Common Stock: Leche Gloria (Glorial1)

Current Market Price: $6.90 PEN

Market Capitalization: $2.6 Billion PEN

*All values in this article are expressed in Peruvian Sols (PEN) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent annual financial report(2019). For some reason the 2019 report was not audited, but the 2018 data was. The company’s financial information can be found by following this link.

Leche Gloria Stock – Summary of the Company

Leche Gloria is a Peruvian milk and milk products manufacturer. They have a large product portfolio that includes milks, butters, yogurts, and cheeses, among others. The company operates four plants in Peru and their supply chain includes over 19,000 Peruvian milk producers. Leche Gloria was founded in 1941 and is headquartered in Lima, Peru.

Revenue and Cost Analysis

In 2019 Leche Gloria had revenues of $3.4 billion, a slight decrease compared to $3.5 billion in 2018. Their COGS was $2.8 billion, representing a gross margin of 18.6%, also a slight decrease compared to 19.7% in 2018.

The company was profitable in each of the last two years. In 2019 Leche Gloria had net income of $146.5 million, representing a profit margin of 4.2%, on par with their profit margin of 4.5% in 2018.

Balance Sheet Analysis

Leche Gloria has a decent balance sheet. They have a solid base of long term assets and sufficient liquidity in the near term. However they are slightly leveraged and have relevant amounts of debt outstanding.

Leche Gloria – Debt Analysis

As of year-end 2019 the company has $915.6 million in total debt outstanding, $110 million of which is classified as current.

Leche Gloria Stock – Share Dynamics and Capital Structure

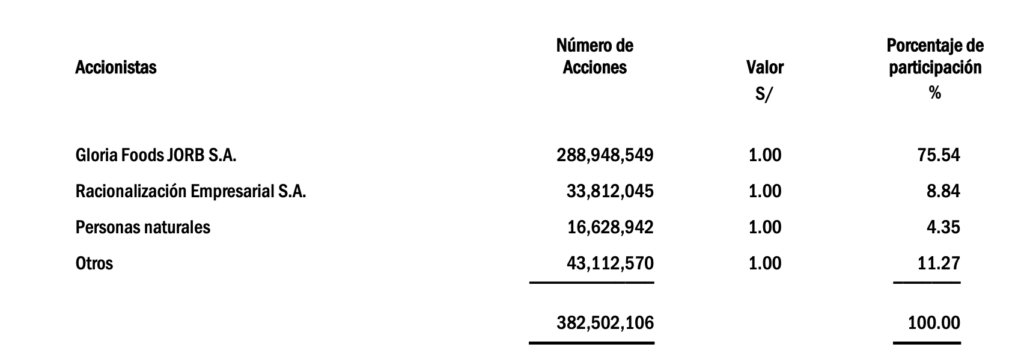

As of year-end 2019 the company has 382.5 million common shares outstanding. Leche Gloria is a subsidiary of Gloria Foods, which owns 75.5% of the company’s outstanding shares.

Leche Gloria Stock – Dividends

In 2019 the company paid total dividends of $0.355 cents per share. At the current market price this implies a dividend yield of 5.2%.

Leche Gloria Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$1.7 billion / $1.5 billion = 1.1

A debt to equity ratio of 1.1 indicates that Leche Gloria uses a mix of debt and equity in its capital structure, but is slightly leveraged, relying more on debt financing for funding.

Working Capital Ratio

Current Assets/Current Liabilities

$1.3 billion / $806 thousand = 1.6

A working capital ratio of 1.6 indicates a sufficient liquidity position. Leche Gloria should not have problems meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

$6.90 / $ 4.04 = 1.7

Leche Gloria has a book value per share of $4.04. At the current market price this implies a price to book ratio of 1.7, meaning the company’s stock currently trades at a premium to the book value of the company.

Leche Gloria Stock – Summary and Conclusions

Leche Gloria is an interesting company. The have a large presence throughout Peru, a huge supplier network, and a diversified product portfolio. They are in decent financial health with solid gross margins and healthy profits. Their liquidity position is sufficient. Although they are leveraged, it is not excessive.

Unfortunately the company’s 2019 financials were not audited, or at least I couldn’t find the audited version. This is a big red flag and makes their stock uninvestable for the time being. I will check back and review the company’s (hopefully) audited 2020 financials before making any final investment decisions.

Investors can compare Leche Gloria stock to other LATAM food stocks, such are Brazilian meat companies Marfrig or Minerva.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.