Common Stock: Empresas CMPC

Current Market Price: $2,320 CLP ($3.24 USD)

Market Capitalization: $5.8 Trillion CLP ($8.1 Billion USD)

*All values in this article are expressed in United States Dollars (USD) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

CMPC Stock – Summary of the Company

CMPC is a Chilean forestry company. They have 3 distinct business segments; pulp, bio packaging, and softys. Their products include wood pulp, grain wood, packaging, paper, and tissue. The company has over 654,000 hectares of forest plantations, mainly pine and eucalyptus. Most of these plantations are located in Chile, Brazil, and Argentina. The company sells its products on over 45 countries and has 40 industrial plants located in 8 countries in South America. They employ over 19,000 people. CMPC was founded in 1920 and is headquartered in Santiago, Chile.

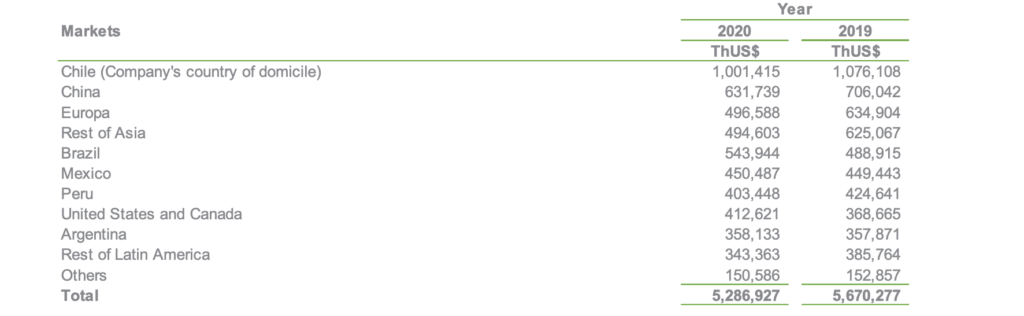

Revenue and Cost Analysis

CMPC had revenue of $5.3 billion in 2020, a decrease from $5.7 billion in 2019. Their COGS in 2020 was $4.4 billion, representing a gross margin of 16.3%, also a decrease compared to 19.5% the previous year.

Due to this decrease in gross margins, CMPC had a net loss of $27.6 million in 2020, a significant deterioration compared to a profit of $84.4 million in 2019.

Balance Sheet Analysis

CMPC has a decent balance sheet. They have a sound short term liquidity position and a good base of long term assets. The company is not leveraged and liability levels are reasonable. However they do have a significant amount of long term debt outstanding.

It is worth noting the company uses derivative instruments to hedge its currency and commodity price exposures. Investors should analyze this derivatives book in detail before investing.

CMPC – Debt Analysis

As of year-end 2020 the company has $4 billion in total debt outstanding, $252.8 million of which is classified as current. $1.8 billion of this debt has more than 5 years until maturity.

CMPC Stock – Share Dynamics and Capital Structure

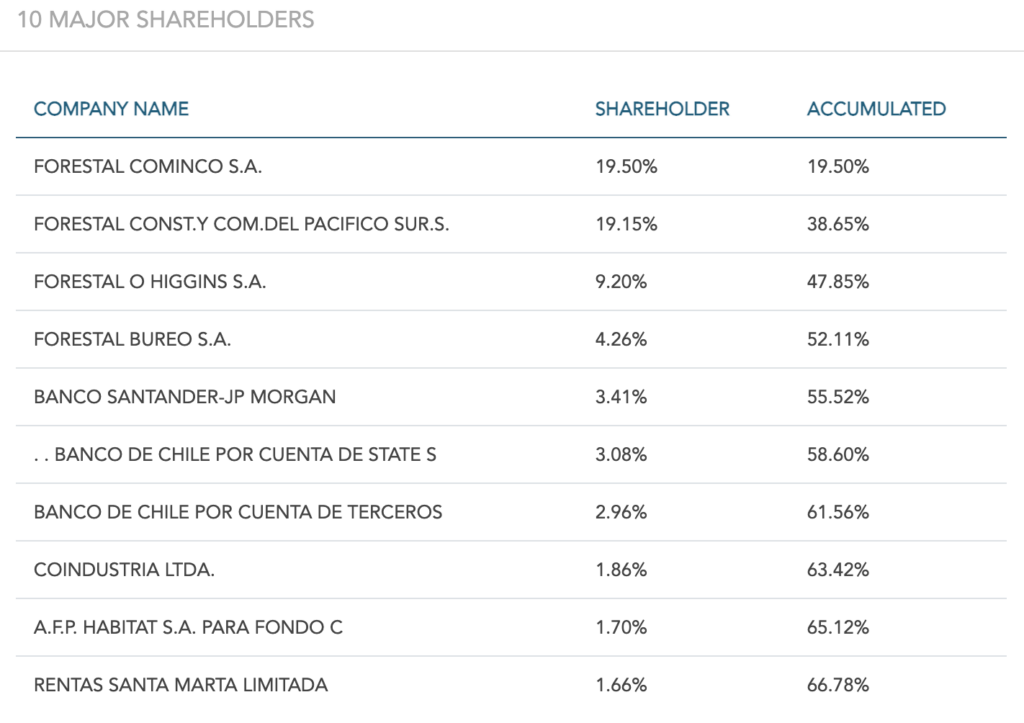

As of year-end 2020 the company has 2.5 billion common shares outstanding. Their 10 largest shareholders own a combined 66.8% of the company.

CMPC Stock – Dividends

The company paid a dividend of $0.0014 cents per share in 2020, a significant decrease compared to $0.0226 cents per share in 2019. At the current market price this implies a dividend yield of 0.04%.

CMPC Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$6.8 billion / $7.8 billion = .87

A debt to equity ratio of .87 indicates that CMPC uses a mix of debt and equity in its capital structure, but is not leveraged, and relies more heavily on equity financing for funding.

Working Capital Ratio

Current Assets/Current Liabilities

$3.6 billion / $1.2 billion = 3

A working capital ratio of 3 indicates a sound liquidity position. CMPC should not have problems meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

$3.24 / $3.14 = 1.03

CMPC has a book value per share of $3.14. At the current market price this implies a price to book ratio of 1.03, meaning CMPC stock currently trades at a slight premium to the book value of the company.

CMPC Stock – Summary and Conclusions

CMPC is a solid company. They are a one of the largest forestry companies in Latin America, with industrial plants in 8 countries. Both their revenue and production are well diversified. The company is in good financial health, with sufficient near term liquidity and reasonable leverage levels. However a decreased gross margin in 2020 caused the company to have a net loss. Investors should monitor the company’s gross margin closely.

I think CMPC stock is a sound investment opportunity for both long term investors looking for exposure to the forestry markets, as well as shorter term investors looking to play the commodity price.

Investors can compare CMPC stock to Brazilian forestry company Klabin.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.