Common Stock: El Comercio (ELCOMEI1)

Current Market Price: $0.82 PEN

Market Capitalization: $226.2 Million PEN

*All values in this article are expressed in Peruvian Soles (PEN) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

El Comercio Stock – Summary of the Company

El Comercio is a Peruvian newspaper and media company. Founded in 1839 it is the oldest newspaper in Peru and one of the oldest Spanish language newspapers in the world. In addition the their flagship El Comecio brand they also own a portfolio of other media brands, such as Gestion, Trome, Publimetro, Peru21, Correo, Ojo, Depor, El Bocon, Canal N, and America Television. The company is headquartered in Lima, Peru and employs around 1,300 people.

Revenue and Cost Analysis

El Comercio had revenues of $1.07 billion in 2019, a slight decrease from $1.12 billion in 2018. Their COGS in 2019 was $697 million, representing a gross margin of 35%, also a decrease compared to 37% the previous year.

The company was profitable in each of the last two years. In 2019 El Comercio had net income of $128.2 million, representing a profit margin of 11.9%, a significant improvement compared to 2.5% in 2018. This improvement is due mostly to an increase in “other income” which is income from the one time sale of several of the company’s brands. Operating expenses were also slightly lower in 2019 compared to 2018.

Balance Sheet Analysis

El Comercio has a decent balance sheet. They have a sufficient, but not strong liquidity position, and a solid base of long term assets. Liability levels are reasonable and the company is not leveraged.

El Comercio – Debt Analysis

As of year-end 2019 the company has $111.3 million in total debt outstanding, $108.2 million of which is classified as current.

El Comercio Stock – Share Dynamics and Capital Structure

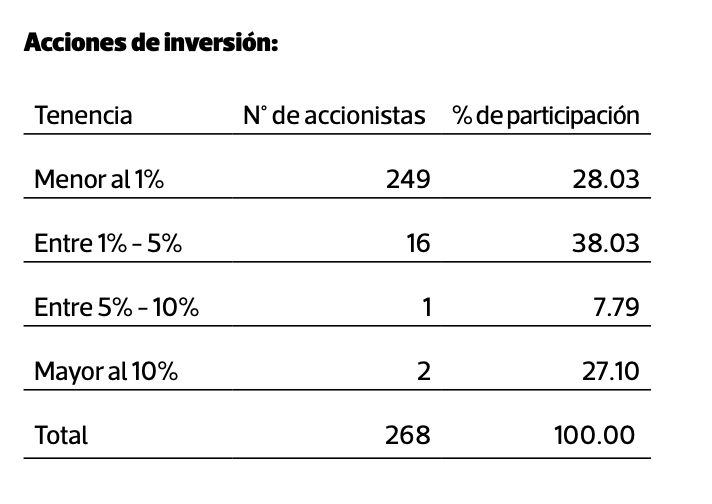

As of year-end 2019 El Comercio has 275.9 million common shares outstanding. They have two major shareholders with an ownership position over 10%. 66% of the company’s shares are owned by smaller shareholders with an ownership position of less than 5%.

El Comercio Stock – Dividends

In 2019 the company paid total dividends of $0.223 cents per share. At the current market price this implies a dividend yield of 27%.

El Comercio Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$624 million / $1.4 billion = .45

A debt to equity ratio of .45 indicates that El Comercio uses a mix of debt and equity in its capital structure, but is not leveraged, and relies more heavily on equity financing for funding.

Working Capital Ratio

Current Assets/Current Liabilities

$453 million / $396 million = 1.1

A working capital ratio of 1.1 indicates a sufficient, but not strong liquidity position. El Comercio should not have problems meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

$0.82 / $5.02 = .16

El Comercio has a book value per share of $5.02. At the current market price this implies a price to book ratio of .16, meaning the company’s stock currently trades at an extreme discount to the book value of the company.

El Comercio Stock – Summary and Conclusions

El Comercio is a historic company. There aren’t many publicly traded companies in the world founded in 1839. Reading through their annual reports feels like reading a piece of history.

Currently, the company is in decent financial health. They are not over leveraged, have sufficient near term liquidity, and are profitable.

The stock is cheap. It currently trades at an extreme discount to book value and has a very high trailing dividend yield. I understand the newspaper industry in dying, but El Comercio is growing its digital media presence and the stock looks too cheap. It looks like either a classic value opportunity, or value trap, and frankly I am not sure which.

I am not comfortable enough with the Peruvian media industry or El Comercio’s digital business to make an investment decision. I will wait for the company’s 2020 annual report to be available and revisit the company. Investors can compare El Comercio stock to other Latin American Media companies such as Saraiva.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.