Common Stock: Caribbean Cement

Current Market Price: $92.20 JMD

Market Capitalization: $78.5 billion JMD ($510 million USD)

*All values in this article are expressed in Jamaican Dollars (JMD) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Caribbean Cement Stock – Summary of the Company

Caribbean Cement is a Jamaican cement and clinker manufacturer. They are the only producer of Portland and blended cement in Jamaica. Their two main plants are located in Rockfort and Kingston. They also have quarry operations in St. Andrews and St. Thomas. In addition to cement and clinker production, the also mine gypsum, shale and pozzolan. All of the company’s materials are mined within 10 miles of their plants. Caribbean Cement was founded in 1952.

Revenue and Cost Analysis

The company has consistently grown its revenues every year for the past four years. In 2020 Caribbean Cement had total revenues of $20.1 billion, a significant increase from $16.5 billion in 2017. Their COGS was $10.9 billion in 2020, representing a gross margin of 45%, an increase from 40% in 2019.

The company has been profitable in each of the past four years. In 2020 Caribbean Cement had net income of $3.2 billion, representing a profit margin of 15.9%, a significant increase from 10.6% in 2019.

Balance Sheet Analysis

Caribbean Cement has a decent balance sheet. In the short term they have a weak liquidity position. However longer term, liability levels are manageable and they have a strong long term property and plant asset. Debt levels are relevant but not excessive.

Debt Analysis

As of year-end 2020 the company has $4.4 billion in total debt outstanding, all of which is classified as long term. The effective interest rate on this debt ranges between 4.95% and 7.45%.

Caribbean Cement Stock – Share Dynamics and Capital Structure

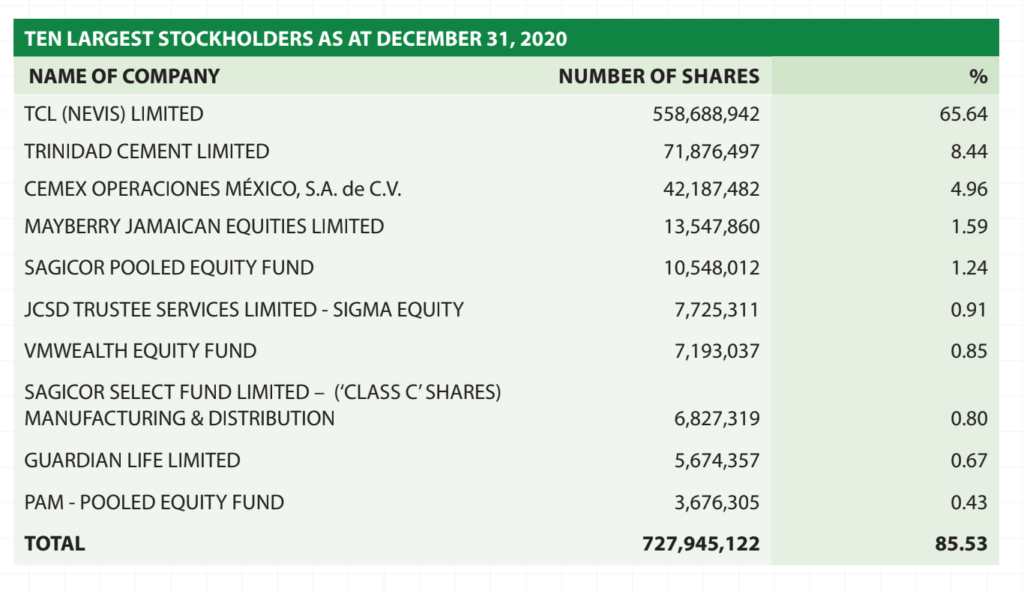

The company’s majority shareholder is CEMEX, a global building materials company. CEMEX owns a majority stake in TCL Limited, Caribbean Cement’s largest shareholder. They also own shares through their Mexican subsidiary.

The company’s 10 largest shareholders own a combined 85.5% of the company.

As of year-end 2020 the company has 851.1 million common shares outstanding.

Dividends

The company does not currently pay a dividend.

Caribbean Cement Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$14.8 billion / $11.5 billion = 1.3

A debt to equity ratio of 1.3 indicates that the company uses a mix of debt and equity in its capital structure, but is leveraged, and relies more heavily on debt financing for funding.

Working Capital Ratio

Current Assets/Current Liabilities

$3.3 billion / $6.6 billion = .5

A working capital ratio of .5 indicates a weak liquidity position. Caribbean Cement may have difficulties meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

$92.20 / $13.54 = 6.8

Caribbean Cements has a book value per share of $13.54. At the current market price this implies a price to book ratio of 6.8, meaning the company’s stock currently trades at a significant premium to the book value of the company.

Caribbean Cement Stock – Summary and Conclusions

Caribbean Cement is an interesting investment opportunity. They appear to have a near monopoly on the Jamaican cement market. They also produce other minerals at their mines, such as gypsum. The company is backed (majority owned) by a large multinational.

Financially the company has some bright spots and some weak spots. Near term liquidity is weak and may cause problems. However longer term their balance sheet appears much stronger. Revenues have grown steadily for several years and the company is consistently profitable. If the company can overcome its near term liquidity crunch, it will be in a strong financial position.

I am quite intrigued by Caribbean Cements stock and a long term buy and hold opportunity. I will revisit the company after I have looked at some other Jamaican stocks and then draw my final conclusion.

Investors can also consider Jamaican paint manufacturer Berger Paints.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.