Common Stock: Fertilizantes Heringer (FHER3)

Current Market Price: R$ 2.68

Market Capitalization: R$ 144.3 million

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Fertilizantes Heringer Stock – Summary of the Company

Fertilizantes Heringer is a Brazilian fertilizer manufacturer. Their core business is the acquisition of fertilizer inputs, mostly from international markets, and the processing and sale of these inputs for the Brazilian market. The company filed for bankruptcy protection in 2019 and the process was completed in early 2020. Fertilizantes Heringer was founded in 1968 and is headquarters in the state of Sao Paulo Brazil. They have around 1,000 employees.

Revenue and Cost Analysis

Heringer has seen their revenue decline significantly over the past several years. In 2017 the company had revenues of R$ 4.8 billion, declining to R$ 3.7 billion in 2018, and declining further to R$ 1.1 billion in 2019. The company did not have an operating profit in either 2018 or 2019.

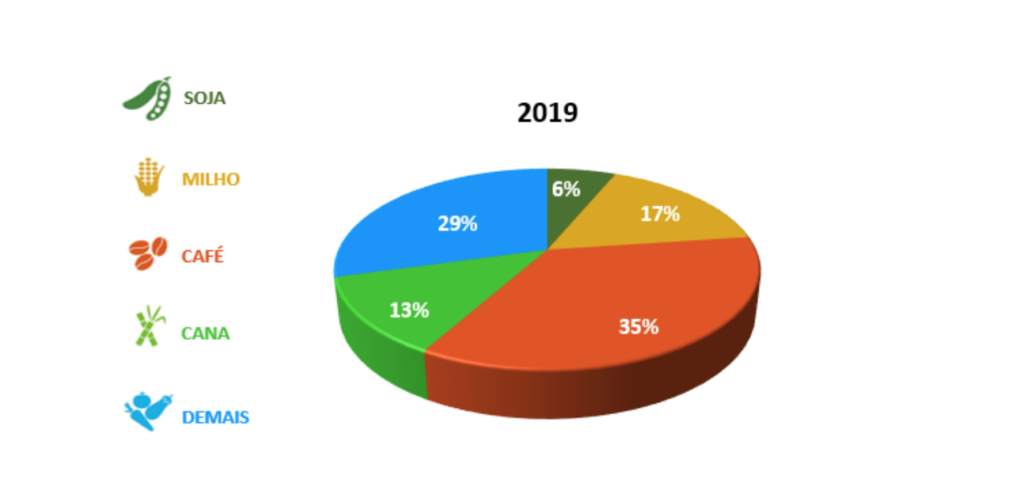

The company’s most important crop markets are coffee, corn, and sugarcane, which accounted for 35%, 17%, and 13% of revenue in 2019 respectively.

Balance Sheet Analysis

The company’s balance sheet improved significantly in 2019 due to restructuring as a result of bankruptcy proceedings. However the company is still in poor financial health. Their liquidity position is sufficient but not strong. They have significant liabilities, including debt, and their assets have been decreasing for several years.

Fertilizantes Heringer – Debt Analysis

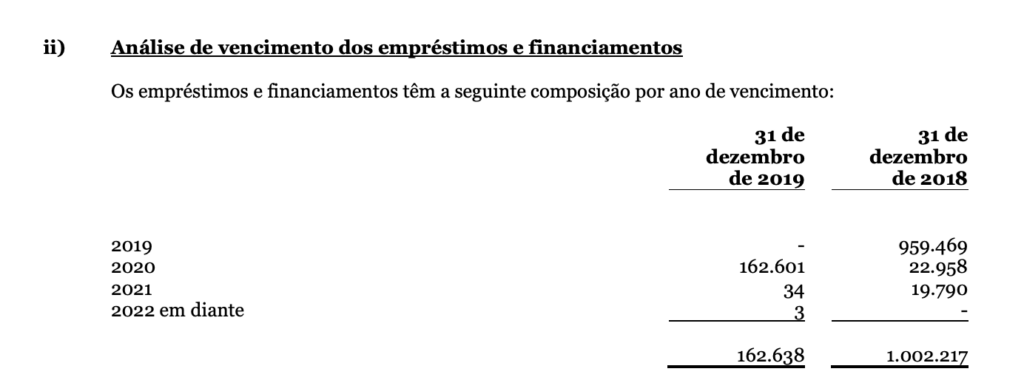

As of year-end 2019 the company has R$ 162.6 million in debt outstanding, all of which is classified as current. The significant decrease in debt form 2018 to 2019 is due to restructuring as a result of bankruptcy proceedings.

Fertilizantes Heringer Stock – Share Dynamics and Capital Structure

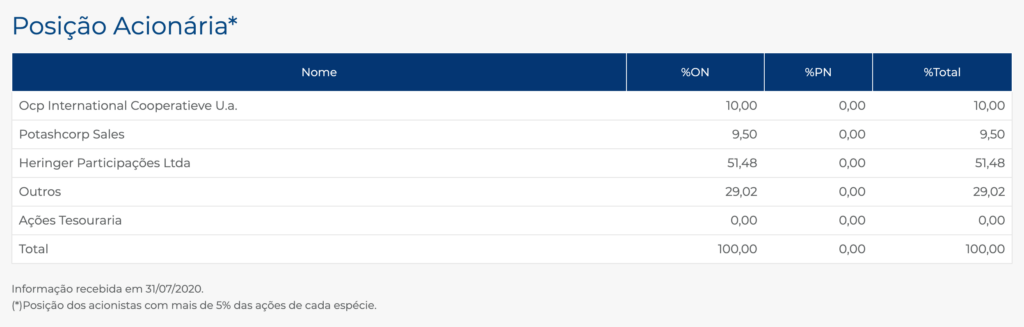

As of year-end 2019 the company has total shares outstanding of 53.8 million. They have several large institutional shareholders that own the majority of the company. Around 29% of the company’s shares are owned by shareholders owning less than 5% of the company.

Fertilizantes Heringer Stock – Dividends

The company did not pay a dividend in 2019.

Fertilizantes Heringer Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 1.5 billion / R$ 31 million = 49

A debt to equity ratio of 49 indicates that Heringer is highly dependent on debt financing to fund itself. The company’s shareholder equity has been deteriorating as a result of the company’s deteriorating operating results.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 762.3 million / R$505.4 million = 1.5

A working capital ratio of 1.5 indicates a sufficient, but not strong short term liquidity position.

Price to Book Ratio

Current Share Price/Book Value per Share.

R$ 2.68/ R$ .58 = 4.6

Based on total shares outstanding, Heringer has a book value per share of R$ .58. At the current market price, this implies a price to book ratio of 4.6, meaning Heringer stock currently trades at a premium to the book value of the company.

Brazilian Agriculture Market – Economic Factors and Competitive Landscape

Brazil is an agricultural powerhouse, it ranks 5th in the world in terms of arable land. Agriculture is a large and important industry for the Brazilian economy. Brazil is the world’s largest producer of oranges, sugarcane, and coffee. They also compete globally in the production of soy, meat, and corn. Brazils’ diverse geography allows it to produce a wide variety of crops.

Global agricultural is a highly competitive market subject to large swings in global commodity prices. Brazilian agricultural companies will have to compete fiercely on a global stage for exports. However, given the scale of the industry in Brazil, I believe it is reasonable to assume that there are many well run, investable agriculture companies in Brazil.

Fertilizantes Heringer Stock – Summary and Conclusions

Fertilizantes Heringer recently completed bankruptcy proceeding and was able to restructure its debt. Although the company is certainty in a better financial position now compared to 2017 and 2018, they are still in poor financial health.

Although Heringer is in a large and important market for the Brazilian economy, the company is in too weak a financial position for me to invest in Fertilizantes Heringer stock. They have not been able to run the company profitably for some time, and I see no catalyst for this to change moving forward. I will need to see how the company performs post-bankruptcy before I reconsider my investment decision. For now, I find other Brazilian agriculture companies such as Brasil Agro, much more appealing.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.