Common Stock: Compañía Sud Americana de Vapores (CSAV)

Ticker: VAPORES

Current Market Price: $56.2 CLP ($0.07 USD)

Market Capitalization: $2.9 trillion CLP ($3.7 billion USD)

*All values in this article are expressed in United States Dollars (USD) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Compañía Sud Americana de Vapores (CSAV) Stock – Summary of the Company

Compañía Sud Americana de Vapores S.A. (CSAV) is a shipping company based in Chile. Its main business is container shipping, through its interest acquired in 2014 in the German company Hapag-Lloyd AG, the world’s fifth-largest shipping line in this segment.

CSAV is a principal shareholder with a 30% interest in Hapag-Lloyd and it is party to a shareholder agreement that controls over 70% of that company. Thus, CSAV exercises significant influence and joint control over Hapag-Lloyd, so it is classified in its financial statements as a joint venture. Its investment in Hapag-Lloyd represents over 85% of the Company’s consolidated assets, which is now its main and only business since July 2020 after closing its directly operated services.

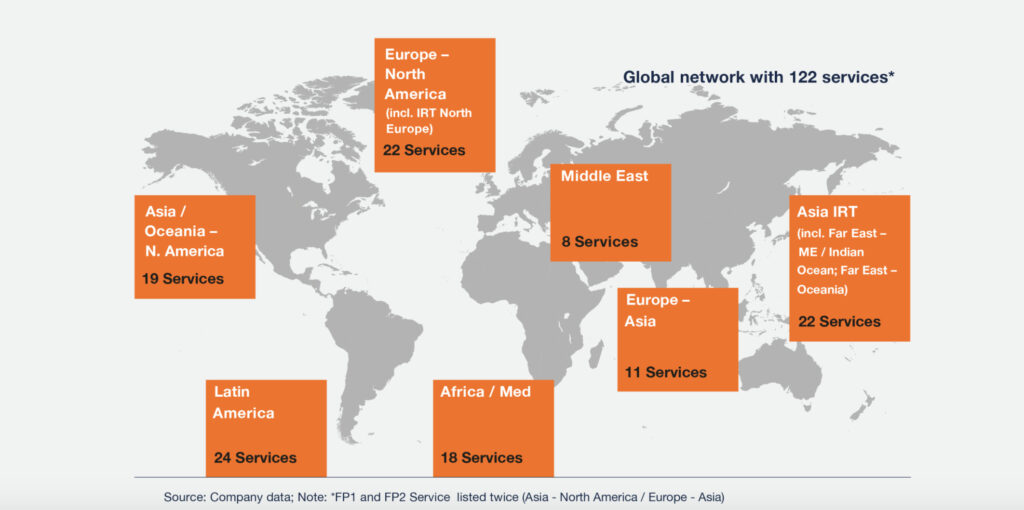

With a fleet of 237 container vessels and total capacity of 1.7 million TEU, Hapag-Lloyd boasts a portfolio of 122 services and a highly diversified, well-balanced logistics network, operating in 129 countries and along the most important global shipping routes. Furthermore, it is the main member of THE Alliance, one of three alliances that together represent more than 90% of global shipping capacity on east-west routes.

Compañía Sud Americana de Vapores S.A. was founded in 1872 and is a publicly traded company listed on the Chilean stock exchange since 1893. The company is headquartered in Valparaiso, Chile.

Revenue and Cost Analysis

CSAV reports no revenue as its assets are all a subsidiary (Joint Venture) in which it has a minority stake. In 2020 the company had net income of $222.1 million, a significant increase from $124.6 million in 2019.

Balance Sheet Analysis

CSAV has a decent but not strong balance sheet. They have a solid asset in their minority ownership of Hapag-Lloyd and low leverage. However their liquidity position is very weak in the near term.

Debt Analysis

As of year-end 2020 the company has $150 million in total debt outstanding, $50.6 million of which is classified as current.

Compañía Sud Americana de Vapores (CSAV) Stock Share Dynamics and Capital Structure

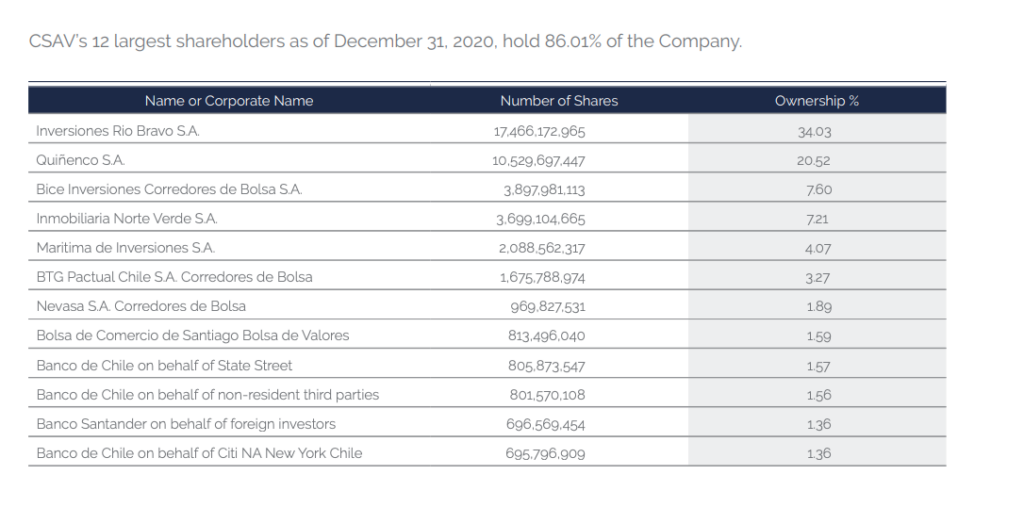

As of year-end 2020 the company has 51.3 billion common shares outstanding. The company’s 12 largest shareholders own 86% of the company.

Dividends

In 2020 the company declared its first dividend in 10 years. CSAV paid total dividends of $0.002 cents per share based on 2020’s results. At the current market price this implies a dividend yield of 2.8%.

3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$2.7 billion / $313.1 million = .12

A debt to equity ratio of .12 indicates that CSAV uses very little debt in its capital structure and relies almost entirely on equity financing for funding.

Working Capital Ratio

Current Assets/Current Liabilities

$82.2 million / $135.2 million = .61

A working capital ratio of .61 indicates a weak liquidity position. CSAV may have difficulties meeting its near term obligations and investors should monitor the company’s liquidity closely.

Price to Book Ratio

Current Share Price/Book Value per Share.

$0.07 / $0.05 = 1.3

CSAV has a book value per share of $0.05 cents. At the current market price this implies a price to book ratio of 1.3, meaning the company’s stock currently trades at a slight premium to the book value of the company.

Compañía Sud Americana de Vapores (CSAV) Stock Summary and Conclusions

CSAV is an interesting company with a long history of operating in Chile. They own a minority interest (~30%) in one of the leading shipping container companies in the world, giving them a truly global presence.

Their financials are decent but not strong. Leverage is low and the company returned to profitability and dividends after nearly a decade. However they have a weak liquidity position.

Although CSAV is a solid company, there is nothing exceptional about it that would compel me to invest. I would rather invest in other Chileans companies, such as BluMar Seafoods.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.