monitor the project and reconsider investing should the price drop or should there be significant positive advancements in the project.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.