Common Stock: Josapar (JOPA3)

Current Market Price: R$ 31.62

Market Capitalization: R$ 334.6 million

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Josapar Stock – Summary of the Company

Josapar is an agriculture and food company that produces and distributes agriculture products as well as produces and sells food products under its own brands. The company’s major products are rice, beans, soy, olive oil, and fertilizer. Their products are sold throughout all of Brazil and exported to over 40 countries. Josapar was founded in 1922 and is headquartered in Porto Alegre, Brazil.

Revenue and Cost Analysis

Josapar has seen its revenue grow slightly over the past several years. In 2017, total revenue was just over R$ 1 billion, which grew to R$ 1.2 billion in 2019. The company’s COGS were R$ 883.7 million in 2019, representing a gross margin of 27.5%, on par with 2018 and 2017’s gross margin of 29%.

The company has been profitable for the last 3 years. In 2019 Josapar had net income of R$ 18.5 million, which represent a profit margin of 1.5%.

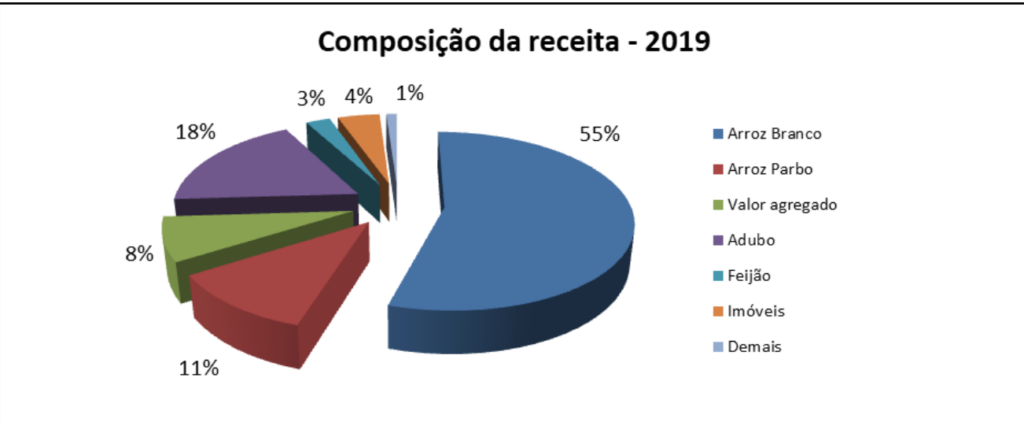

Around 66% of the company’s revenue in 2019 was from rice sales, with the remainder coming from all their other products.

Balance Sheet Analysis

Josapar has a mediocre balance sheet. It has a sound liquidity position, but it also has high liability levels, including debt.

Josapar – Debt Analysis

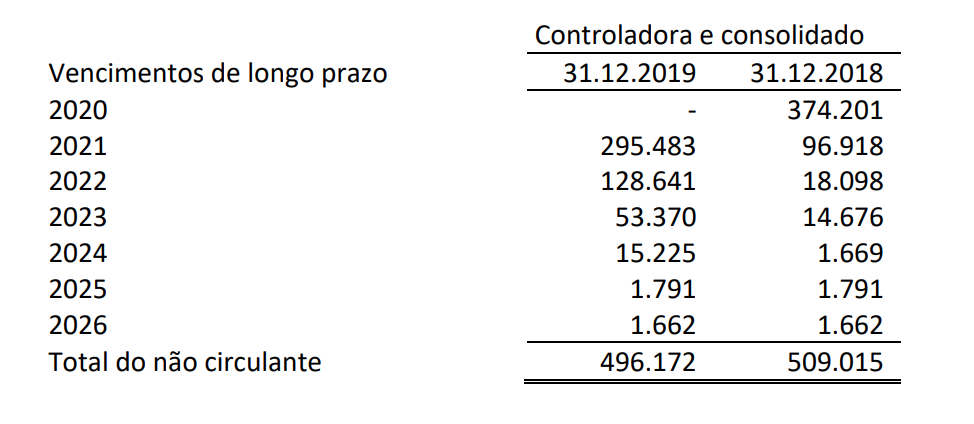

The company has a significant amount of debt. As of year-end 2019 Josapar has R$ 913.5 million in debt outstanding, R$ 416.1 million of which is classified as current. A small portion of their current debt is denominated in foreign currency. This means the depreciation of the Brazilian Real will likely negatively impact the company’s 2020 results.

Josapar Stock – Share Dynamics and Capital Structure

As of year-end 2019 the company has 10.4 million common shares outstanding and 131 thousand preferred share outstanding. Fully diluted shares outstanding is just below 10.6 million shares

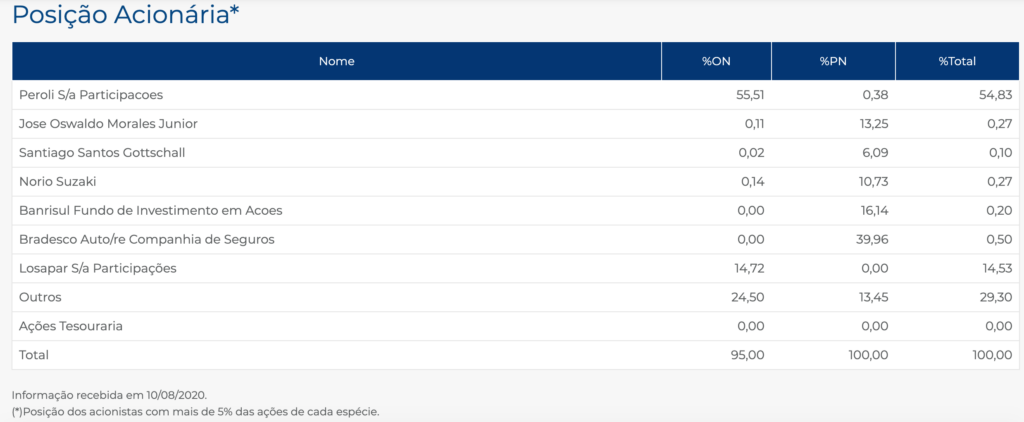

The company has two major shareholder who own 55% and 15% of the common shares respectively. The remainder of the shares are held by smaller investors.

Josapar Stock – Dividends

In 2019, common stock holders received 3 dividend payments totaling R$ .648. At the current market price this implies a dividend yield of 2.1%.

Josapar Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 1.1 billion / R$ 670.2 million = 1.7

A debt to equity ratio of 1.7 indicates that Josapar uses a significant amount of debt in its capital structure, more debt than equity. This leverage increase risks for common stock investors.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 1.1 billion/ R$ 527.5 million = 2.1

A working capital ratio of 2.1 indicates a sound liquidity position. Josapar should not have problems meeting it short term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

R$ 31.62 / R$ 63.34 = .5

Based on total shares outstanding (Common + Preferred) Josapar has a book value per share of R$ 63.34. At the current market price this implies a price to book ratio of .5, meaning the company’s stock trades at a significant discount to the book value of the company.

Brazilian Food and Agriculture Market – Economic Factors and Competitive Landscape

Brazil is an agricultural powerhouse, it ranks 5th in the world in terms of arable land. Agriculture is a large and important industry for the Brazilian economy. Brazil is the world’s largest producer of oranges, sugarcane, and coffee. They also compete globally in the production of soy, meat, and corn. Brazils’ diverse geography allows it to produce a wide variety of crops.

Global food and agricultural is a highly competitive market subject to large swings in global commodity prices. Brazilian agricultural companies will have to compete fiercely on a global stage for exports. However, given the scale of the industry in brazil, I believe it is reasonable to assume that there are many well run, investable agriculture and food companies in Brazil.

Josapar Stock – Summary and Conclusions

Josapar is a good company. They run a sound business selling dietary staples to a large socio-economic demographic. They have been consistently profitable and the stock currently trades at a significant discount to book value. Although Josapar is not going to shoot the lights out, it could potentially be a conservative long term investment.

However, the company has excessive debt, a large portion of which is due in 2020. Due to the company’s debt burden I am not willing to invest in Josapar stock at this time, as it increases risk beyond that which I am willing to bear for a rice and beans company. I will wait to see how the company performed in 2020 and handled its debt. I will be eager to reassess my investment decision in a few months and compare Josapar stock to other Brazilian agriculture companies on my watch list, such as Brasil Agro.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.

One Comment

Comments are closed.