Common Stock: Brasil Agro (AGRO3)

Current Market Price: R$ 22.20

Market Capitalization: R$ 1.2 billion

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Brasil Agro Stock – Summary of the Company

Brasil Agro is a Brazilian farming and agriculture company focused on the acquisition, development, exploration, and commercialization of rural properties for agricultural use. The company has a portfolio of over 269,000 hectares, of which 30% is developed and 28% is under development. They currently operate or have operated properties in seven Brazilian states, as well as Paraguay. Their major products include grains, cotton, sugarcane, and meat. Brazil Agro was founded in 2005 and is headquartered in Sao Paulo Brazil.

Revenue and Cost Analysis

Brasil Agro has increased its revenue steadily for the past several years. The company had total revenue of R$384 million for the fiscal year 2018, which increased to R$705.2 million for the fiscal year 2020. In 2020, the company had net revenue after COGS of R$221.3 million, implying a gross margin of 31%.

Brasil Agro has been consistently profitable. In the fiscal year 2020, the company had net income of R$119.5 million, implying a profit margin of 17%.

Balance Sheet Analysis

Brasil Agro has a solid balance sheet. They have a strong base of long term assets, mostly land and sufficient liquidity. Liability levels are reasonable, and although the company has a relevant amount of debt, it appears manageable.

It is worth using that the company has an extensive derivatives book which it uses to hedge commodity prices. Investors should analyze this derivative exposure in detail before investing.

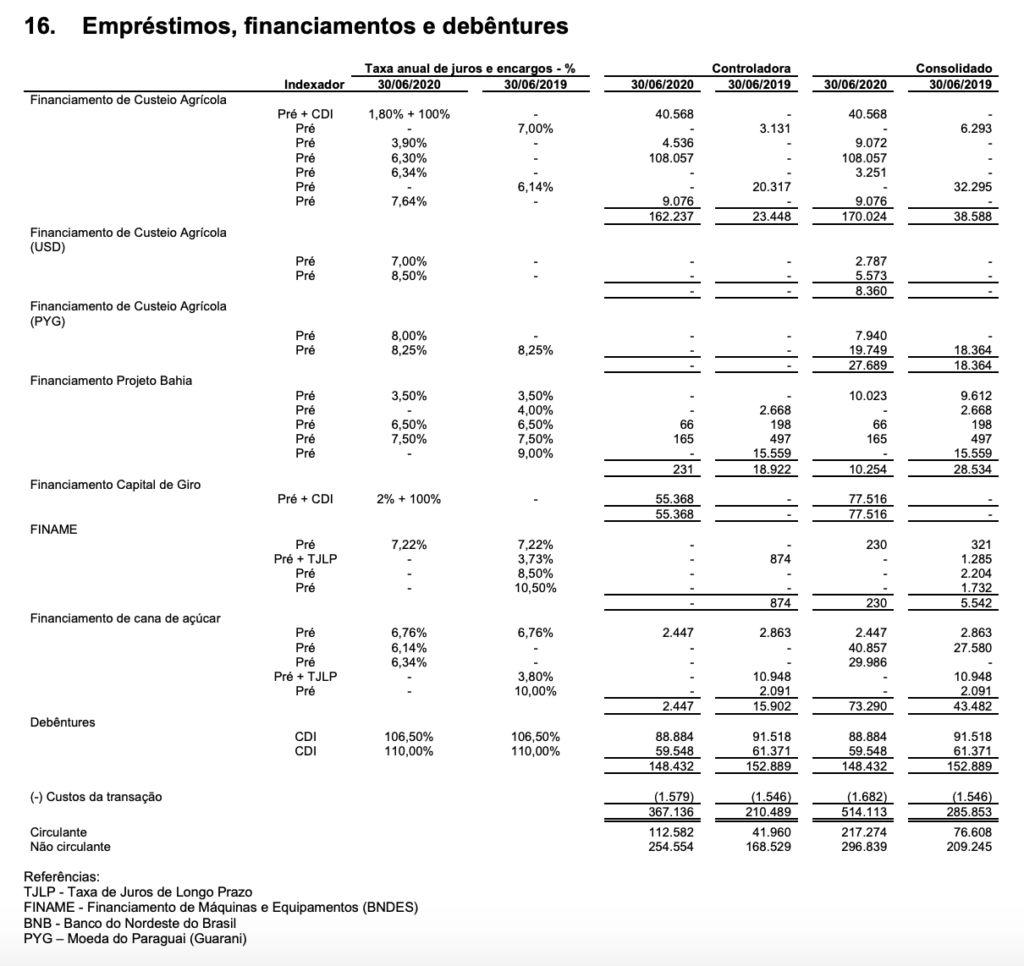

Brasil Agro – Debt Analysis

As of the fiscal year end 2020, Brasil Agro has R$514.1 million in total debt outstanding, the majority of which is due in the next two years. Some of this debt is subject to convents related to indicators measuring the company’s financial health.

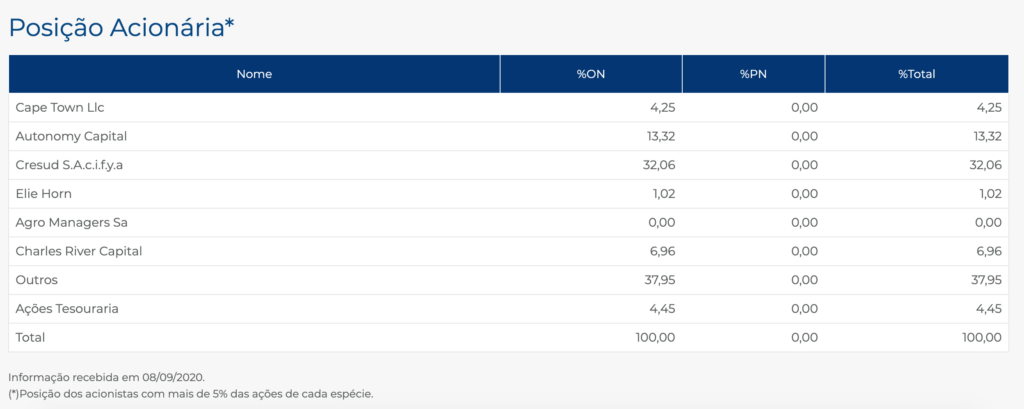

Brasil Agro Stock – Share Dynamics and Capital Structure

As of the fiscal year end 2020, Brasil Agro had 62.1 million common shares outstanding. The company has several large institutional shareholders, however around 38% of the company’s outstanding shares are held by entities owning less than 5% of the float.

Brasil Agro Stock – Dividends

For the fiscal year 2020, Brasil Agro paid a dividend of R$.71 per share. At the current market price this implies a dividend yield of 3.2%. This is a decrease from the R$ .93 dividend paid for the fiscal year 2019.

Brasil Agro Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$922.8 million/ R$1.1 billion = .82

A debt to equity ratio of .82 indicates that Brasil Agro uses a mix of debt and equity financing, but relies slightly more on equity financing to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

R$642.4 million / R$ 400 million = 1.6

A working capital ratio of 1.6 indicates a sufficient but not strong liquidity position. Brasil Agro should not have problems meeting its near-term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

R$22.20/ R$18.06 = 1.2

Brasil Agro has a book value per share of R$18.06. At the current market price this implies a price to book ratio of 1.2, meaning the company’s stock trades at a slight premium to the book value of the company.

Brazilian Agriculture Market – Economic Factors and Competitive Landscape

Brazil is an agricultural powerhouse, it ranks 5th in the world in terms of arable land. Agriculture is a large and important industry for the Brazilian economy. Brazil is the world’s largest producer of oranges, sugarcane, and coffee. They also compete globally in the production of soy, meat, and corn. Brazils’ diverse geography allows it to produce a wide variety of crops.

Global agricultural is a highly competitive market subject to large swings in global commodity prices. Brazilian agricultural companies will have to compete fiercely on a global stage for exports. However, given the scale of the industry in brazil, I believe it is reasonable to assume that there are many well run, investable agriculture companies in Brazil.

Brasil Agro Stock – Summary and Conclusions

Brasil Agro is a solid company. They appear to be well run and are sound financially. The company has been profitable for the past several years and pays a dividend. Its liability levels, including debt, appear to be manageable. The company’s stock currently trades around book value, so it is certainly not overvalued.

I will need to do more research about the agricultural markets before I feel comfortable investing in Brasil Agro stock. But if I do decide I want exposure to the global commodity markets, an investment in Brasil Agro is a possibility.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.

5 Comments

Comments are closed.