Common Stock: InRetail Group (OTC:INREF)

Current Market Price: $45.00 (USD) $162.00 (PEN)

Market Capitalization: $4.6 billion (USD) $16.6 billion (PEN)

*All values in this article are expressed in Peruvian Soles (PEN) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

InRetail Group Stock – Summary of the Company

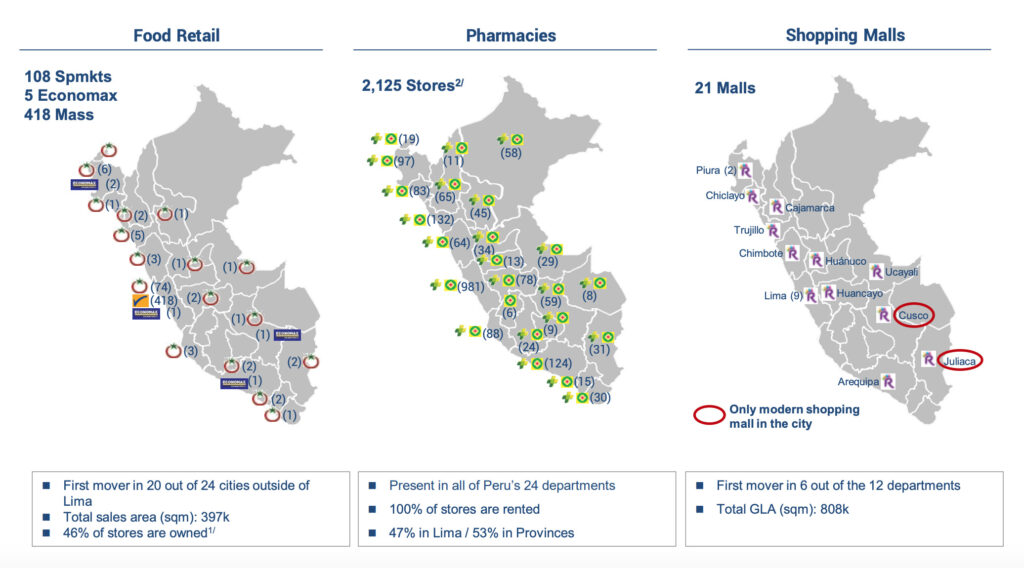

InRetail is a Peruvian multi format retailer. They are the largest retail food chain in Peru, the largest pharmacy chain and distributor in the Andean region, and the largest shopping center operator in Peru. They employ over 38,000 people. InRetail, was founded in 2011 and is headquartered in Lima, Peru.

Their supermarket chain has 531 stores and accounts for around 47% of revenue. Their pharmacy chain has over 2,100 stores and accounts for around 50% of revenue. Their shopping center business has 21 locations and accounts for the remaining 3% of revenue.

Revenue and Cost Analysis

In 2020 InRetail had total revenue of $14.4 billion, a significant increase compared to $13.1 billion in 2019. Their COGS was $10.2 billion in 2020, representing a gross margin of 29%, a slight decrease from 30% in 2019.

The company was profitable in each of the last two years. In 2020 InRetail had net income of $339.4 million, representing a profit margin of 2.4%, a significant decrease compared to 4.6% in 2019.

InRetail Group – Acquisitions

“In December 2020 InRetail Perú acquired through Supermercados Peruanos S.A. andInRetail Foods S.A.C. 100 percent of the capital stock of Makro Supermayorista S.A. for anamount of US$359,619,000, equivalent to S/1,300,743,000. Established in 2008, MakroSupermayorista S.A. is the leading cash and carry operator in Perú, supplying consumer goodsmainly to professional customers. Makro operates 16 stores in Lima and Provinces. The acquisition was financed through a bridge loan.”

Balance Sheet Analysis

InRetail has a weak balance sheet. The company is highly leveraged with poor liquidity and high levels of debt.

It is worth noting the company uses derivatives to hedge its interest rate exposure. Investors should analyze this derivatives book in detail before investing.

InRetail Group – Debt Analysis

As of year-end 2020 the company has $7 billion in total debt outstanding, $1.8 billion of which is classified as current. A significant portion of this debt is denominated in US Dollars, potentially exposing the company to a depreciating Peruvian currency.

InRetail Group Stock – Share Dynamics and Capital Structure

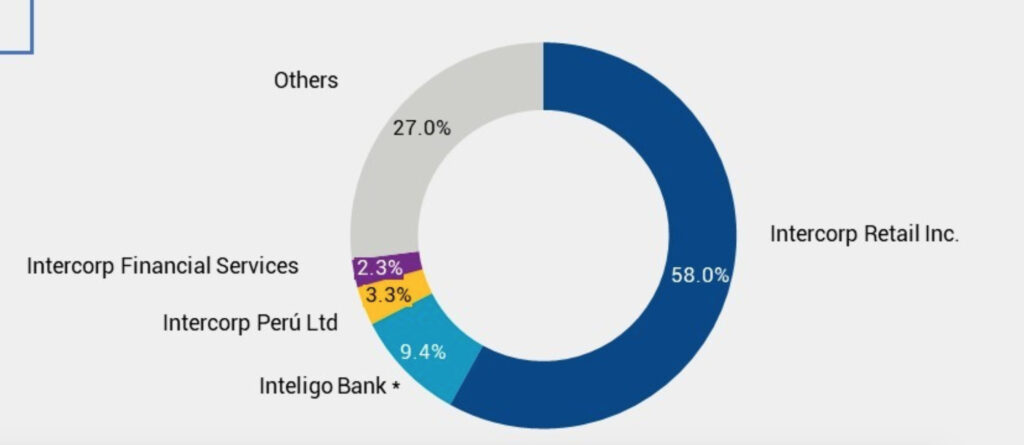

As of year-end 2020 the company has 102.8 million common shares outstanding. The Peruvian company Intercorp group owns around 63.5% of the company.

InRetail Group Stock – Dividends

In 2020 InRetail paid total dividends of $0.56 USD per share. At the current market price this implies a dividend yield of 1.3%.

InRetail Group Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$13.5 Billion / $4.7 Billion = 2.9

A debt to equity ratio of 2.9 indicates that InRetail is leveraged and relies heavily on debt financing to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

$4.3 Billion / $6.1 Billion = .71

A working capital ratio of .71 indicates a weak liquidity position. InRetail may have problems meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

$162.00 / $45.85 = 3.5

InRetail has a book value per share of $45.85 PEN. At the current market price (converted to PEN), this implies a price to book ratio of 3.5, meaning InRetail stock currently trades at a premium to the book value of the company.

InRetail Group Stock – Summary and Conclusions

InRetail Group is an impressive company. They are growing quickly and already have a scale and diversity to their business that positions them well to capture the future growth of Peru and the Andean region.

Although I like their business, the company is in a weak financial position. They are highly leveraged and exposed to the US Dollar carry trade. Due to their financial position, I am not willing to invest in InRetail stock currently, but will certainly leave the company at the top of my watch list, and reconsider should their financial health improve.

Investors can compare InRetail stock to Brazilian pharmacy chain and distributor, Group Dimed.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.