Common Stock: Eros Resources (TSXV:ERC)

Current Market Price: $.10 CAD

Market Capitalization: $9.6 million CAD

**Note: All values in this article are expressed in Canadian Dollars (CAD) unless otherwise noted.

Eros Resources Stock – Summary of the Company

Eros Resources is a mineral exploration company focused on the acquisition, exploration, and development of mineral and oil and gas properties in North America. The company owns a portfolio of exploration stage properties. Eros was founded in 1981 and is headquartered in Vancouver Canada.

Revenue and Cost Analysis

Eros has very limited revenue from oil production, which was only $30 thousand in 2019. The company regularly runs an operating loss and is likely to continue to do so for the foreseeable future.

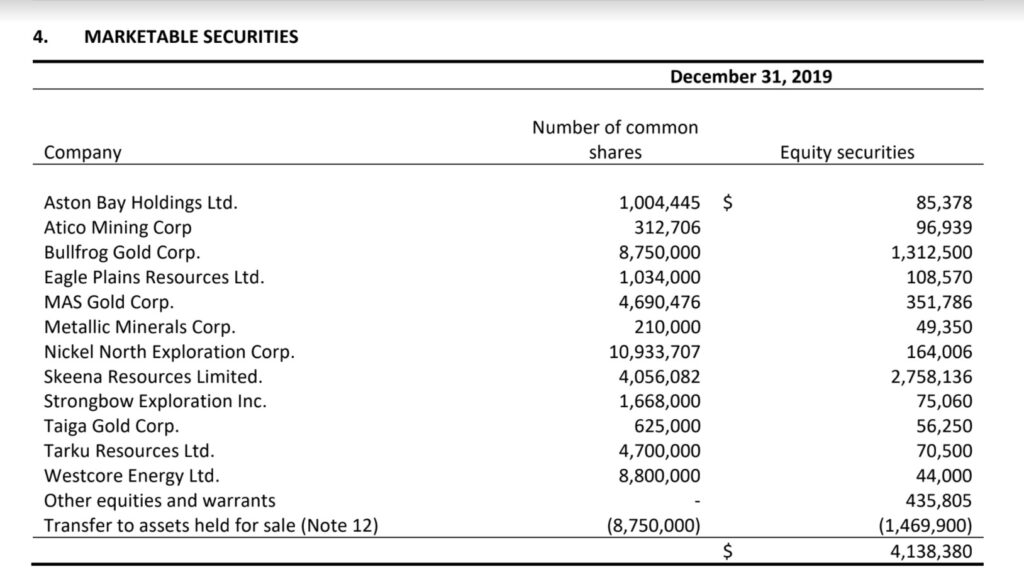

The company has a portfolio of marketable securities, which it regularly sells. This causes net income to vary. In 2019, the company had net income of $2.7 million, mostly due to a gain on the sale of securities. In 2018, the company had a net loss of $5.4 million, due mostly to a loss on the sale of securities.

Eros Resources – Royalty and Streaming Agreements

Several of the company’s mineral properties in Canada are subject to net smelter royalties ranging from .5% to 2%.

Balance Sheet Analysis

Eros has a sound balance sheet. The have a strong liquidity position and reasonable liability levels. Most of their assets are marketable securities.

Eros Resources – Debt Analysis

As of year-end 2019, Eros does not have any debt outstanding.

Eros Resources Stock – Share Dynamics and Capital Structure

The company has 96.9 million common shares outstanding. In addition, they have 3.5 million options outstanding. Fully diluted shares outstanding is around 100.4 million shares.

Eros Resources Stock – Dividends

The company does not currently pay a dividend and is unlikely to do so for the foreseeable.

Management – Skin in the game

There has not been any relevant insider activity recently, providing no signal to investors. However, insider ownership is high, with the CEO owning around 11% of the company’s shares.

Eros Resources Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$3.2 million/5.2 million =.63

A debt to equity ratio of .63 indicates that Eros uses a mix of debt and equity in its capital structure, but relies mostly on equity financing to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

$2.8 million/ $402 thousand = 7

A working capital ratio of 7 indicates a sound liquidity position. Eros should not have problems meeting its near-term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

$.10/$.05 = 2

Based on fully diluted shares outstanding Eros has a book value per share of $.05. At the current market price this implies a price to book ratio of 2, meaning the company’s stock trades at a premium to the book value of the company.

Eros Resources Stock – Summary and Conclusions

I am not currently interested in oil and gas investments. Although Eros has some mineral properties in its portfolio, it is mostly an oil and gas explorer. Furthermore, a large portion of the company’s value comes from its marketable securities portfolio, which I would need to analyze before investing.

For now, I would prefer to invest in gold and silver focused companies, such as Equinox Gold.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.