Common Stock: Grazziotin (CGRA3)

Current Market Price: R$ 28.46

Market Capitalization: R$ 566 million

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Grazziotin Stock – Summary of the Company

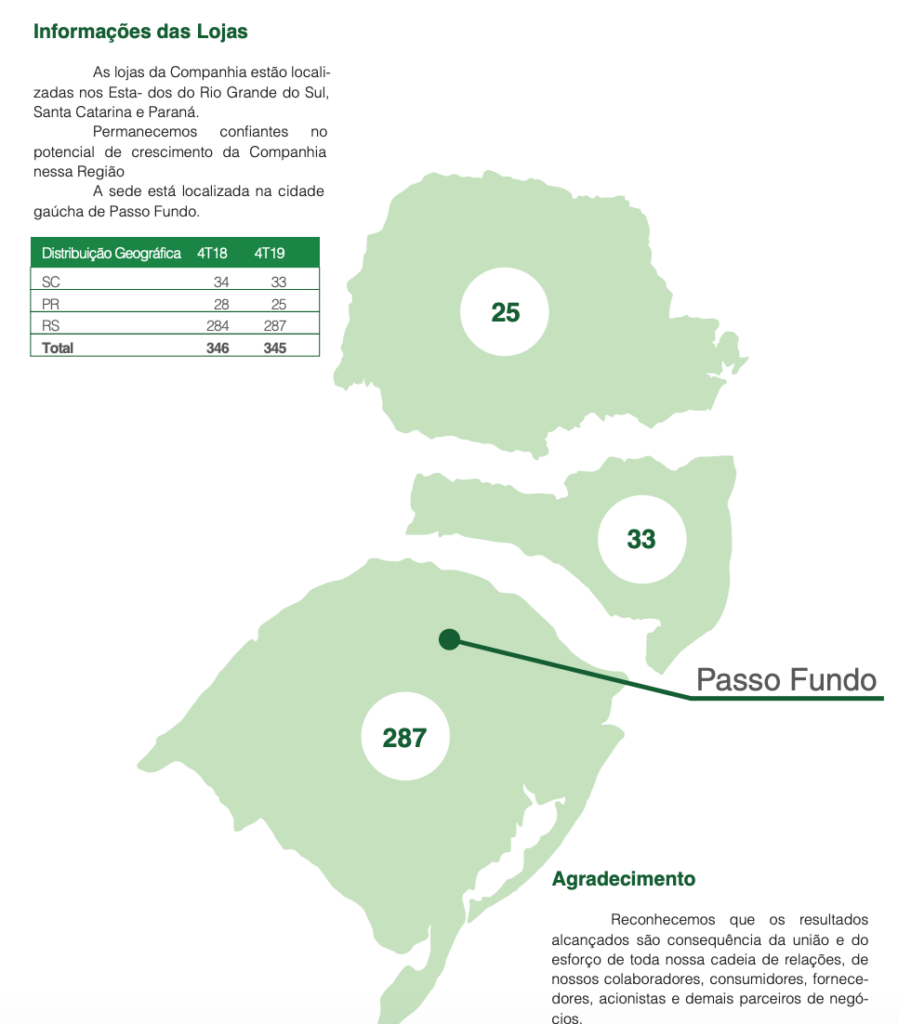

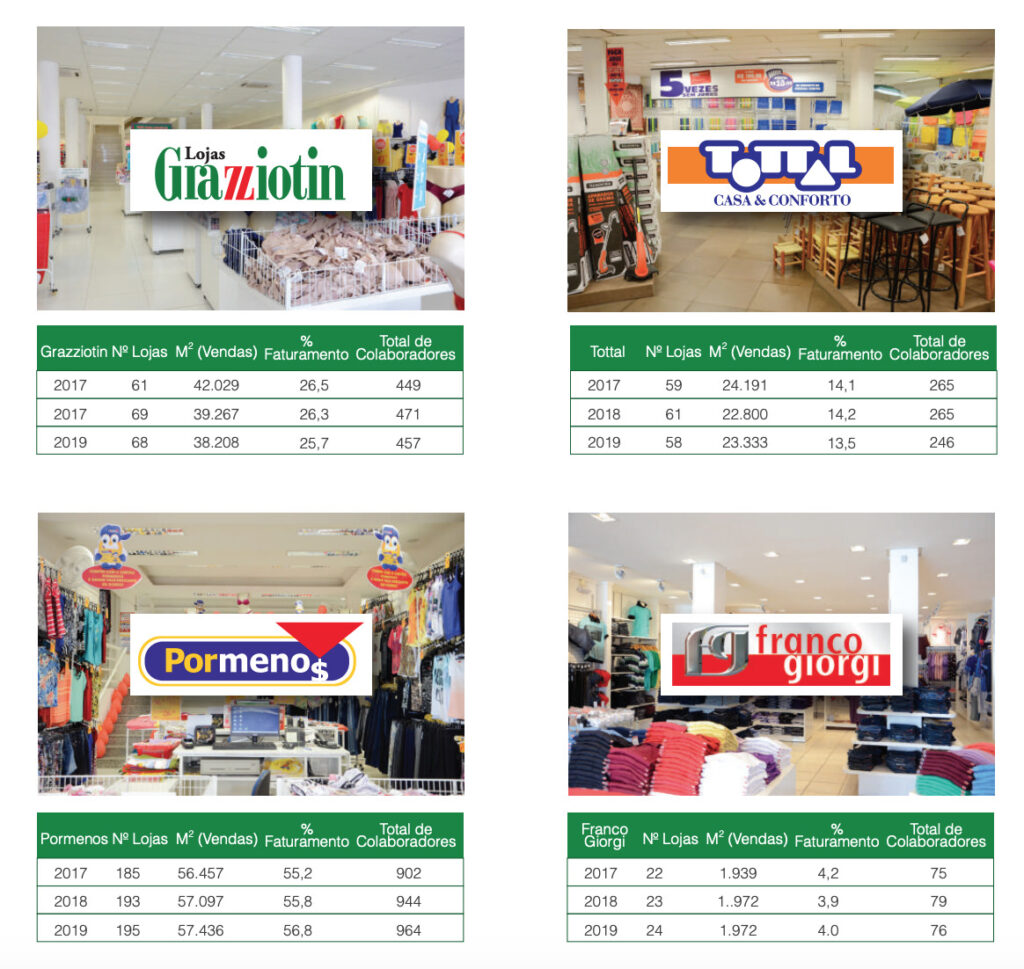

Grazziotin is a Brazilian retailer that sells clothing and homewares under several different brand names. The company operates 345 stores in the south of Brazil, in the states of Rio Grande do Sul, Parana, and Santa Catarina. Grazziotin was founded in 1950 and is headquartered in the state of Rio Grande do Sul, Brazil.

Revenue and Cost Analysis

Grazziotin has steadily increased its sales over the past several years. Total revenue increased from R$ 428.2 million in 2017, to R$ 463.1 million in 2018, increasing again to R$ 480.4 million in 2019. In 2019 the company had COGS of R$ 224 million, representing a gross margin of 53%, on par with their gross margins for both 2017 and 2018.

The company has been profitable in each of the last three years. In 2019 Grazziotin had net income of 129.5 million, representing a profit margin of 27%. This is a significant increase over net income of R$ 61.4 million and R$ 53.7 million in 2017 and 2018 respectively. This increase is due largely to an increase in financial revenue as well as a one-time tax credit recognition. 2018 and 2017 are more typical years in terms of the company’s earnings potential moving forward.

Balance Sheet Analysis

Grazziotin has a sound balance sheet. They have a solid liquidity position and a good base of long term assets. Liability levels are reasonable.

Grazziotin – Debt Analysis

As of year-end 2019 Grazziotin does not have any debt outstanding.

Grazziotin Stock – Share Dynamics and Capital Structure

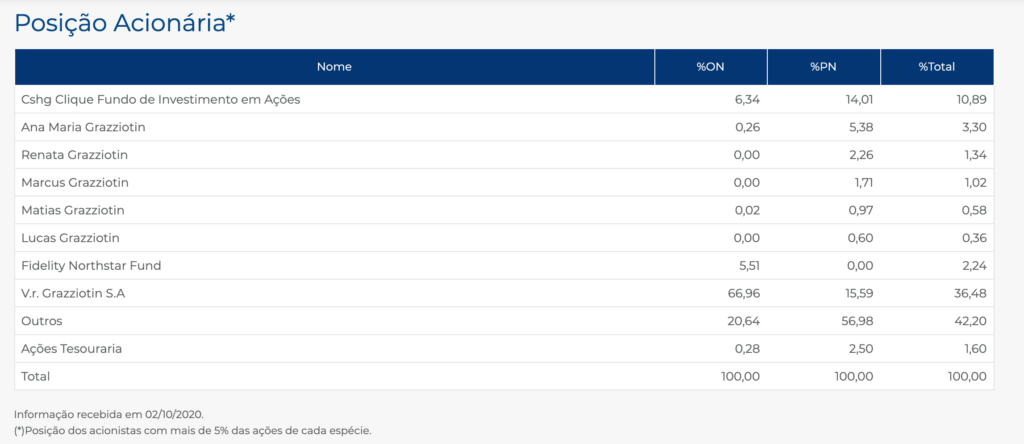

As of year-end 2019 Grazziotin has 8.1 million common shares outstanding and 12 million preferred shares outstanding. Total shares outstanding is around 20.1 million.

Members of the Grazziotin family still own a significant stake in the company. One investment fund owns around 11% of the shares. Around 42% of the company is owned by other shareholders with a stake of less than 5%.

Grazziotin Stock – Dividends

Based on 2019 results, Grazziotin paid shareholders a dividend of R$. 445 cents per share. At the current market price this represents a dividend yield on the company’s common stock of 1.6%.

Grazziotin Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$278.5 million / R$ 586 million = .48

A debt to equity ratio of .48 indicates that Grazziotin uses a mix of debt and equity in its capital structure, but relies more heavily on equity financing to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 370 million / R$ 179 million = 2.06

A working capital ratio of 2.06 indicates a sound liquidity position. Grazziotin should not have problems meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

R$ 28.46/ R$ 29.15 = .98

Based on total shares outstanding Grazziotin has a book value per share of R$ 29.15. At the current market price this implies a price to book ratio of .98, meaning Grazziotin stock currently trades at a slight discount to the book value of the company.

Grazziotin Stock – Summary and Conclusions

Grazziotin is clearly a very well-run company. They have been growing revenue while remaining profitable for several years. Their balance sheet is clean with solid liquidity and manageable liability levels, including no debt. The stock appears to be reasonably valued, trading around book value, and management returns capital to shareholders via a dividend.

Although I like Grazziotin as a company, I am not sure how I feel about investing in brick and mortar retail on a long term (5+ year) investment horizon. I am not going to take a position in Grazziotin stock yet. I will put the company at the top of my watch list, as it is one of the better Brazilian companies I have looked at thus far from a financial perspective. I will reconsider my investment decision based on 2020 results, which I will compare to other retailers in Southern Brazil, such as Grupo Dimed.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.

One Comment

Comments are closed.