Common Stock: Duratex (DTEX3)

Current Market Price: R$ 18.78

Market Capitalization: R$ 13 billion

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Duratex Stock – Summary of the Company

Duratex is a Brazilian construction and woodworking materials manufacturing company. They are the largest wood panel manufacturer in Brazil. Their principal products are wood panels, ceramics, sanitary metals, and shower products. The company has 16 industrial plants in Brazil and 3 in Colombia. Its international subsidiaries are located in The United States, Belgium, Peru, and Uruguay. Duratex was founded in 1951 and is headquartered in Sao Paulo, Brazil. They currently employ around 12,000 people.

Revenue and Cost Analysis

Duratex had net revenue of R$ 5 billion in 2019, roughly equal to its net revenue in 2018. Their COGS was R$ 3.8 billion, representing a gross margin of 23%, also equal to their gross margin in 2018.

The company was profitable in each of the last two years. In 2019 Duratex had net income of R$ 405.7 million, representing a profit margin of 8%, a slight decrease from 8.7% in 2018.

Duratex – Acquisitions

In 2019 Duratex acquired Cecrisa Ceramic Tiles, one of the largest tile manufacturers in Brazil. The maximum value of the acquisition was R$ 539 million, with R$ 264 million being paid upfront, and an additional R$ 275 million being contingent on future performance.

Balance Sheet Analysis

Duratex has a decent, but leveraged balance sheet. They have a solid base of assets and sufficient near term liquidity, however liability levels, including debt, are fairly high.

It is worth noting the company has a book of complex derivatives such as swaps and forwards it uses in an attempt to hedge foreign currency exposure. Investors should analyze these derivatives in detail before investing.

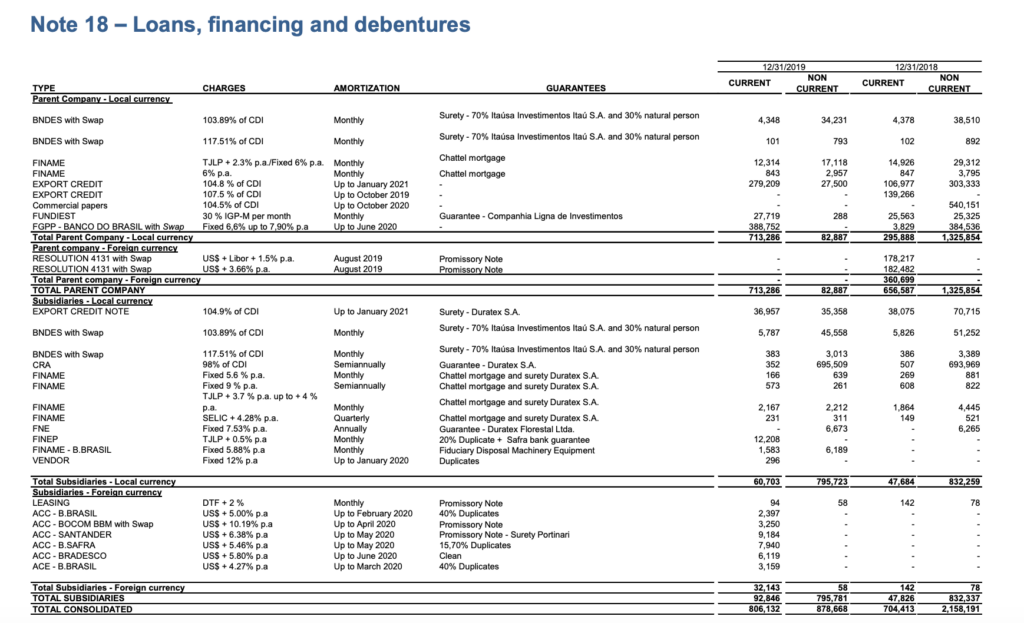

Duratex – Debt Analysis

As of year-end 2019 Duratex has total debt outstanding of R$ 2.9 billion, R$ 871 million of which is classified as current.

Duratex Stock – Share Dynamics and Capital Structure

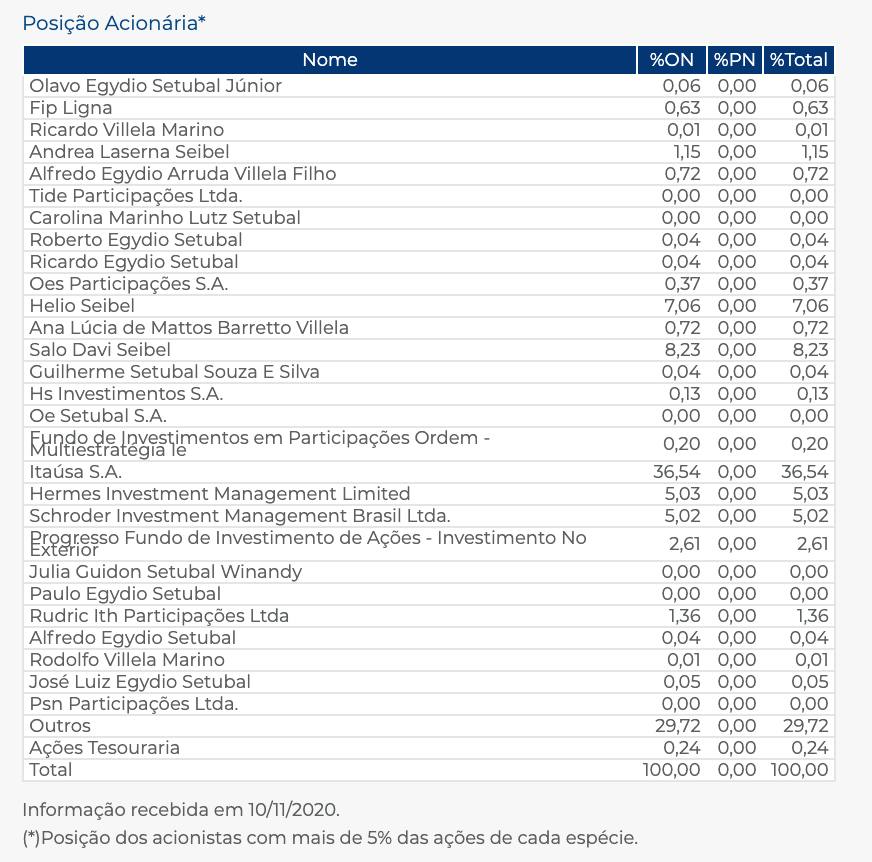

As of year-end 2019 Duratex has 691.8 million common shares outstanding. Insiders and institutional investors own around 70% of the company, with the remaining 30% being held by shareholders with an ownership position of less than 5%.

Duratex Stock – Dividends

Based on 2019’s results Duratex paid a dividend of R$ 0.373 cents per share. At the current market price this implies a dividend yield of 2%.

Duratex Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 5.8 billion / R$ 4.9 billion = 1.2

A debt to equity ratio of 1.2 indicates that Duratex uses a mix of debt and equity in its capital structure, but is slightly levered and relies more heavily on debt financing to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 3.5 billion / R$ 2.1 billion = 1.6

A working capital ratio of 1.6 indicates a sufficient, but not strong liquidity position. Duratex should not have problems meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

R$ 18.78 / R$ 7.13 = 2.6

Duratex has a book value of R$ 7.13 per share. At the current market price this implies a price to book ratio of 2.6, meaning Duratex stock currently trades at a premium to the book value of the company.

Duratex Stock – Summary and Conclusions

Duratex is a decent company. They have a solid presence throughout Brazil and some presence internationally. The company is profitable and returned capital to shareholders via a dividend in 2019. They are in a decent position financially, however their debts levels are fairly high.

Duratex stock currently trades near to its all-time high. The company’s valuation is by no means cheap and in my opinion provides little margin of safety for investors. Although Duratex is an OK company, I don’t see anything compelling enough for me to chase the stock at these levels. I will leave the company on my watch list and revisit their 2020 results. Investors can compare Duratex stock to other ceramics manufacturers such as Portobello.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.