Common Stock: CSU Card System (CARD3)

Current Market Price: R$ 14.24

Market Capitalization: R$ 595 million

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

CSU Card System Stock – Summary of the Company

CSU Card System is a Brazilian technology service provider that offers technology products to help companies with relationship management, loyalty programs, payment processing, e-commerce sales, contact centers, and third party data center management. The company was founded in 1992 and is headquartered in Sao Paulo Brazil. They currently have around 5,800 employees.

Revenue and Cost Analysis

The company’s total sales have declined over the past three years. In 2017 CSU had sales of R$ 486.8 million, which declined to R$ 433.7 million in 2019. Their gross Margin has also declined over this period, from 35% in 2017 to 25% in 2019.

CSU has been profitable for the past three years. Net income was R$ 26.8 million in 2019, representing a profit margin of 6.2%

Balance Sheet Analysis

CSU has a decent but not strong balance sheet. Liquidity is not strong but appears sufficient. The company’s liabilities appear manageable based on operating results. They do have a relevant amount of debt outstanding.

CSU Card System – Debt Analysis

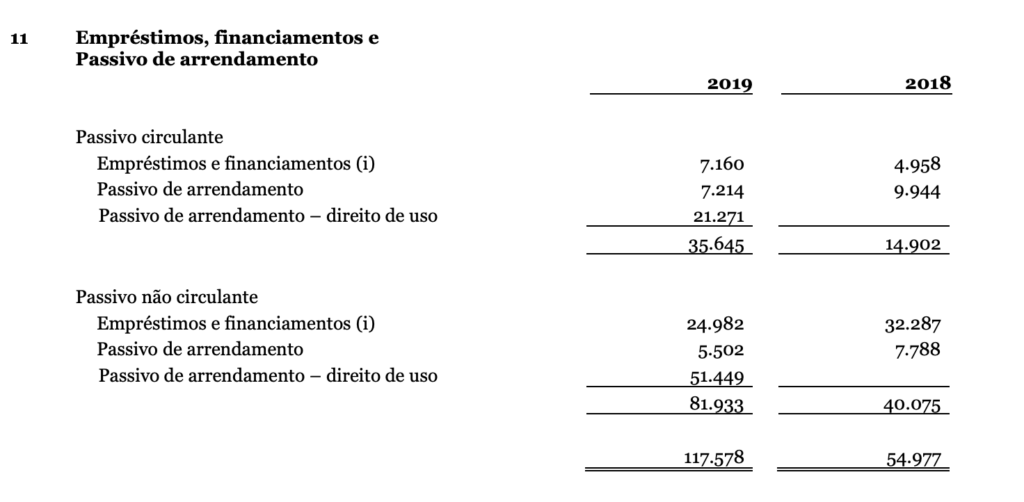

As of year-end 2019, the company has R$ 117.5 million in debt outstanding, of which R$ 82 million is classified as long term.

CSU Card System Stock – Share Dynamics and Capital Structure

As of year-end 2019 the company has 41.8 million common shares outstanding, around 43% of which float in the market.

CSU Card System Stock – Dividends

In 2019, the company made three dividend payments which totaled R$ .256 per share. At the current market price this implies a dividend yield of 1.8%

Management – Skin in the game

The company founder and president, Marcos Ribeiro Leite, controls around 57% of the company’s shares.

CSU Card System Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 238.4 / R$ 257.2 = .93

A debt to equity ratio of .93 indicates that CSU uses a mix of debt and equity in its capital structure, relying almost equally on each for funding.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 133.5/ R$ 139.7 = .96

A working capital ratio of .96 indicates a mediocre liquidity position. Although it is not likely CSU Card System will have problems meeting its obligations in the short term, investors should monitor the company’s liquidity position closely for any deterioration.

Price to Book Ratio

Current Share Price/Book Value per Share.

R$ 14.24/ R$ 6.15 = 2.3

CSU has a book value per share of R$ 6.15. At the current market price this implies a price to book ratio of 2.3, meaning the company’s stock trades at a premium to the book value of the company.

CSU Card System Stock – Summary and Conclusions

CSU Card Systems is an interesting business with a wide range of business lines. The company is in decent financial health. They have been profitable for the past several years and return capital to shareholders via a dividend. However, they have a significant amount of debt outstanding and their liquidity position is not strong.

A technology company that is growing its client base like CSU is should see growing revenue. But that is not the case for CSU, revenue has been declining and so have margins. It’s not clear to me what the company’s focus is, as they have so many different business lines.

This is clearly a wonderful business for the founder, but I am not so sure it is investor friendly. I am interested in the company, and will continue to monitor their financial reports. But I am not going to take a position at this time. If I were going to invest in Brazilian stocks I would prefer to allocate to companies like Dimed or Dohler.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.