Preferred Stock: Excelsior Alimentos (BAUH4)

Current Market Price: R$ 86.97

Market Capitalization: R$ 454.1 million

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Excelsior Alimentos Stock – Summary of the Company

Excelsior Alimentos is a Brazilian food company focused on the production and sale of processed meat products. The company’s main products include hams, sausages, pates, and bolognas. They sell their products through retail chains, resellers, and small commercial establishments, mostly in the south of Brazil. Excelsior was founded in 1891 and is headquartered in the state of Rio Grande do Sul, Brazil.

Revenue and Cost Analysis

Excelsior had total revenue of R$ 180.1 million in 2019, a slight increase from R$ 173.9 million in 2018. They had COGS of R$ 134.6 million and R$ 128.3 million in 2019 and 2018 respectively, maintaining a gross margin of around 26% in both years.

Excelsior was profitable in each of the past 2 years, with net income of R$ 26.9 million in 2019 and R$ 10 million in 2018. This significant increase in net income was due in large part to an income tax credit of R$ 9.5 million in 2019.

Balance Sheet Analysis

Excelsior Alimentos has a sound balance sheet. They have a sufficient liquidity position and low liability levels relative to the size of their asset base and operations.

Excelsior Alimentos – Debt Analysis

As of year-end 2019, Excelsior has an irrelevant amount of debt outstanding, valued at R$ 16 thousand.

Excelsior Alimentos Stock – Share Dynamics and Capital Structure

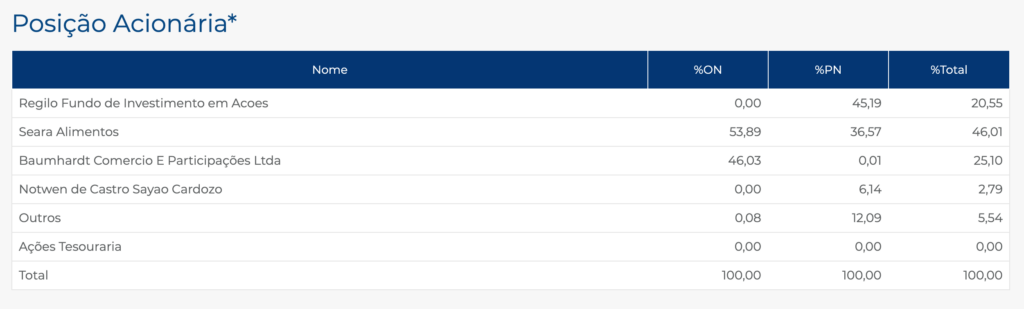

As of year-end 2019 Excelsior has 2.8 million common shares outstanding and 2.4 million preferred shares outstanding. Total shares outstanding is around 5.2 million.

The majority of the company’s shares are controlled by Seara Alimentos, another Brazilian food company.

Excelsior Alimentos Stock – Dividends

In 2019, the company paid a dividend of R$ .779 per common share and R$ .857 per preferred share. At the current market price this represents a preferred dividend yield of 1%.

Excelsior Alimentos Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 49.4 million / R$ 71.7 million = .69

A debt to equity ratio of .69 indicates that Excelsior uses a mix of debt and equity in its capital structure, but relies more heavily on equity financing to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 66.8 million / R$ 45.8 million = 1.5

A working capital ratio of 1.5 indicates a sound liquidity position. Excelsior should not have problems meeting its near-term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

R$ 86.97/ R$13.74 = 6.3

Based on total shares outstanding (Common + Preferred) Excelsior has a book value per share of R$ 13.74. At the current market price this implies a price to book ratio of 6.3, meaning the company’s stock currently trades at a significant premium to the book value of the company.

Excelsior Alimentos Stock – Summary and Conclusions

Excelsior Alimentos is a strong and stable business. They have been operating in the south of Brazil for almost 130 years. The company is healthy financially with very little risk on its balance sheet, including no outstanding debt. The shares are tightly held by another food company, and management returns capital to shareholders via a dividend.

There is a lot to like about Excelsior stock. Although it is not likely to put up large growth numbers, it is a solid business, and if purchased at the right price, will make a good addition to a Brazilian stock portfolio.

However, I don’t believe it is currently trading at an attractive valuation. The stock has increased around 800% in the last two years, and currently trades at a significant premium to book value. I will put Excelsior at the top of my wish list, and continue to monitor the stock along with other Brazilian food companies, such as Josapar. But I will not be investing in Excelsior Alimentos stock at this price.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.

One Comment

Comments are closed.