Common Stock: Minera SIMSA (MOROCOC1)

Current Market Price: $0.85 PEN

Market Capitalization: $78 Million PEN

*Note: All values in this article are expressed in Peruvian Soles (PEN) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Minera SIMSA Stock – Summary of the Company

SIMSA is a Peruvian mining company focused on the acquisition, exploration, development, and operation of zinc and lead properties in Peru. The company owns and operates two mines in Peru. SIMSA was founded in 1942 and is headquartered in Lima, Peru.

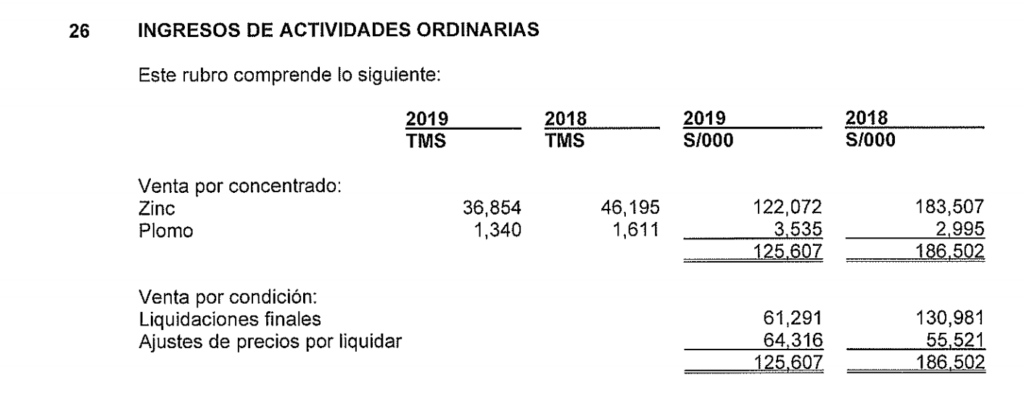

Revenue and Cost Analysis

SIMSA has total revenue of $125.6 million in 2019, a significant decrease compared to $186.5 million in 2018. Their COGS was $109 million in 2019, representing a gross margin of 13%, a significant deterioration compared to 35% the previous year. Almost all of the company’s revenue comes from zinc, with the small remainder coming from lead.

This deterioration in the company’s gross margin caused SIMSA to have a net loss of $22.4 million in 2019, compared to a profit of $20.5 million in 2018.

Balance Sheet Analysis

SIMSA has a weak balance sheet. Their liquidity position is poor and they have significant liabilities, including debt.

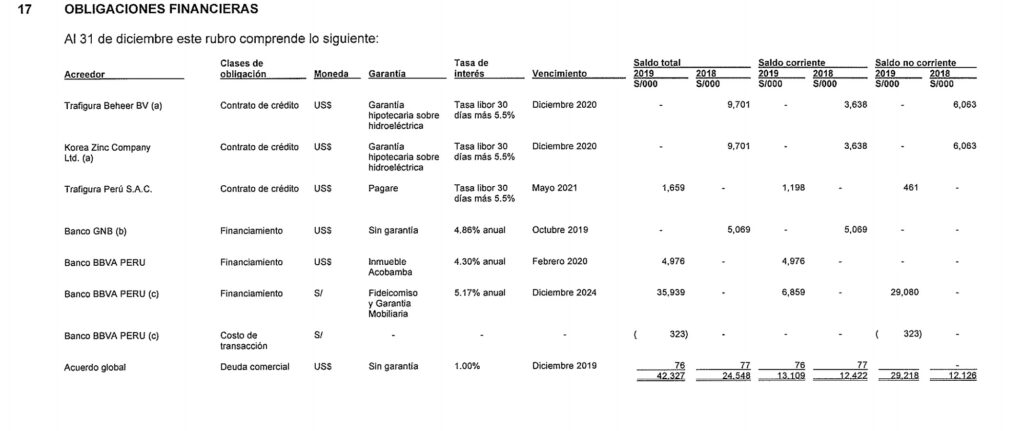

Minera SIMSA – Debt Analysis

As of year-end 2019 the company has $42.3 million in total debt outstanding, $13.1 million of which is classified as current. A portion of this debt is denominated in US Dollars.

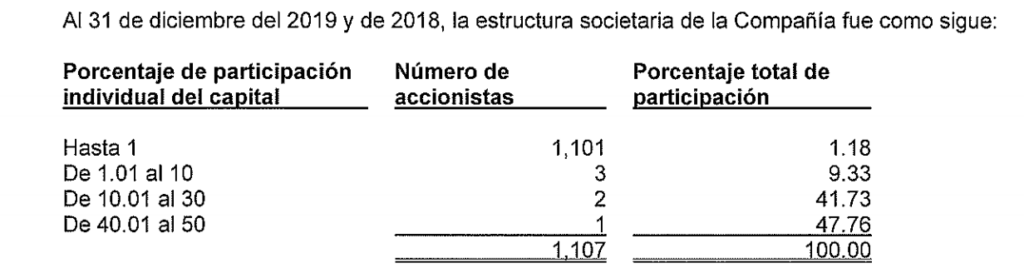

Minera SIMSA Stock – Share Dynamics and Capital Structure

As of year-end 2019 the company has 91.7 million common shares outstanding. They have three shareholders with an ownership position larger than 10%.

Minera SIMSA Stock – Dividends

The company did not pay a dividend in 2019.

Minera SIMSA Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$198.5 million / $197.4million = 1

A debt to equity ratio of 1 indicates that SIMSA uses equal parts debt and equity in its capital structure and is not overly reliant on either form of financing.

Working Capital Ratio

Current Assets/Current Liabilities

$43.4 million / $84.3million = .51

A working capital ratio of .51 indicates a weak liquidity position. SIMSA may have problems meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

$0.85 / $2.15 = .4

SIMSA has a book value per share of $2.15. At the current market price this implies a price to book ratio of .4, meaning SIMSA stock currently trades at a significant discount to the book value of the company.

Minera SIMSA Stock – Summary and Conclusions

SIMSA owns two decent zinc properties in Peru. However the company is in poor financial health. Their operating results deteriorated significantly in 2019 and the company had a large net loss. Additionally their liquidity position is very weak.

I’m not interested in investing in zinc companies at this time, particularly ones facing financial difficulties like SIMSA. I would prefer to allocate to precious metals miners, such as Fortuna Silver.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.