Common Stock: Biomm (BIOM3)

Current Market Price: R$ 16.79

Market Capitalization: R$ 1 billion

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Biomm Stock – Summary of the Company

Biomm is a Brazilian Biopharmaceutical company. They were founded in 2001 when they spun out from Biobrás, the largest insulin producer in Brazil at the time. The company recently decided to restart its insulin business and is currently constructing a manufacturing facility at its headquarters in the state of Minas Gerais. Biomm owns 20 patents. In addition to insulin and diabetes medication, they also offer a biosimilar used for the treatment of breast cancer.

Revenue and Cost Analysis

Biomm is currently ramping up production and their new insulin manufacturing facility is not yet 100% complete. This means that the company’s revenue, although increasing, is still low. Total revenue has increased from nearly zero in 2017, to R$ 1.5 million in 2018, to R$ 9 million in 2019.

Since Biomm is still ramping up its operations, the have run a net loss for the past three years. In 2019 the company had a net loss of R$ 55.8 million, and increase from 2018’s net loss of R$ 42.5 million.

Balance Sheet Analysis

Biomm has a leveraged balance sheet. The company has a solid base of assets and sufficient liquidity, but they also have a relatively high level of debt for a manufacturer with little revenue.

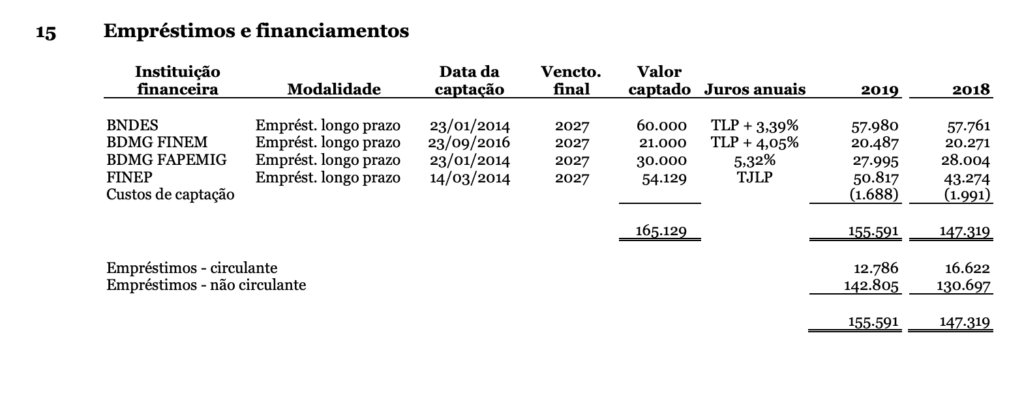

Biomm – Debt Analysis

As of year-end 2019 Biomm has total debt outstanding of R$ 155.5 million, R$ 12.7 million of which is classified as current.

Biomm Stock – Share Dynamics and Capital Structure

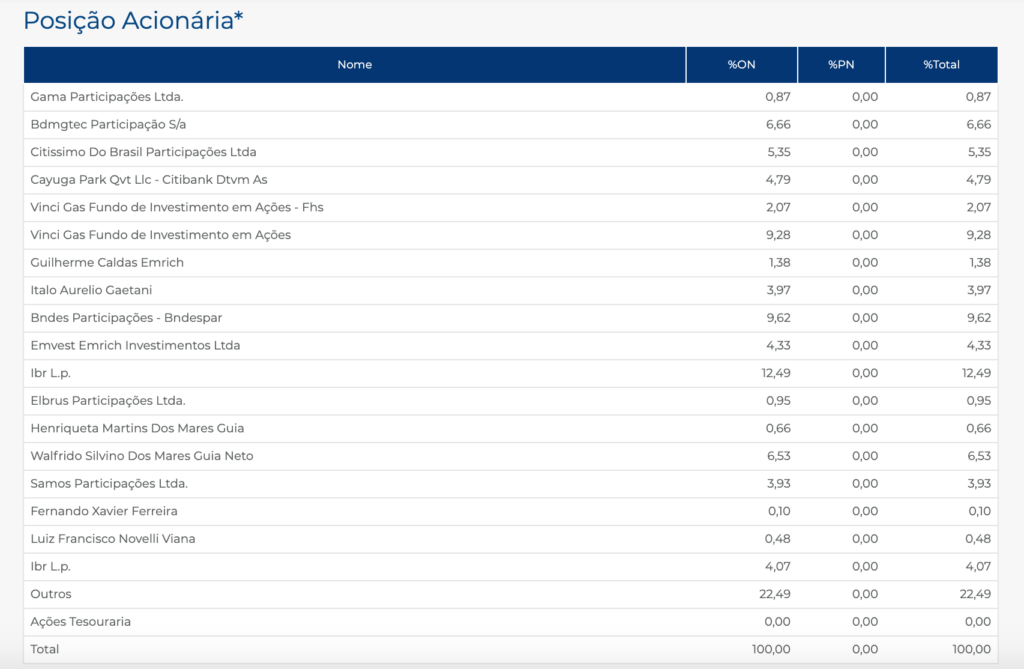

As of June 2020, Biomm has 60.8 million common shares outstanding. 22.5% of the company’s shares are held by investors with less than a 5% shares, with the remainder being held by insiders and several institutional investors.

Biomm Stock – Dividends

The company did not pay a dividend in 2018 or 2019.

Biomm Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 235.2 million / R$153.5 million = 1.5

A debt to equity ratio of 1.5 indicates that Biomm uses a mix of debt and equity in its capital structure, but is leveraged, meaning it relies more heavily on debt financing to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 148 million / R$ 60.8 million = 2.4

A working capital ratio of 2.4 indicates a sufficient liquidity position. Biomm should not have problems meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

R$ 16.79 / R$ 2.53 = 6.6

Biomm has a book value per share of R$ 2.53. At the current market price this implies a price to book ratio of 6.6, meaning the company’s stock currently trades at a significant premium to the book value of the company.

Brazilian Biotech Market – Economic Factors and Competitive Landscape

Brazils population over the age of 60 is expected to double over the next 20 years, growing from 30 million people currently to 60 million by the year 2050. There are an estimated 16.7 million diabetics in Brazil. It would appear that the market for insulin is quite large in Brazil and that all pharmaceutical companies in Brazil will benefit from a demographic tailwind.

Biomm Stock – Summary and Conclusions

Biomm is an interesting company. There are not many publicly traded biotech companies in Brazil. The company is currently ramping up production, and although sales are low, they are growing. Biomm is poised to benefit from both a large diabetic population and a growing elderly population, so it is reasonable to assume the company’s sales have plenty of room to grow.

The company is in an OK position financially. Liquidity is decent, however they are fairly leveraged, with a sufficient amount of debt for a company running a net loss.

I like the market and opportunity it presents for Biomm, but I don’t like the company’s current valuation. I would prefer to wait until their manufacturing facility is completed to see what their financials look like when they are operating at full capacity. For now, if I had to invest in Brazilian equity, I would prefer to allocate to a more stable business operating in a similar market, such as Grupo Dimed.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.