Common Stock: Marcopolo (POMO3)

Current Market Price: R$ 2.42

Market Capitalization: R$ 2.3 billion

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Marcopolo Stock – Summary of the Company

Marcopolo is a Brazilian bus manufacturer that produces and sells busses, bus bodies, and bus components. They have 15 manufacturing plants worldwide, 5 of which are in Brazil. Their international factories are located in China, India, Colombia, Mexico, Argentina, South Africa, and Australia. Marcopolo dominates the Brazilian market with a market share of 49.8% of bus sales in 2019. The company was founded in 1949 and is headquartered in the state of Rio Grande do Sul, Brazil. They employee around 17,300 people globally.

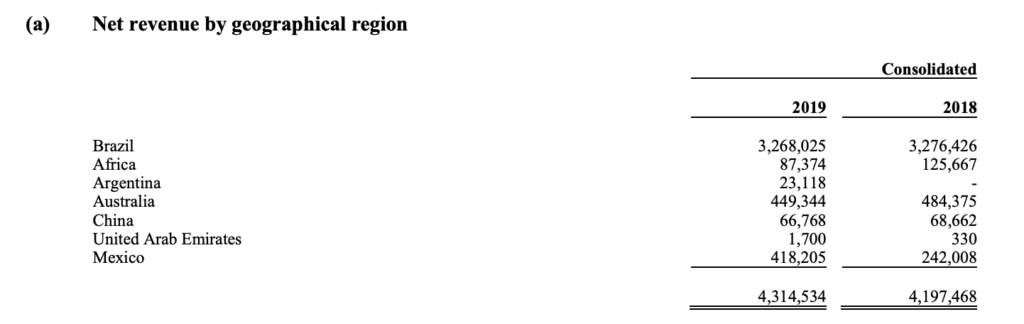

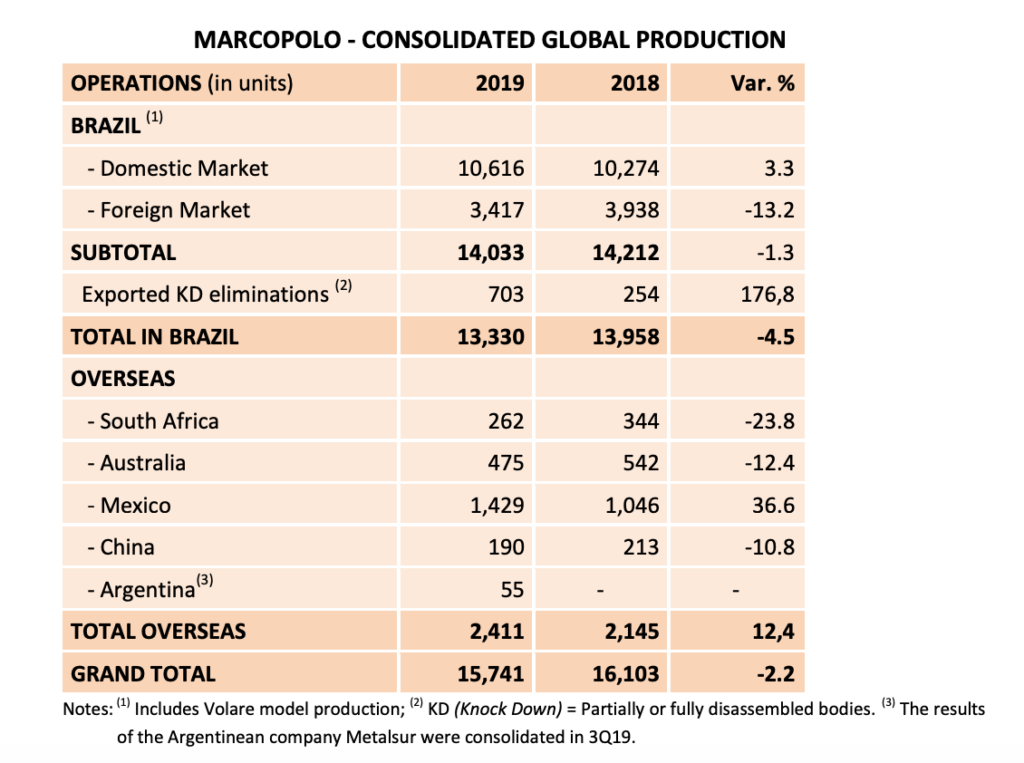

Revenue and Cost Analysis

In 2019 Marcopolo produced a total of 15,741 busses globally. Total revenue was R$ 4.3 billion, a slight increase from R$ 4.2 billion in 2018. Their COGS in 2019 was R$ 3.6 billion, representing a gross margin of 15%. The company’s gross margin has remained stable in the 14%-16% range for the past 3 years.

Marcopolo is a profitable business and has had relevant net income for the past 3 years. The company had net income of R$ 212 million in 2019, representing a profit margin of 5%. This is a significant improvement compared to net income of R$ 191 million and R$ 82.1 million in 2018 and 2017 respectively.

Balance Sheet Analysis

The company has a decent, but not strong balance sheet. They have a solid base of long term assets and their liquidity position is sufficient in the near term. However they are leveraged and have a significant amount of debt outstanding.

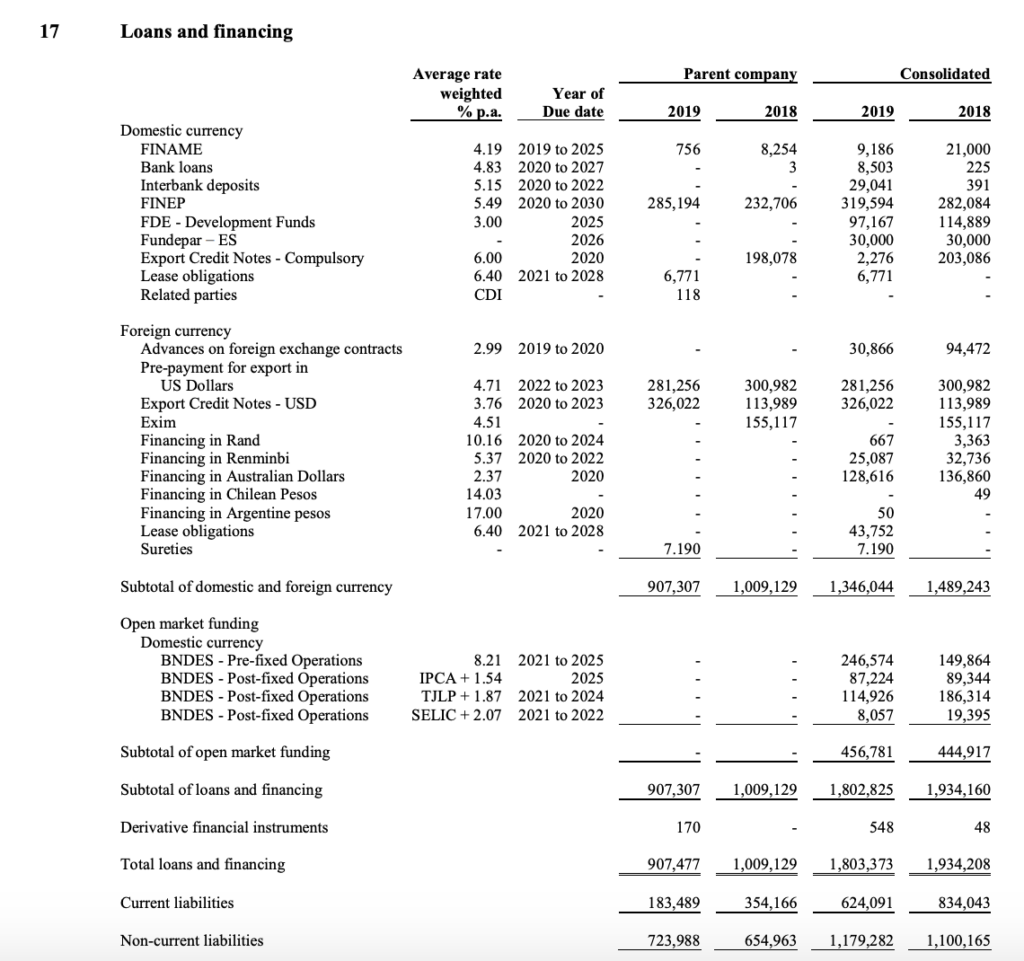

Marcopolo – Debt Analysis

As of year-end 2019 the company has R$ 1.8 billion in total debt outstanding, R$ 624 million of which is classified as current. A relevant portion of this debt is denominated in foreign currency, mainly the US dollar, exposing Marcopolo to the negative effects of a depreciating Brazilian Real.

It is worth noting that the company’s consolidated debt position includes Banco Moneo, the company’s financing division. Investors should break out Banco Moneo’s finances and analyze them separately.

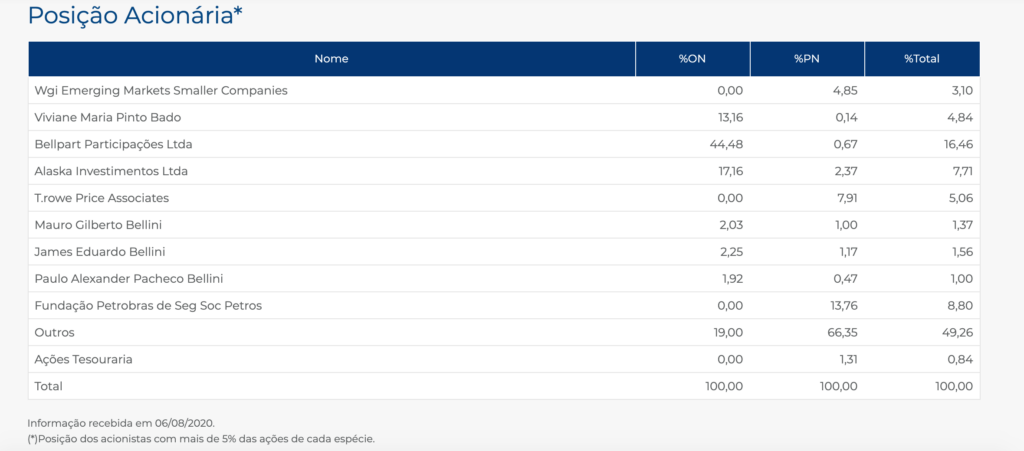

Marcopolo Stock – Share Dynamics and Capital Structure

As of year-end 2019 Marcopolo has 341.6 million common shares outstanding and 605.2 million preferred shares outstanding. Total shares outstanding is around 946.9 million shares. Insiders and several institutional investors own around 51% of the company’s shares, with the remaining 49% being held by shareholders with an ownership position of less than 5%.

Marcopolo Stock – Dividends

Based on 2019’s results, Marcopolo paid total dividends of R$ 0.073 cents per common share. At the current market price this implies a dividend yield of 3%.

Marcopolo Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 2.8 billion / R$ 2.3 billion = 1.2

A working capital ratio of 1.2 indicates that Marcopolo uses a mix of debt and equity in its capital structure, but has a leveraged balance sheet and relies more heavily on debt financing.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 2.8 billion / R$ 1.5 billion = 1.8

A working capital ratio of 1.8 indicates a sufficient but not strong liquidity position. Marcopolo should not have problems meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

R$ 2.42 / R$ 2.49 = .97

Based on total shares outstanding (common + preferred) Marcopolo has a book value per share of R$ 2.49. At the current market price this implies a price to book ratio of .97, meaning the company’s stock currently trades at a slight discount to the book value of the company.

Marcopolo Stock – Summary and Conclusions

Marcopolo is an impressive company. They have been able to grow internationally while at the same time dominating the Brazilian market. Their financial position is fairly healthy. They run their operation profitably, and have sufficient liquidity in the near term. Management has returned capital to shareholders via a divided.

However, the company is leveraged and does have a significant amount of debt outstanding, including US dollar denominated debt. This risk is somewhat hedged due to the company having some receivables in foreign currency, but I still don’t like their exposure to the US dollar carry trade.

I like Marcopolo’s business, but I don’t think this is the right time to invest in Marcopolo stock. The company’s business is likely to suffer due to the lingering effects of the coronavirus crisis. I will wait to see their 2020 financials and see how their financial position has evolved. I will be particularly focused on their debt position. I will be comparing their 2020 results to other Brazilian manufacturers in a similar industry, such as Iochpe-Maxion.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.