Common Stock: Ferreycorp (FERREYC1)

Current Market Price: $2.15 PEN

Market Capitalization: $2.1 Billion PEN

*All values in this article are expressed in Peruvian Soles (PEN) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Ferreycorp Stock – Summary of the Company

Ferreycorp is a Peruvian conglomerate engaged in the import, distribution, sale, leasing and maintenance of construction, mining, agricultural and transport equipment, vehicles and machinery such as, tractors, trucks and excavators. Caterpillar products and related services account for 76% of the company’s revenue. The remaining 24% is comprised of complementary businesses such as Metso construction equipment, the Massey Ferguson and Valtra agricultural trucks, the Paus underground mining equipment, Kenworth and DAF trucks, Iveco dumpers, Terex and Demag cranes, Good Year tires, Chevron lubricants and personal protection equipment of 3M and MSA brands, among others.

The company’s main market is Peru, which accounts for 87% of revenue. In addition to Peru the company is also present in Guatemala, El Salvador, Belize, Chile, Colombia, and Ecuador. Operations in these countries account for the remaining 13% of revenue.

Ferreycorp was founded in 1922 and is headquartered in Lima, Peru. The company employs over 6,600 people.

Revenue and Cost Analysis

Ferreycorp had revenue of $5.9 billion in 2019, a significant increase from $5.2 billion in 2018. Their COGS was $4.5 billion in 2019, representing a gross margin of 23%, on par with their gross margin of 24% in 2018.

The company was profitable in each of the last two years. In 2019 Ferreycorp had net income of $246.4 million, representing a profit margin of 4%, equal to their profit margin in 2018.

Balance Sheet Analysis

Ferreycorp has a decent balance sheet. They have sufficient short term liquidity and a solid base of long term assets. However the company is leveraged and has relevant amounts of debt outstanding.

Ferreycorp – Debt Analysis

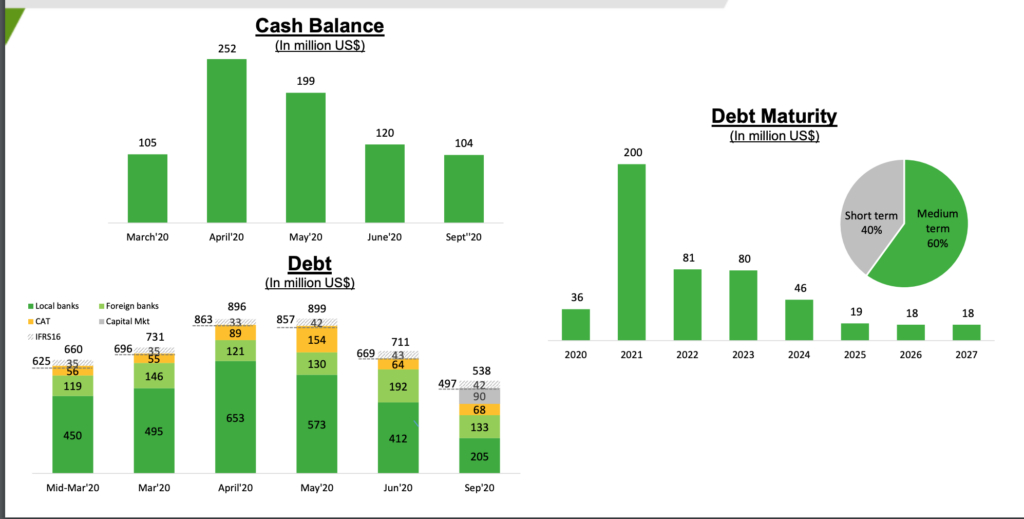

As of September 2020, the company has $538 million USD in total debt outstanding. The majority of this debt is due in 2021.

Ferreycorp Stock – Share Dynamics and Capital Structure

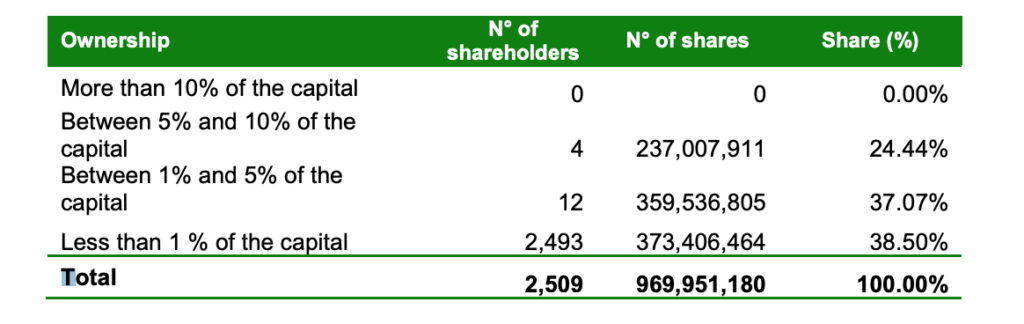

As of year-end 2019 the company has 970 million common shares outstanding. The company only has 4 shareholders with an ownership position larger than 5%.

Ferreycorp Stock – Dividends

The company paid total dividends (normal + extraordinary) of $0.227 cents per share in 2019. At the current market price this implies a dividend yield of 10.6%.

Ferreycorp Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$3.6 billion / $2.2 billion = 1.7

A debt to equity ratio of 1.7 indicates that Ferreycorp is leveraged and relies heavily on debt financing to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

$3.4 billion / $2.4 billion = 1.4

A working capital ratio of 1.4 indicates a sufficient liquidity position. Ferreycorp should not have problems meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

$2.15 / $2.22 = .97

Ferreycorp has a book value per share of $2.22. At the current market price this implies a price to book ratio of .97, meaning the company’s stock currently trades at a slight discount to the book value of the company.

Ferreycorp Stock – Summary and Conclusions

Ferreycorp is a solid company. They have a long history representing CAT in Peru, and are the market leader in heavy equipment. In addition to CAT products, they also represent other well-known brands. Although the majority of their revenue is in Peru, they have a growing regional presence in several other LATAM countries.

Peru is a growing mining jurisdictions and Ferreycorp is well positioned to capture this growth. The company is financially healthy, with sufficient liquidity, profits, and a dividend. However the company is leveraged, with a significant portion of their debt coming due in 2021.

I like this company a lot. I will wait for their complete 2020 financials to be made available before making my final decision. I would feel more comfortable if the company’s debt position improved, but would still consider investing at current leverage levels.

Investors can compare Ferreycorp stock to Brazilian construction equipment company Mills.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.