Common Stock: Berger Paints

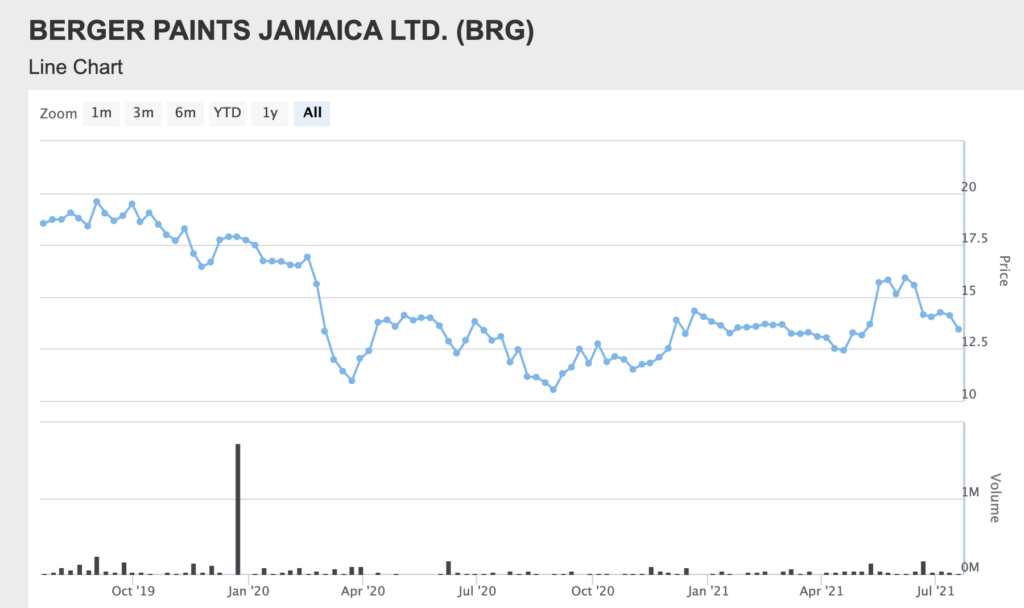

Current Market Price: $13 JMD

Market Capitalization: $2.8 Billion JMD ($18 million USD)

*All values in this article are expressed in Jamaican Dollars (JMD) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Berger Paints Stock – Summary of the Company

Berger Paints is a Jamaican paint manufacturer. They produce and distribute decorative, industrial, and wood coatings, as well as paint-related materials. In addition the are a distributor of automotive coatings. They are the largest paint manufacturer in the English speaking Caribbean. Berger Paints was founded in 1953 and is headquartered in Kingston, Jamaica.

Revenue and Cost Analysis

In 2020 Berger Paints had revenue of $2.3 billion, a decrease from $2.5 billion in 2019. This decrease in revenue in mostly due to the corona virus lockdowns. These lockdowns also caused supply chain constraints, which increased the company’s production cost and negatively impacted profitability.

However Berger was profitable in both 2019 and 2020. In 2020 the company had net income of $11.6 million, representing a profit margin of 0.5%, a decrease from 1.2% in 2019.

Balance Sheet Analysis

Berger has a strong balance sheet. They have a solid liquidity position in the near term and low long term liability levels.

It is worth noting that the company has a defined benefit pension obligation that investors should analyze in detail before investing.

Debt Analysis

As of year-end 2020 the company does not have any debt outstanding.

Berger Paints Stock – Share Dynamics and Capital Structure

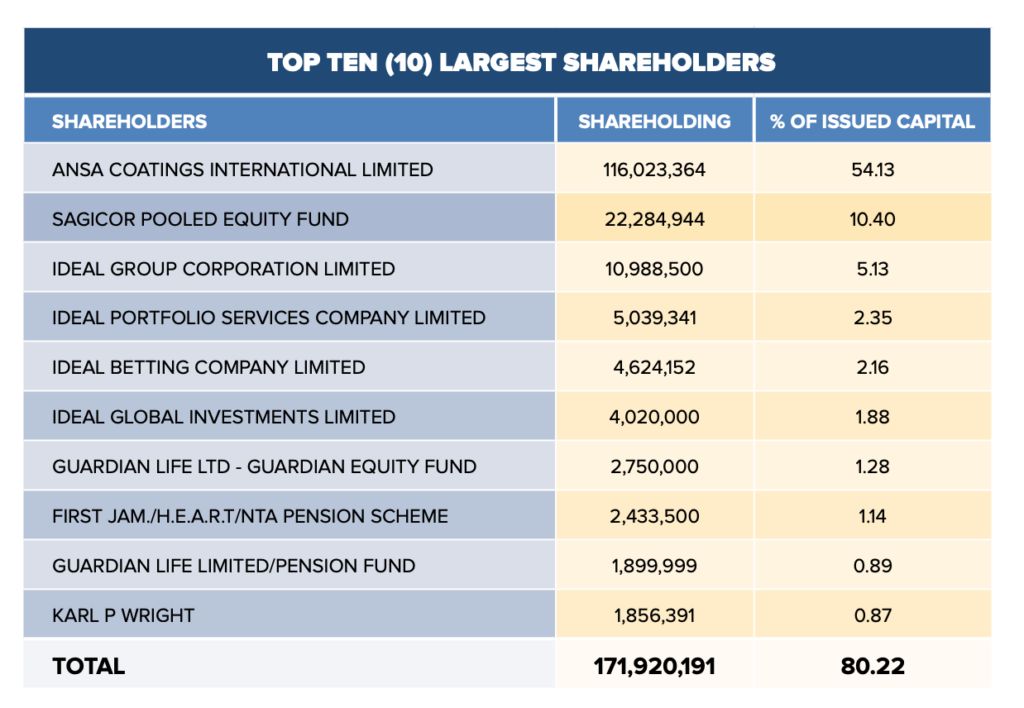

Berger Paints is a subsidiary of Ansa Limited, one of the largest conglomerates in the Caribbean. Ansa controls 54% of Berger’s outstanding shares. The company’s top ten shareholders own a combined 80% of the company.

As of year-end 2020 the company has 214.3 million common shares outstanding.

Dividends

The company did not pay a dividend in 2019 or 2020.

Berger Paints Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$676 million / $1.1 billion = .59

A debt to equity ratio of .59 indicates that Berger uses a mix of debt and equity in its capital structure, but is not leveraged and relies more heavily on equity financing.

Working Capital Ratio

Current Assets/Current Liabilities

$1.3 billion / $484 million = 2.7

A working capital ratio of 2.7 indicates a strong liquidity position. Berger should not have a problem meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

$13 / $3.15 = 4.1

Berger has a book value per share of $3.15. At the current market price this implies a price to book ratio of 4.1, meaning the company’s stock currently trades at a premium to the book value of the company.

Berger Paints Stock – Summary and Conclusions

Berger Paints is a solid company with a long history of successful operations in the Caribbean. They are financially sound, with good liquidity, no debt, and are profitable. The coronavirus lockdowns negatively impacted the company in 2020, but they appear to have weathered the storm.

Berger Paints stock looks like an OK vehicle for investors looking for low risk, long term exposure to the Caribbean consumer and housing markets. Shorter term I don’t see any catalyst that would make the stock interesting for shorter term investors.

I will wait and analyze Berger’s parent company, Ansa Limited, before drawing any final conclusions about Berger Paints and its stock.

Investors can also consider similar LATAM companies, such as Cementos Pacasmayo or Portobello.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.