Common Stock: Carozzi

Current Market Price: $1558.3 CLP

Market Capitalization: $347 Billion CLP

*All values in this article are expressed in Chilean Pesos (CLP) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Carozzi Stock – Summary of the Company

Carozzi is a Chilean food company that produces and distributes food products domestically and internationally. They have a large and diversified product portfolio that includes; pastas, flours, juices, sauces, deserts, chocolates, rice, and oils, among others. Carozzi dominates many of these markets and is the largest seller in Chile in many of the categories in which it competes including pastas, premixes, and flours, and sauces, among others.

Their main markets are Chile, Peru, and Argentina, but they also have a presence in Paraguay, Ecuador, Uruguay, and The United Stated. They only have one client representing more than 10% of sales. The company has a network of over 5,000 agricultural suppliers and employs over 10,500 people.

Carozzi was founded in 1898 and is headquartered in San Bernardo, Chile.

Revenue and Cost Analysis

Carozzi had revenue of $878 billion in 2019, a significant increase compared to $800 billion in 2018. Their COGS was $580 billion in 2019, representing a gross margin of 34%, on par with their gross margin of 35% the previous year.

The company was profitable in each of the last two years. In 2019 Carozzi had net income of $48 billion, representing a profit margin of 5.5%, on par with their profit margin of 5.9% in 2018.

Balance Sheet Analysis

Carozzi has a decent, but leveraged balance sheet. They have a solid base of long term assets and sufficient liquidity in the near term. However they are leveraged, with relevant liability levels, including debt.

Carozzi – Debt Analysis

As of year-end 2019 the company has $385 billion in total debt outstanding, $111 billion of which is classified as current.

Carozzi Stock – Share Dynamics and Capital Structure

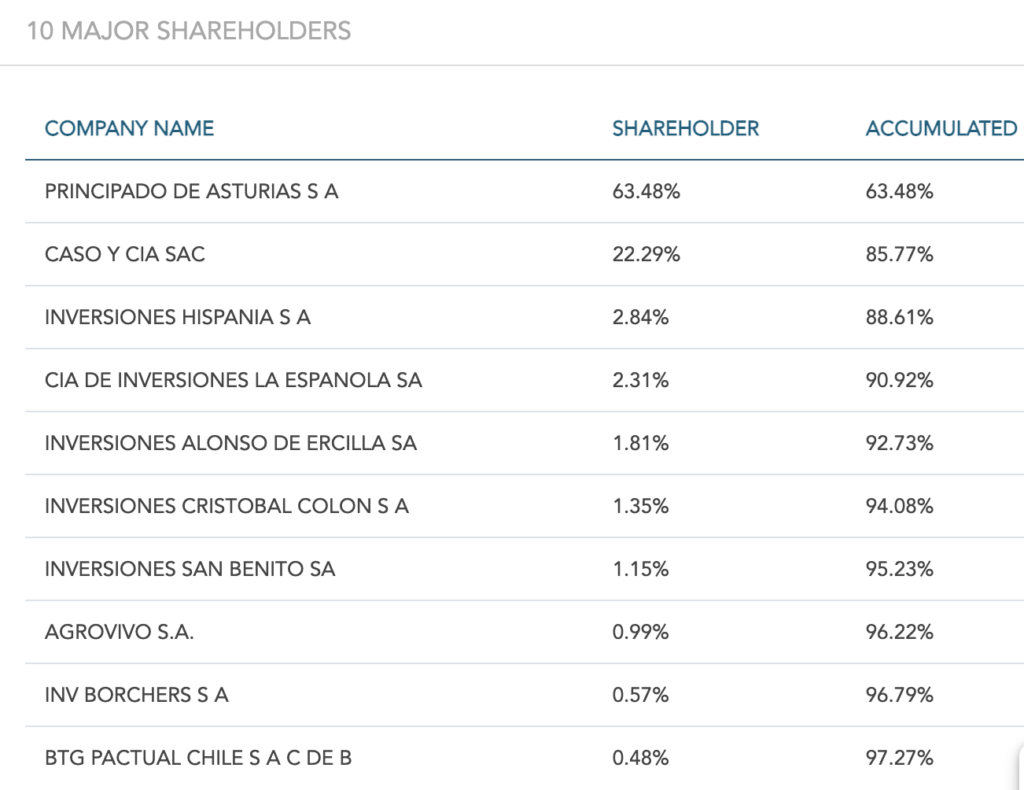

As of year-end 2019 the company has 223 million shares outstanding. Their 10 largest shareholders own a combined 97.2% of the company.

Carozzi Stock – Dividends

The company paid total dividends of $44 in 2019. At the current market price this implies a dividend yield of 2.8%.

Carozzi Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$613 billion / $517 billion = 1.2

A debt to equity ratio of 1.2 indicates that Carozzi uses a mix of debt and equity in its capital structure, but is slightly leveraged, relying more heavily of debt financing for funding.

Working Capital Ratio

Current Assets/Current Liabilities

$372 billion / $236 billion = 1.6

A working capital ratio of 1.6 indicates a sufficient liquidity position. Carozzi should not have problems meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

$1558 / $2315 = .67

Carozzi has a book value per share of $2315. At the current market price this implies a price to book ratio of .67, meaning Carozzi stock currently trades at a discount to the book value of the company.

Carozzi Stock – Summary and Conclusions

Carozzi is an impressive company with a long history of success. They have a diversified product portfolio and dominate many of the categories in which they compete. Exports are relevant and the company is not overly reliant on any single client or brand.

They are in decent financial health, with sufficient near term liquidity and profits. However they are leveraged.

I am always impressed by any company that has been in business for over 120 years. From my first analysis, Carozzi stock appears to be investable long term. However at this point I will wait to see their 2020 financials before making any decisions.

Investors can compare Carozzi stock to Brazilian food company Camil.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.