Preferred Stock: Mangels (MGEL4)

Current Market Price: R$ 5.55

Market Capitalization: R$ 32 million

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Mangels Stock – Summary of the Company

Mangels is a Brazilian aluminum products manufacturing company. Their main focus is the automotive industry, including the light vehicle, bus, truck, and motor cycle segments. Their main product is an aluminum wheel. They also produce a kitchen gas canister commonly used in Brazil. The company declared bankruptcy in 2014 and finished the process in 2017. Mangels was founded in 1928 and is headquarters in Sao Bernardo do Campo, Brazil.

Revenue and Cost Analysis

Mangels has grown is revenues significantly over the past several years, increasing it from R$ 446 million in 2017, to R$ 476.7 million in 2018, and R$ 556.3 million in 2019. The company had COGS of R$ 462.7 million in 2019, representing a gross margin of 17%. Mangels has also improved its gross margins significantly over the past several years, increasing from 13% and 14% in 2017 and 2018 respectively.

Although Mangels has been improving its revenues and margins, the company has not been profitable since it completed bankruptcy proceedings in 2017. The company had a net loss of R$ 6.5 million in 2019. This represents an improvement over net losses of R$ 24.3 million and R$ 46.4 million in 2017 and 2018 respectively.

As of year-end 2019 the company has two major clients that each represent 11% of total revenue.

Balance Sheet Analysis

Mangels has a weak balance sheet. Liquidity is sufficient in the short to medium term. However the company has significant debt outstanding, including USD denominated debt. Although the company’s balance sheet has improved significantly post-bankruptcy, it is by no means strong.

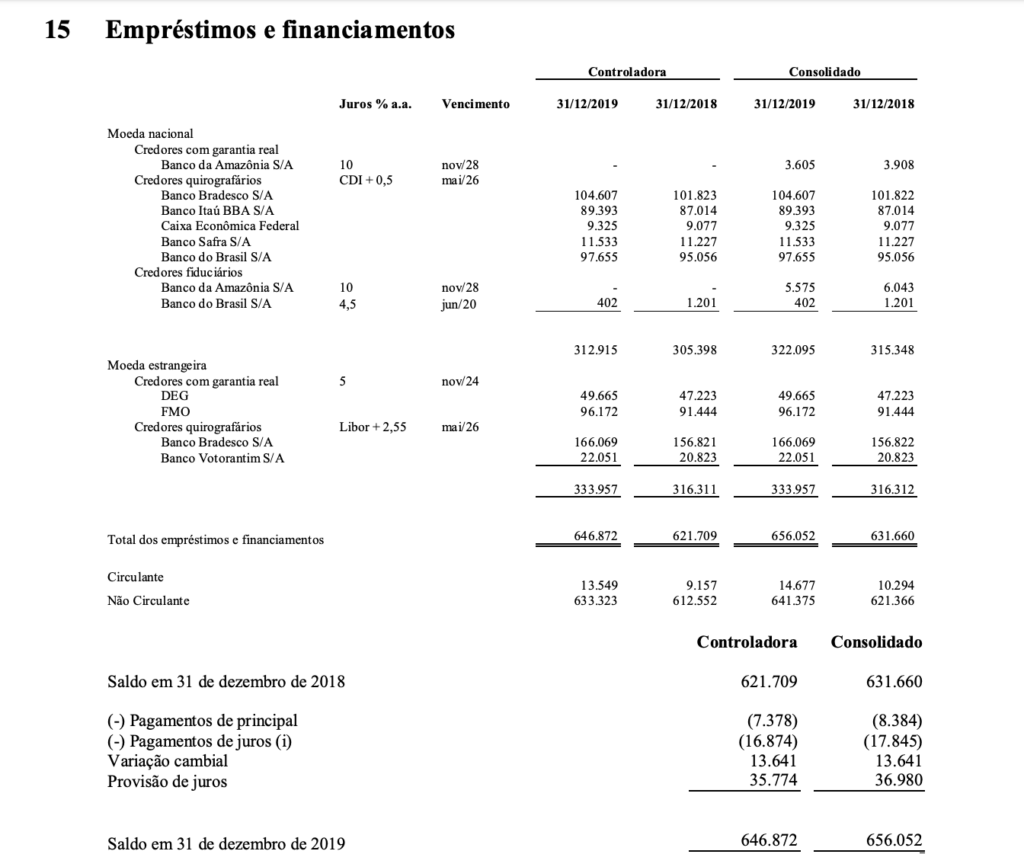

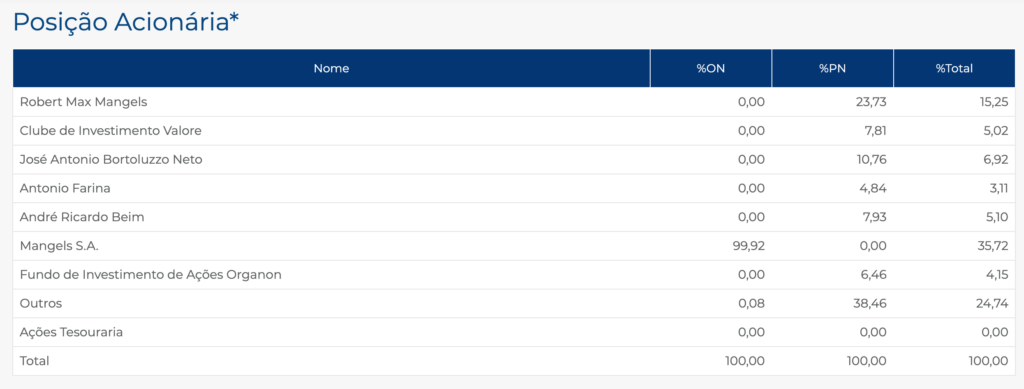

Mangels – Debt Analysis

Mangels has a significant amount of debt outstanding. As of year-end 2019 the company has R$ 656 million in total debt outstanding, of which R$ 14.6 million is classified as current. Furthermore, the company is heavily exposed to foreign currency fluctuations via its US Dollar denominated debt. R$ 334 million of the company’s debt is denominated in foreign currency. The negative effects of a depreciating Brazilian Real are likely to be a drag on the company’s performance moving forward.

Mangels Stock – Share Dynamics and Capital Structure

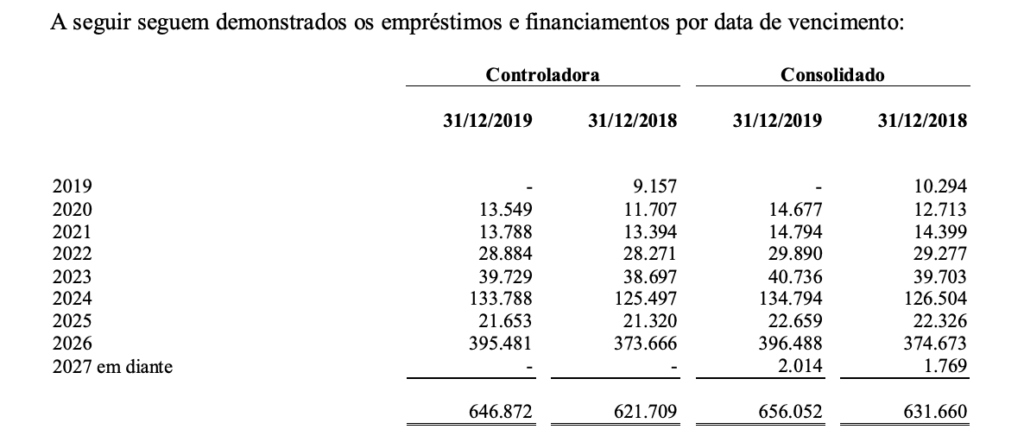

As of year-end 2019 the company has 2 million common shares outstanding and 3.7 million preferred shares outstanding. Total shares outstanding is around 5.7 million shares. Mangels has several significant shareholders associated with the founding family. Around 39% of the company’s shares are owned by small shareholders with less than 5% ownership.

Mangles Stock – Dividends

The company did not pay a dividend in 2019.

Mangels Stock – 2 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 737.3 million / -R$ 370.6 million = -1.98

A debt to equity ratio of negative 1.98 indicates that Mangels has accumulated losses and has significantly more liabilities than shareholder equity. The company faces the possibility of insolvency and investors should carefully analyze the company’s liabilities before investing.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 209.5 million / R$ 68.6 million = 3.05

A working capital ratio of 3.05 indicates a sound liquidity position. Mangels should not have problems meeting its near term obligations. However the company has significant long term debts and investors should consider the schedule of these debts and how the company’s liquidity will be affected moving forward.

Mangels Stock – Summary and Conclusions

Mangels is a decent company with a long history. The company completed bankruptcy proceedings in 2017, and has come out the other side in a much healthier position. Sales and margins have been improving, but the company remains unprofitable.

Most concerning is the company’s long term debt, particularly the debt denominated in foreign currency. I have seen many Brazilian company’s get crushed by this carry trade, and given the amount of long term debt Mangels owes, I am not willing to invest in Mangels stock. If I were going to allocate to a Brazilian manufacturer, I would prefer a less leveraged company, such as Dohler.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.